How to Register a Charity in Canada: A Step-by-Step Guide

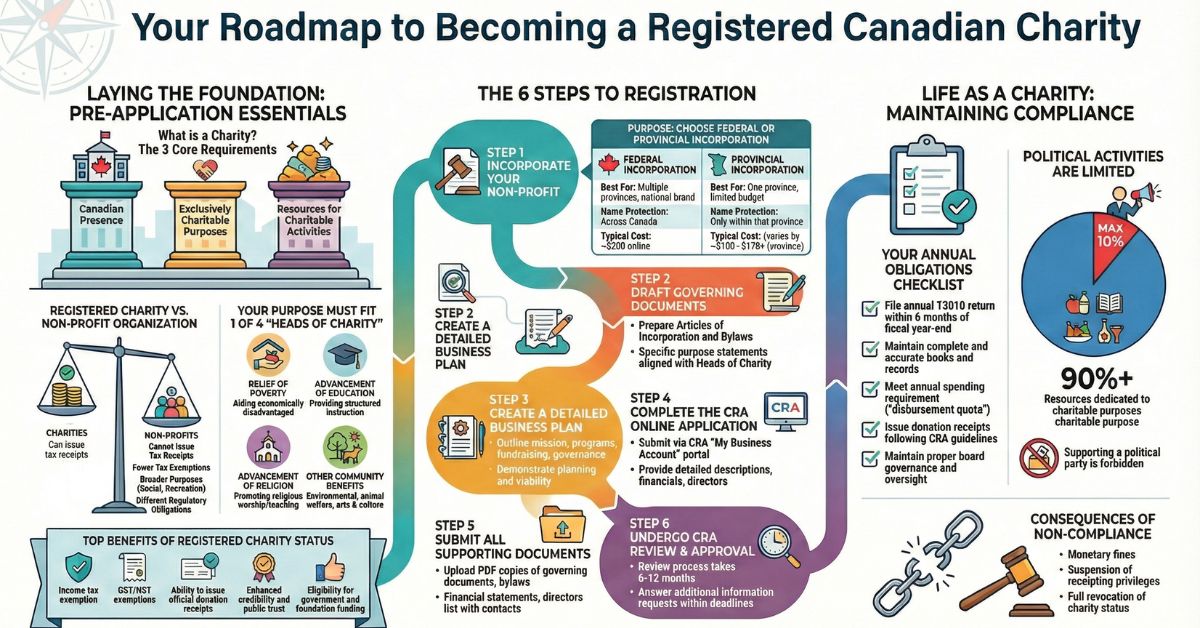

Starting a registered charity in Canada is a significant milestone that requires careful planning and attention to regulatory requirements. While the process involves multiple steps and detailed documentation, successfully obtaining charitable status from the Canada Revenue Agency unlocks valuable benefits that can transform your organization's fundraising capabilities and operational sustainability.

We understand that navigating the registration process can feel overwhelming at first. However, once you complete the steps successfully, your registered charity will be able to issue tax receipts for donations, access government funding, and gain credibility with supporters.

In this guide, we'll walk you through everything you need to know about charity registration in Canada. From understanding the basic requirements and charitable purposes to maintaining compliance after approval, we'll cover the essential information to help you successfully register your charity with the CRA.

What Are the Requirements to Register a Charity in Canada?

Before applying for charity status, your organization must meet specific criteria set by the Canada Revenue Agency (CRA). Understanding these fundamental requirements is essential for a successful application.

Basic Eligibility Criteria

To qualify for charity registration, your organization must have three key factors in place:

- Canadian Presence: The organization must be established and reside in Canada

- Charitable Purposes: It must be established and operated exclusively for charitable purposes

- Resource Dedication: The organization must devote its resources, including funds, personnel, and property to charitable activities

Registered Charity vs. Non-Profit Organization

Many people confuse charities with non-profit organizations, but they are quite different:

Registered Charities:

- Must operate for charitable purposes under one of the four heads of charity

- Can issue official tax receipts for donations

- Exempt from income tax, GST, and HST

- Subject to strict CRA compliance requirements

- Must file annual T3010 returns

Non-Profit Organizations:

- Can operate for social welfare, civic improvement, recreation, etc.

- Cannot operate for profit but purposes are less restrictive

- Cannot issue tax receipts

- Different regulatory obligations

Advantages of Registered Charity Status

- Income tax exemption

- GST/HST relief (registered charities are exempt from paying GST/HST on most goods and services, and can claim a 50% rebate on GST/HST paid for services like legal and accounting fees)

- Ability to issue official donation receipts

- Enhanced credibility and legitimacy

- Eligibility to receive gifts from other registered charities

- Access to government and foundation funding

Obligations of Registered Charities

- Devote resources exclusively to charitable purposes

- Maintain direction and control over all resources

- Keep complete and accurate books and records

- Issue accurate donation receipts

- Maintain Canadian legal entity status

- Meet annual spending requirements (disbursement quota)

- File annual Form T3010 within six months of fiscal year-end

Understanding the Four Heads of Charity in Canada

When you register a charity in Canada, your organization's purposes must fall under one or more of the four recognized categories of charitable work, commonly called the "four heads of charity." The CRA uses these categories to determine whether your organization qualifies for charitable registration.

The Four Charitable Categories

1. Relief of Poverty

This category includes organizations that help people who are economically disadvantaged or unable to provide basic necessities for themselves. Relief of poverty doesn't require recipients to be destitute, but they must have genuine financial need.

Examples include:

- Food banks and soup kitchens

- Homeless shelters and transitional housing

- Programs providing clothing, furniture, or household items to low-income families

- Financial assistance programs for those unable to afford basic necessities

- Programs supporting unemployed or underemployed individuals

2. Advancement of Education

Organizations under this category must provide formal or informal instruction, training programs, or research that benefits the public. The education provided must be beneficial, structured, and accessible.

Examples include:

- Schools, colleges, and universities

- Scholarship and bursary programs

- Literacy programs and tutoring services

- Libraries and learning resource centers

- Educational research institutes

- Museums with educational programming

- Training programs for specific skills or professions

3. Advancement of Religion

This category covers organizations that promote religious worship, teaching, or practice. The religion must involve belief in a supreme being or beings and include practices connected with that belief.

Examples include:

- Churches, synagogues, mosques, temples, and other places of worship

- Religious education programs

- Missionary work and religious outreach

- Production and distribution of religious materials

- Supporting clergy and religious workers

- Maintenance of religious buildings and sites

4. Other Purposes Beneficial to the Community

This is the broadest category and includes charitable purposes that don't fit into the first three categories but still provide a public benefit. The purpose must be recognized as charitable under common law and benefit the community in a way the law regards as charitable.

Examples include:

- Environmental protection and conservation

- Animal welfare organizations

- Arts and culture organizations (theaters, orchestras, art galleries)

- Community health clinics and health promotion

- Disaster relief organizations

- Human rights advocacy within legal limits

- Community development and improvement programs

- Recreation programs for youth, seniors, or disadvantaged groups

How to Define Your Charitable Purposes

When writing your charitable purposes for your CRA charity registration application, you must:

- Be specific: Vague purposes like "helping people" won't be accepted

- Use recognized charitable language: Reference one or more of the four heads of charity

- Define your beneficiaries: Specify who will benefit from your work

- Describe your activities: Explain how you'll achieve your charitable purposes

- Ensure exclusivity: Your purposes must be exclusively charitable

Your charitable purposes become part of your legal governing documents and cannot be easily changed once registered, so it's critical to get them right from the start.

Factors That May Prevent Charity Registration

The CRA may deny registration for several reasons:

- Organization resides outside Canada

- Purposes are not charitable under the Income Tax Act

- Providing personal benefits to members, shareholders, directors, or trustees

- Providing private benefit to specific individuals or groups

- Supporting or opposing political parties or candidates

- Conducting business activities for profit

- Participating in illegal activities or activities contrary to public policy

- Gifting to organizations that are not qualified donees

Steps to Register a Charity in Canada

1. Incorporate Your Non-Profit Organization

Although incorporation is not mandatory, it is highly recommended. Incorporating provides liability protection, a clear structure, and credibility. You can incorporate federally through Corporations Canada or provincially through the appropriate provincial registry.

For Ontario charities, refer to the Ontario Not-for-Profit Corporations Act (ONCA) for compliance requirements.

Provincial vs. Federal Incorporation: Which Is Right for You?

One of the first decisions you'll make when starting your charity is whether to incorporate federally or provincially. Both options allow you to register as a charity with the CRA, but each has distinct advantages depending on your organization's scope and plans.

Federal Incorporation

Best for organizations that:

- Plan to operate in multiple provinces or territories

- Want automatic name protection across Canada

- Anticipate expanding operations nationwide

- Prefer dealing with one federal regulator

Advantages:

- Name is protected across all of Canada

- Easier to expand operations to other provinces

- Single set of federal rules to follow

- Professional image for national organizations

Costs:

- Approximately $200 for online filing

- $250 for paper filing

- Additional fees for name searches and reservations

Process:

- Apply through Corporations Canada

- Use the Canada Not-for-profit Corporations Act (NFP Act)

- Receive federal incorporation number

Provincial Incorporation

Best for organizations that:

- Plan to operate primarily in one province

- Want lower incorporation costs

- Need to comply with provincial-specific requirements

- Prefer working with local regulators

Advantages:

- Lower incorporation fees in most provinces

- May be more familiar with local regulations

- Simpler if operating in one province only

- Direct access to provincial support services

Costs by Province:

- Ontario: Approximately $155 online ($200 by mail)

- British Columbia: Approximately $100

- Alberta: Approximately $100

- Quebec: Approximately $178

- Costs vary by province

Process:

- Apply through your provincial corporate registry

- Follow provincial nonprofit corporations legislation

- Receive provincial incorporation number

Making Your Decision

Consider federal incorporation if you plan to:

- Fundraise across Canada

- Deliver programs in multiple provinces

- Build a national brand

- Partner with organizations across the country

Consider provincial incorporation if you:

- Will operate primarily or exclusively in one province

- Have a limited budget for incorporation

- Prefer working with local regulators

- Have no immediate plans for expansion

Important: Regardless of which option you choose, you can still register as a charity with the CRA. Your incorporation choice affects your corporate governance structure, not your eligibility for charitable status.

2. Draft Governing Documents

You must prepare a governing document such as:

- Articles of Incorporation (if incorporated)

- Constitution and Bylaws (if unincorporated)

Ensure your purposes align with CRA’s charitable categories. A poorly worded purpose statement can lead to delays or rejection.

3. Create a Detailed Business Plan

Your business plan should outline:

- The charity’s mission and vision

- Key programs and services

- Fundraising plans and revenue sources

- Governance structure (board of directors, officers, and roles)

4. Complete the CRA Charity Registration Application

To apply for charitable status, you must complete the CRA’s online application through the My Business Account portal. The application requires:

- A detailed description of your activities

- A fundraising plan

- A financial forecast

- Your governing documents

How to Access and Use the My Business Account Portal

The CRA requires all charity registration applications to be submitted online through the My Business Account (MyBA) portal. Here's how to access and navigate the system:

Creating Your My Business Account

Step 1: Register for a CRA User ID

- Visit the CRA's website at www.canada.ca/my-cra-account

- Click "Register" if you don't have a CRA user ID

- You'll need: your Social Insurance Number (SIN), date of birth, current postal code, and information from your most recent tax return

Step 2: Access My Business Account

- Once you have a CRA user ID, go to My Business Account

- Log in using your CRA user ID and password

- Set up multi-factor authentication for security

Step 3: Link Your Organization

- If your organization is already incorporated, you may need to link it to your account

- You'll need your organization's business number (BN) if it has one

- If newly incorporated, you may need to wait a few weeks for the CRA to register your organization in their system

Navigating the Charity Registration Application

Once logged into My Business Account:

1. Find the Application:

- Look for "Register a Charity" or "Apply for Charitable Registration"

- The application is called "Application to Register a Charity" and is completed entirely online through the CRA My Business Account portal

- There is no longer a specific numbered form for standard charity applications; the process uses a digital workflow system

2. Required Information You'll Need Ready:

- Your organization's legal name and business number

- Date of incorporation

- Fiscal year-end date

- Contact information for the organization

- List of directors with full names, addresses, and roles

- Your governing documents (uploaded as PDFs)

- Detailed description of proposed activities

- Financial projections for the next two years

- Fundraising plans

3. Sections of the Application:

Section A: Identification

- Legal name of the organization

- Operating name (if different)

- Business address

- Mailing address (if different)

- Contact person information

Section B: Organization Information

- Date of incorporation or establishment

- Type of organization (incorporated, unincorporated, trust)

- Fiscal year-end

- Accounting method (cash or accrual)

Section C: Directors/Trustees/Like Officials

- Full name of each director

- Home address

- Position/title

- Email address and phone number

- You must list all directors

Section D: Purpose and Activities

- Detailed description of your charitable purposes

- Explanation of how purposes fit within the four heads of charity

- Description of each planned activity

- How activities further your charitable purposes

- Target beneficiaries

Section E: Financial Information

- Revenue projections for next 2 years (by source)

- Expenditure projections for next 2 years (by category)

- Asset information if applicable

- Details about any property owned or planned purchases

Section F: Fundraising

- Planned fundraising activities and methods

- Professional fundraisers being used (if any), including their fees and commission structures

- Detailed fundraising cost estimates broken down by activity

- Projected fundraising ratio (fundraising expenses as a percentage of funds raised)

- Explanation of how you will ensure fundraising costs remain reasonable (ideally under 35%)

- Percentage of total revenue that will be dedicated directly to charitable activities

4. Document Uploads: You'll need to upload PDF copies of:

- Articles of incorporation or constitution

- Bylaws or trust deed

- Most recent financial statements (if operating more than one year)

- Any partnership agreements

- Property documents (if applicable)

5. Save Your Progress:

- The application allows you to save and return later

- You don't need to complete it in one sitting

- Make sure to save frequently

6. Review Before Submitting:

- Review all sections carefully

- Check for typos and errors

- Ensure all required documents are attached

- Verify director information is accurate

- Confirm financial projections are realistic

7. Submit the Application:

- Once complete, submit electronically through the portal

- You'll receive a confirmation number

- Save this number for your records

- You should receive an acknowledgment email within 2-4 weeks

Troubleshooting Common Portal Issues

Problem: Can't find my organization's business number

- Solution: If newly incorporated, wait 2-3 weeks after incorporation then call CRA Business Enquiries at 1-800-959-5525

Problem: Forgot CRA user ID or password

- Solution: Use the "Forgot your user ID" or "Forgot your password" links on the login page

Problem: Application times out while completing

- Solution: Save your work frequently. The session may time out after 20 minutes of inactivity

Problem: Document upload fails

- Solution: Ensure documents are in PDF format and under the file size limit (usually 150MB total)

Problem: Can't access My Business Account

- Solution: Clear your browser cache, try a different browser, or call CRA technical support

After Submission

- Monitor your My Business Account for CRA correspondence

- The CRA will send questions or requests for additional information through the portal

- Response time: You typically have 30 days to respond to CRA inquiries

- Check your account regularly (at least weekly) during the review process

- Set up email notifications if available

Getting Help

If you need assistance:

- CRA Charities Directorate: 1-800-267-2384

- Technical support for My Business Account: 1-800-959-5525

- Consider hiring a charity lawyer for complex applications

Required Documents and Information

5. Submit Supporting Document

Ensure you include all required documents, such as:

- Articles of Incorporation

- Bylaws

- Financial statements (if available)

- A list of directors and their contact information

6. CRA Review and Approval Process

The CRA may take several months to review your application. They might request additional information or clarification. Once approved, your charity will receive a Registered Charity Number and be listed in the Charities Listings.

Application Review Process

Once you submit your charity registration application through the My Business Account portal, the CRA follows a structured review process to evaluate your organization.

Review for Completion

After submission, the Charities Directorate first verifies that your application is complete.

If your application is complete:

- You will receive an acknowledgment letter through My Business Account within 2-4 weeks

- The letter confirms receipt and provides an estimated review timeline (typically 6-12 months)

- Your application is assigned to a CRA program officer for detailed review

If your application is incomplete:

- It will be rejected and returned immediately

- The CRA will specify what documents or information are missing

- You must resubmit with all required materials

- Common reasons include draft governing documents, missing financial projections, or incomplete director information

Requests for Additional Information: The CRA may request supplementary information or clarification at any stage of the review. You will have 60 days to respond to these requests. If you fail to respond within the deadline, your file may be closed or your application may be denied.

Review for Charitable Status

The assigned program officer conducts a thorough review to ensure your organization meets all requirements for charitable registration.

What the Officer Evaluates:

- Whether your purposes fit within the four heads of charity (relief of poverty, advancement of education, advancement of religion, or other purposes beneficial to the community)

- Whether your activities are exclusively charitable and directly further your stated purposes

- Whether your governing documents contain all required CRA clauses

- Whether your organization provides sufficient public benefit

- Whether your financial projections are realistic and demonstrate sustainability

- Whether your governance structure is appropriate for a registered charity

Denial Reasons: Applications will be denied if the organization's purposes and activities are clearly not charitable, if governing documents are inadequate, if there are private benefit concerns, or if the organization cannot demonstrate it will operate exclusively for charitable purposes.

Application Outcomes

If Approved: You will receive a notice of registration through My Business Account that includes:

- Your Registered Charity Number (RCN)

- Your organization's rights and responsibilities as a registered charity

- The effective date of registration

- Your charity designation (charitable organization, public foundation, or private foundation)

Your organization will be added to the public Charities Listings and can immediately begin issuing official donation receipts.

If Denied: You will receive a letter explaining the specific reasons for denial and the legal basis for the CRA's decision.

Appeals

If your application is denied, you have the right to appeal the decision.

How to Appeal:

- File a notice of objection to the CRA Appeals Intake Centre

- You have 90 days from the date the denial decision was mailed to you to file your objection

- The deadline is strict and cannot be extended

- Clearly state why you believe the decision was incorrect and provide supporting evidence

Important: If you fail to respond to a CRA request for clarification within the 60-day deadline and your file is closed due to non-response, you cannot appeal. This is considered an abandoned application, not a denial. You would need to submit a new application if you still wish to obtain charitable status.

Head Body vs. Internal Division Applications

Head Body Registration

For organizations with multiple branches or divisions:

- Governing documents must show control over internal divisions

- Must have authority to create/close divisions

- Must own property of divisions

- Must control boards and budgets of divisions

Internal Division Registration

For branches of existing registered charities:

- Must provide letter of good standing from head body

- Letter must include establishment date, confirmation of division status

- Must provide head body's governing documents

- Authorized signature from head body official required

Maintaining Charity Compliance in Canada

Once registered, maintaining compliance is crucial for retaining charity status.

Annual Obligations

- Annual Filing: Submit Form T3010 within 6 months of fiscal year-end

- Financial Records: Maintain complete and accurate books and records

- Disbursement Quota: Spend required percentage on charitable activities

- Donation Receipts: Issue proper receipts following CRA guidelines

- Governance: Maintain proper board oversight and conflict of interest policies

Common Compliance Issues

- Late or incomplete T3010 filings

- Inadequate books and records

- Improper donation receipts

- Failure to meet disbursement quota

- Political activities exceeding 10% limit

- Private benefit issues

Penalties for Non-Compliance

- Penalties for late filing

- Suspension of donation receipting privileges

- Revocation of charity status

- Public listing in Canada Gazette

- Transfer of remaining assets to qualified donees

Special Considerations

Activities Outside Canada

If conducting international activities:

- Provide detailed oversight and control mechanisms

- Identify who will manage programs abroad

- Demonstrate charitable purposes alignment

- Show compliance with Canadian laws

Political Activities

- Limited to 10% of resources

- Must be non-partisan

- Cannot support/oppose political parties or candidates

- Must further charitable purposes

Fundraising Activities

- Must be incidental to charitable purposes

- Excessive commercial activity may jeopardize status

- Professional fundraising arrangements require disclosure

Revoking Charity Registration

Organizations may voluntarily revoke registration, but consequences include:

- Loss of tax exemptions

- Cannot issue donation receipts

- Public notice in Canada Gazette

- Must transfer assets to qualified donees

- Permanent record of revocation

Need Help Registering Your Charity?

The charity registration process involves complex legal and regulatory requirements that can be overwhelming for new organizations. Common mistakes in governing documents or application submissions often result in delays, rejections, or future compliance issues that could have been easily avoided.

Professional legal assistance ensures your charitable purposes are properly articulated, your governing documents meet CRA standards, and your application is complete and accurate. Experienced charity lawyers understand the nuances of CRA requirements and can guide you through potential pitfalls that aren't obvious to first-time applicants.

If you need expert assistance with any aspect of the registration process, contact B.I.G. Charity Law Group for professional legal support. Our specialized charity lawyers will help ensure a smooth registration process and maximize your chances of successful approval.

Frequently Asked Questions

Registering a charity in Canada involves specific costs, timelines, and legal requirements.

The Canada Revenue Agency oversees the registration process and distinguishes between different types of charitable organizations.

How much does it cost to register a charity in Canada?

There is no fee to apply for charitable registration with the Canada Revenue Agency.

The application process itself is free.

You will need to pay incorporation fees to set up your organization first.

These fees vary by province and usually range from $200 to $300.

You may also want to hire a lawyer or consultant to help with the application.

These professional fees can add to your total costs.

How long does it take to register as a charity in Canada?

The Canada Revenue Agency usually takes 6 to 12 months to review charity registration applications.

Complex applications may take longer.

The review time depends on how complete your application is.

Missing documents or unclear information can delay the process.

We recommend submitting a thorough application with all required documents to avoid delays.

What is the difference between a nonprofit and a charity in Canada?

Not all nonprofits qualify as registered charities in Canada.

Charities must have purposes that fall under the four recognized categories of charitable work.

Registered charities can issue tax receipts to donors.

Nonprofits cannot issue these receipts unless they become registered charities.

Charities also receive more tax benefits and exemptions than regular nonprofit organizations.

What is required to register a charity in Canada?

Your organization must have charitable purposes that fit into one of four categories.

These are relief of poverty, advancement of education, advancement of religion, or other purposes that benefit the community.

You need proper governing documents like articles of incorporation.

These documents must include specific language required by the Canada Revenue Agency.

Your charity must operate only for charitable purposes.

It cannot exist mainly to benefit private individuals.

What are the different types of charities?

Canada recognizes three types of registered charities.

These are charitable organizations, public foundations, and private foundations.

Charitable organizations carry out their own charitable activities.

They can also make grants to other qualified organizations.

Public foundations mainly give grants to other charities.

Private foundations are usually controlled by a single family or corporation and also focus on grant-making.

What is a registered Canadian charity?

A registered Canadian charity is an organization that the Canada Revenue Agency approves. It meets legal requirements and operates for charitable purposes.

Registered charities can give official tax receipts to donors. They receive tax-exempt status on most income.

These organizations must file annual returns. They must also follow strict rules about their activities and governance.

What are the requirements for charity reporting in Canada?

File annual T3010 returns on time, spend at least 3.5% of assets on charitable activities, keep proper records, and report major changes to the CRA.

Related Articles:

- What’s the Difference Between a Nonprofit and Charity in Canada?

- How to Incorporate a Federal Not-for-Profit

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)