Must-Have Legal Documents for Your Canadian Church

As your church grows, it's essential to ensure that your legal documents are well-maintained. Whether you're starting a new congregation or managing an existing one, understanding the key legal documents for Canadian churches can help you avoid potential issues and keep everything running smoothly. Here’s a detailed guide to the important legal documents every church in Canada should have, along with tips on how to keep them up to date.

For more details on establishing your church, explore our guide on how to register a church in Canada.

Essential Documents Checklist for Canadian Churches

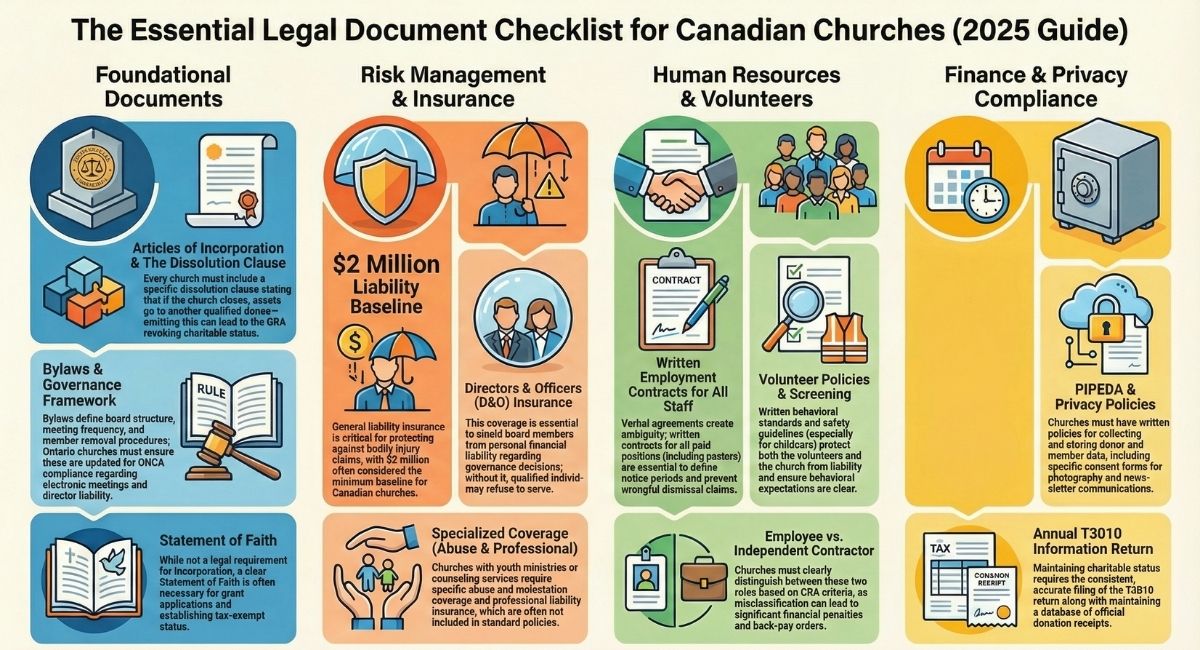

Before diving into details, here's your complete document checklist for 2025:

Foundational Documents:

- Articles of Incorporation and all amendments

- Bylaws (including amendment procedures and meeting protocols)

- CRA charitable registration certificate

- Board resolutions and meeting minutes (organized by year)

- Statement of Faith or religious doctrine

Operational Policies:

- Volunteer policies and screening procedures

- Child and vulnerable persons protection policy

- Conflict of interest policy

- Financial management and signing authority policy

- Privacy policy (PIPEDA compliance)

- Facility use agreements and rental policies

Human Resources Documents:

- Employment contracts and job descriptions

- Independent contractor agreements

- Payroll records and T4 slips

- Workplace health and safety policies

- Performance review documentation

Insurance and Risk Management:

- General liability insurance policy

- Directors and officers (D&O) insurance

- Property insurance documentation

- Professional liability coverage (for counselling ministries)

- Abuse and molestation coverage

- Facility use waivers and liability releases

Financial and Tax Records:

- Annual T3010 information return filings

- Official donation receipts and donor database

- Bank statements and financial statements

- Budget approvals and financial audits

- HST/GST documentation and rebate claims

This checklist ensures you're covering all CRA requirements while protecting your church from legal and financial risks.

Articles of Incorporation

What Are They? Articles of Incorporation are required to officially establish your church as a legal entity in Canada. This document typically includes:

- Church Name: The official name of your church.

- Address: The physical location where your church operates.

- Purpose Statement: A description of your church’s mission and objectives.

- Initial Board of Directors: Names and addresses of the first board members.

Why Are They Important? Filing these documents is often the first step in forming a new church. They are necessary for your church to be recognized legally, which is crucial for conducting business and receiving donations.

⚠️ Critical CRA Requirement: Your Articles of Incorporation must include a "dissolution clause" stating that if your church closes, remaining assets go to another qualified donee—not to members or directors. Without this specific clause, CRA may deny or revoke your charitable status. Many churches overlook this requirement during incorporation and face complications later when applying for charitable registration.

How to Prepare:

- Draft the Articles with clear information about your church’s mission and structure.

- Submit them to the appropriate federal or provincial authorities. For instance, in Ontario, you would file with the Ministry of Public and Business Service Delivery under the Ontario Not-for-Profit Corporations Act (ONCA).

- Ensure compliance with provincial regulations, as each province might have specific requirements.

Bylaws

What Are They? Bylaws are a set of rules that govern how your church operates. They cover:

- Board Structure: How the board is organized and its responsibilities.

- Meeting Frequency: How often the board meets.

- Board Terms: Duration of board members' terms.

- Removal Procedures: How members can be removed from the board.

- Dissolution Procedures: What happens if the church needs to close.

- Amendment Process: How bylaws can be changed.

Why Are They Important? Bylaws provide a framework for decision-making and conflict resolution, helping to avoid disputes and ensure smooth operations within the church.

📋 ONCA Compliance Update: Ontario churches incorporated under ONCA must ensure bylaws include specific provisions on membership rights, electronic meeting capabilities, director liability limitations, and proper notice procedures. Churches incorporated before October 2021 that haven't updated their bylaws should conduct a comprehensive bylaw review for compliance. Non-compliant bylaws can create governance vulnerabilities and potential director liability issues.

How to Prepare:

- Consult with experienced charity lawyers to draft comprehensive bylaws that align with Canadian laws and your church’s needs.

- Regularly review and update them to reflect current practices and legal requirements.

- Define the role and rights of members if your church has a membership structure.

Volunteer Policies and Agreements

What Are They? These documents outline the expectations and responsibilities for volunteers. They include:

- Safety Guidelines: Rules for ensuring the safety of volunteers and participants, particularly in sensitive areas like childcare.

- Behavioral Standards: Acceptable and unacceptable conduct.

- Project Guidelines: How tasks should be completed and how liability is managed.

Why Are They Important? Written policies and agreements clarify the role of volunteers and protect both them and the church from potential issues.

How to Prepare:

- Create detailed policies for various volunteer roles, considering Canadian standards and regulations.

- Have volunteers sign agreements acknowledging their understanding and acceptance of these policies.

- Regularly review and update policies to address new concerns or changes in regulations.

Insurance and Risk Management Documents

What Are They? Churches face unique risks and need proper insurance coverage documented and maintained. Essential insurance documents include:

- General Liability Insurance: Protects against bodily injury and property damage claims on church property or during church activities.

- Directors and Officers (D&O) Insurance: Shields board members from personal liability for governance decisions.

- Property Insurance: Covers building damage, theft, equipment loss, and business interruption.

- Professional Liability Insurance: For churches offering pastoral counselling, mental health support, or professional services.

- Abuse and Molestation Coverage: Critical protection for churches with children's and youth ministries—not always included in general liability policies.

- Cyber Liability Insurance: Increasingly important as churches store donor and member data digitally.

Why Are They Important? Without proper insurance documentation, your church board members could face personal liability, and the church could face financial ruin from a single incident. A slip-and-fall injury, property damage claim, or abuse allegation could cost hundreds of thousands of dollars without adequate coverage.

Canadian churches have faced devastating lawsuits that bankrupted congregations when insurance was inadequate or lapsed. Your insurance documents prove coverage existed at the time of an incident—critical for claims filed years later.

How to Prepare:

- Conduct an annual insurance review with a broker experienced in religious organizations—church needs differ significantly from standard commercial policies.

- Keep all current policies, renewal notices, previous year policies (for claims that arise later), and claims documentation in a dedicated insurance file.

- Ensure coverage limits align with your church's assets, activities, and regional lawsuit trends—$2 million general liability is often the baseline.

- Document any incidents immediately, even if no claim is filed—this creates a contemporaneous record that protects the church if claims emerge later.

- Review coverage whenever you add new programs (daycare, counselling, community meals) as these may require additional insurance.

- Store insurance certificates in both physical and digital formats, with copies accessible to board chairs and facility managers.

Do churches need insurance in Canada?

While not legally required, insurance is practically essential for Canadian churches. Most mortgage lenders require property insurance, and liability insurance protects board members from personal financial risk. Without D&O insurance, qualified individuals may refuse board positions. CRA doesn't require insurance for charitable registration, but insurance companies often require certain policies and procedures that align with good governance practices.

Employment and Contractor Documents

What Are They? If your church has paid staff or contractors, you need comprehensive employment documentation:

- Employment Contracts: Written agreements outlining salary, benefits, job duties, termination procedures, and intellectual property ownership.

- Job Descriptions: Clear documentation of roles, responsibilities, reporting relationships, and performance expectations.

- Independent Contractor Agreements: For musicians, guest speakers, facility contractors, or temporary workers—properly distinguishing contractors from employees.

- Payroll Records: T4 slips, Records of Employment (ROEs), vacation tracking, benefits documentation, and statutory deduction remittances.

- Performance Reviews: Regular evaluation documentation showing objective assessment of work performance.

- Termination Documentation: Records of disciplinary actions, performance improvement plans, and termination reasons (essential for defending wrongful dismissal claims).

Why Are They Important? Proper employment documentation protects both your church and your workers, ensures CRA compliance, and prevents costly disputes over compensation or termination.

CRA scrutinizes charity employment arrangements during audits. They want to ensure compensation is reasonable, roles advance charitable purposes, and workers aren't misclassified. Churches have lost charitable status when CRA determined they paid excessive compensation to founders or family members without proper documentation justifying the amounts.

Employment Standards Act violations can result in significant financial penalties and back-pay orders. Without written contracts, churches are vulnerable to wrongful dismissal claims that can cost 12-24 months of salary per terminated employee.

How to Prepare:

- Use written contracts for all paid positions, even part-time or short-term contract work—verbal agreements create ambiguity and legal risk.

- Clearly distinguish between employees and independent contractors using CRA's criteria—misclassification carries significant penalties.

- Maintain payroll records for at least 7 years as required by CRA—this includes timesheets, pay stubs, T4 slips, and benefit records.

- Review compensation annually against CRA's reasonable compensation guidelines for charities—document the rationale for all salary decisions in board minutes.

- For senior pastors and executives, document compensation packages in board resolutions showing the decision-making process.

- Keep personnel files secure with restricted access—separate medical and accommodation information from general employment files to comply with privacy laws.

Do churches need written employment contracts in Canada?

Yes, written employment contracts are essential for Canadian churches with paid staff. While verbal contracts are technically legal, they create ambiguity around termination notice, job duties, and compensation. Written contracts protect both the church and employee by clearly documenting expectations, notice periods, and termination procedures. They're also critical evidence if employment disputes reach court or CRA audits compensation practices.

Do churches need employment contracts for staff?

Absolutely. Every paid church position should have a written employment contract or offer letter. This includes senior pastors, administrative staff, custodians, and part-time workers. The contract should specify whether the position is employee or contractor status, outline compensation and benefits, define job duties, and establish termination procedures. Without written contracts, churches risk wrongful dismissal claims and CRA compliance issues.

Privacy and Data Protection Policies

What Are They? Churches collect significant personal information and must comply with Canada's privacy legislation. Essential privacy documents include:

- Privacy Policy: Written documentation of how you collect, use, store, protect, and dispose of personal information.

- Consent Forms: For photography, video recording, testimonial sharing, and newsletter communications.

- Data Retention Schedule: Documented timelines for how long you keep member information, donor records, and volunteer files.

- Data Breach Response Plan: Step-by-step procedures if personal information is lost, stolen, or accessed without authorization.

- Access Request Procedures: Process for members to request copies of information the church holds about them.

Why Are They Important? The Personal Information Protection and Electronic Documents Act (PIPEDA) applies to churches in many situations. Provincial privacy laws like Alberta's PIPA and BC's PIPA also govern church data practices.

Non-compliance can result in complaints to the Privacy Commissioner, investigation costs, mandatory breach notifications, and reputational damage that undermines congregation trust. Churches have faced significant fines and legal costs when member data was compromised or misused.

Beyond legal compliance, proper privacy practices build trust. When members know their giving history, pastoral counselling notes, and family information are protected, they're more comfortable engaging fully with church life.

How to Prepare:

- Create a written privacy policy covering donor information, member databases, children's ministry records, pastoral counselling notes, and employee files.

- Obtain written consent before using photos or personal stories in marketing, social media, or publications—general bulletin announcements aren't sufficient.

- Limit access to personal information to authorized staff only—use password-protected systems with access logs.

- Implement secure digital storage with encrypted databases, regular backups, and off-site backup storage.

- Develop procedures for handling data breaches—know who to notify, how quickly, and what documentation is required.

- Train all staff and volunteers who handle personal information on privacy obligations and data security practices.

- Review and update privacy policies annually as technology, church practices, and regulations evolve.

Do churches need PIPEDA privacy policies?

Yes, PIPEDA applies to churches in most provinces when they engage in commercial activities (like facility rentals or paid programs) or when they operate in provinces without substantially similar provincial privacy laws. Even where PIPEDA doesn't strictly apply, having privacy policies demonstrates good governance and protects against future regulatory changes. Churches with websites, email lists, or donor databases should have written privacy policies regardless of strict legal requirements.

Statement of Faith

What Is It? A Statement of Faith outlines your church’s core beliefs and values. While not legally required, it is important for transparency and can be necessary for certain applications.

Why Is It Important? It helps visitors and members understand the church’s beliefs and practices. It can also be useful for applications related to grants or tax-exempt status.

How to Prepare:

- Clearly articulate your church’s beliefs and practices in simple terms.

- Make it accessible on your church’s website or through other communication channels.

Other Policies

What Are They? Additional policies might include:

- Financial Policies: Rules on handling church finances, transactions, and access to bank accounts.

- Disciplinary Policies: Procedures for addressing violations by board members or members.

- Facility Use Policies: Guidelines for renting out or using church facilities, including liability considerations.

Why Are They Important? These policies ensure consistency in operations and protect the church from legal and financial issues.

How to Prepare:

- Develop comprehensive policies based on your church’s specific needs and Canadian regulations.

- Review and update them regularly to keep them relevant and effective.

Additional Documents

What Are They?

- Charity Registration Status: If your church is registered as a charity, ensure you have your Canada Revenue Agency (CRA) registration documents. While churches are generally automatically considered registered charities, having official documentation can be useful for receiving donations and grants.

- Meeting Minutes: Accurate records of all board and business meetings.

- Member Database: A list of legal, voting members to keep track of your congregation.

Why Are They Important? These documents help maintain proper records and support administrative tasks such as applying for grants or managing church operations.

How to Prepare:

- Keep detailed and accurate records of all meetings and decisions.

- Maintain an updated database of members and ensure all legal documents are accessible.

Maintaining well-organized legal documents and policies is vital for the effective operation of your church. Whether you're drafting new documents or reviewing existing ones, ensure they are up-to-date and in compliance with Canadian laws. If you need help creating or updating your church’s legal documents, consider consulting with charity lawyers with significant experience registering and auditing religious charities. This will allow you to focus on your ministry and serve your community with confidence. If you are seeking assistance with drafting or reviewing any of the above-referenced documents for your church, the experienced charity lawyers at B.I.G. Charity Law Group can help. Call us at 416-488-5888 or email ask@charitylawgroup.ca to get started.

Frequently Asked Questions

Find answers to common questions about starting and operating churches in Canada.

What do you need to start a church in Canada?

You need a clear religious purpose, founding members, a constitution and bylaws, and incorporation as a non-profit organization in your province. You'll also need to apply for charitable status with Canada Revenue Agency, establish a governing board, and demonstrate you'll advance religion through worship services and community activities.

Are churches registered charities in Canada?

Yes, most churches are registered charities in Canada. Churches automatically qualify for charitable status under the "advancement of religion" category. However, they must still apply to CRA, meet specific requirements, and maintain their charitable activities to keep their status.

What are common mistakes when starting a church?

Common mistakes include inadequate financial planning, unclear governance structures, poor record-keeping, mixing personal and church finances, and failing to meet CRA reporting requirements. Many also underestimate ongoing administrative costs and don't establish proper policies for handling donations and expenses.

What qualifies a church to be a church?

A church must have a recognized religious doctrine, regular worship services, ordained or recognized religious leaders, and a committed congregation. It should demonstrate genuine religious activities like worship, religious education, and spiritual guidance rather than just social or community functions.

Are churches tax exempt in Canada?

Yes, registered churches are exempt from income tax on their charitable income and don't pay property tax on buildings used for religious purposes. They must still pay employment taxes for staff and HST/GST on taxable purchases, though they can claim rebates on some taxes.

Are church donations tax deductible in Canada?

Yes, donations to registered churches are tax deductible. Donors can claim up to 75% of their net income annually and receive official donation receipts. Churches must issue proper receipts and follow CRA guidelines for eligible donations to maintain donors' tax benefits.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)