Can I Issue Tax Receipts for Auction Items?

Charity auctions are an exciting way to raise funds while giving donors a chance to support your cause. But when it comes to issuing tax receipts for auction items, many charities feel uncertain about the rules.

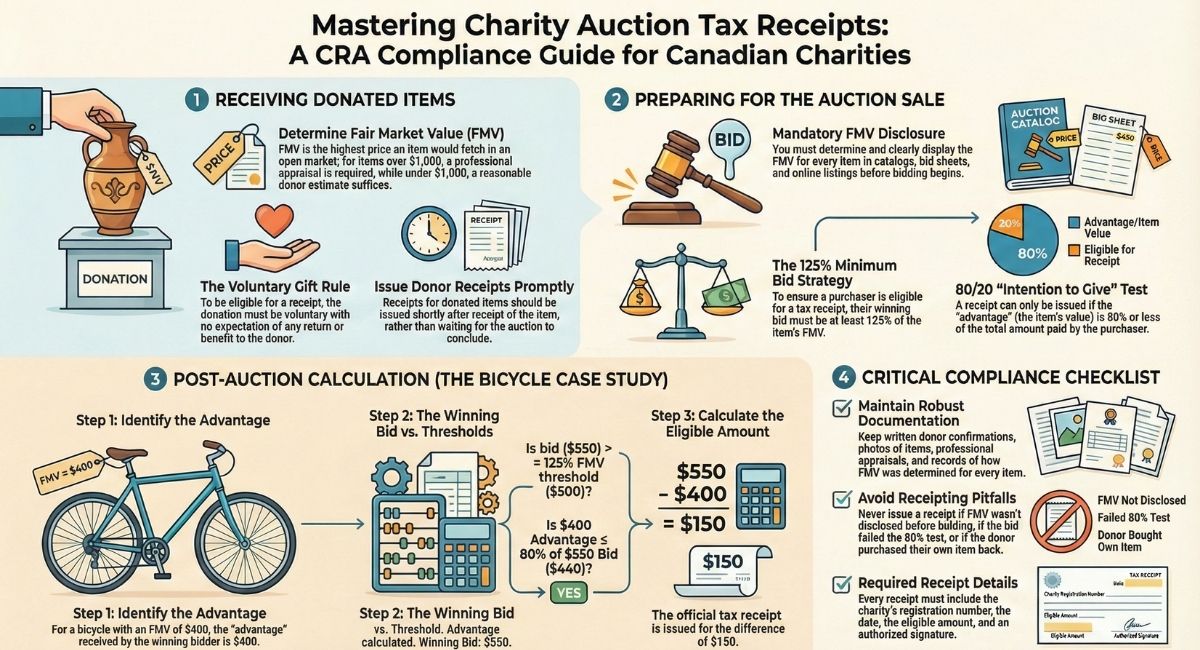

The Canada Revenue Agency (CRA) has specific guidelines about when you can and cannot issue charitable donation receipts for auction items. Whether someone donates an item to your auction or purchases something during bidding, different rules apply.

This guide will walk you through everything you need to know about receipting auction items in Canada. You'll learn about fair market value requirements, the intention to give threshold, and see practical examples that make the rules crystal clear.

Can You Issue Tax Receipts for Items Donated to a Charity Auction?

When someone donates an item for your charity auction, you can issue a tax receipt—but only if you follow CRA guidelines. Understanding these rules helps you stay compliant while showing appreciation for your donors' generosity.

The good news is that receipting donated auction items is generally straightforward. You'll need to determine the item's fair market value and ensure you have proper documentation from the donor.

Key Requirements for Receipting Donated Items

You can issue a receipt to someone who donates an item to your auction when you meet these conditions:

- The donor must be eligible to receive a charitable tax receipt

- You must determine the fair market value of the donated item

- The donation must be voluntary with no expectation of return

- You need proper documentation supporting the item's value

The receipt should be issued shortly after you receive the donated item. Don't wait until after the auction takes place.

Fair Market Value Requirements for Donated Auction Items

Fair market value (FMV) represents the highest price an item would sell for in an open market between a willing buyer and seller. This is the amount you'll show on the donor's tax receipt.

For most items under $1,000, you can accept the donor's reasonable estimate of value. However, for high-value items, you may need a professional appraisal.

Here's what you need to know about determining FMV:

For items valued under $1,000:

- Accept the donor's reasonable valuation

- Ensure the value seems appropriate for the item

- Keep notes about how the value was determined

For items valued over $1,000:

- Request professional appraisal documentation

- Verify the appraiser's qualifications

- Keep appraisal records with your receipting documentation

The CRA expects you to exercise due diligence when accepting valuations. If a donor claims their used laptop is worth $5,000 when similar models sell for $500, you should question this amount.

Documentation You Must Maintain

Keep detailed records for every donated auction item. Your documentation should include:

- Written confirmation from the donor describing the item

- Supporting evidence of the item's fair market value

- Photos of donated items when appropriate

- Appraisals for high-value donations

- The official donation receipt you issued

This documentation protects both your charity and the donor if the CRA ever questions the receipt.

Tax Receipts for Items Purchased at Charity Auctions

Receipting items purchased at auction involves more complexity than receipting donated items. You need to calculate whether the purchaser made a true charitable gift or simply bought something at market value.

The CRA's rules ensure that tax receipts only acknowledge genuine charitable donations. When someone buys an auction item, they're receiving something in return—which affects their eligible donation amount.

Not every auction purchase qualifies for a tax receipt. You'll need to apply the "intention to give" test and calculate the advantage the purchaser received.

Understanding the Advantage and Eligible Amount

When someone purchases an item at your auction, you must calculate two important figures:

The advantage: This is the fair market value of the item they received. This represents the benefit they got in exchange for their payment.

The eligible amount: This is the portion of their payment that exceeds the item's fair market value. Only this amount qualifies as a charitable donation.

For example, if someone pays $600 for an item worth $400, they received a $400 advantage. The eligible donation amount would be $200.

The 80/20 Rule for Auction Receipts

The CRA applies an important threshold called the "intention to give" test. This determines whether the purchaser's primary intention was to make a charitable gift or simply to acquire the item.

You can only issue a receipt when the advantage to the purchaser is 80% or less of the total amount paid.

Here's how this works:

- Calculate the advantage (the item's fair market value)

- Divide the advantage by the total amount paid

- If this percentage is 80% or less, you can issue a receipt

- If it exceeds 80%, no receipt can be issued

This rule ensures that people are genuinely making donations rather than just purchasing items at or near market value.

Establishing Fair Market Value Before the Auction

You must determine and disclose the fair market value of auction items before bidding begins. This transparency is essential for CRA compliance.

Purchasers need to know an item's FMV before they bid. This allows them to make informed decisions about how much to offer.

Best practices for displaying FMV:

- Clearly label each auction item with its fair market value

- Include FMV in your auction catalogue or program

- Announce FMV during live auctions

- Display FMV prominently on silent auction bid sheets

- Include FMV in online auction listings

Never hide or obscure the fair market value. Making this information obvious protects your charity and helps bidders understand the tax implications of their purchases.

The 125% Minimum Bid Requirement

To meet the intention to give threshold, the winning bid must be at least 125% of the item's fair market value. This minimum ensures the purchaser is making a meaningful charitable contribution beyond just acquiring the item.

You can set minimum bids at or above this 125% threshold. Many charities start bidding at exactly 125% of FMV to ensure all winning bids qualify for receipts.

Setting strategic minimum bids:

- Calculate 125% of each item's FMV

- Round to convenient bid amounts (e.g., $505 becomes $510)

- Clearly communicate minimum bids to potential bidders

- Explain that minimum bids ensure receipt eligibility

This approach maximizes your fundraising while ensuring receipt compliance.

Practical Example: Tax Receipts for a Bicycle Sold at Auction

Let's walk through a real-world example to see how auction receipting works in practice. This will help you understand how to apply the CRA's rules to your own auction items.

Imagine your charity receives a donated bicycle for your annual fundraising auction. A professional assessment determines the bike's fair market value is $400.

During the auction, an enthusiastic supporter places the winning bid of $550 for the bicycle.

Calculating the Eligible Amount for Tax Receipting

Now you need to determine whether you can issue a receipt and for how much. Follow these steps:

Step 1: Identify the fair market value The bicycle's FMV is $400. This represents the advantage the purchaser receives.

Step 2: Determine the total amount paid The winning bid was $550.

Step 3: Calculate the advantage percentage Divide the advantage by the amount paid: $400 ÷ $550 = 0.727 or 72.7%

Step 4: Apply the 80% threshold test Since 72.7% is less than 80%, the purchase passes the intention to give test.

Step 5: Calculate the eligible donation amount Subtract the advantage from the total paid: $550 - $400 = $150

You can issue a charitable donation receipt to the purchaser for $150.

Verifying the Minimum Bid Requirement

Let's also verify that the winning bid met the 125% minimum threshold:

- Fair market value: $400

- 125% of FMV: $400 × 1.25 = $500

- Winning bid: $550

The winning bid of $550 exceeds the $500 minimum, so this requirement is satisfied.

Understanding the Maximum Advantage Threshold

Finally, let's confirm the advantage didn't exceed 80% of the winning bid:

- Total amount paid: $550

- 80% of amount paid: $550 × 0.80 = $440

- Actual advantage: $400

Since the $400 advantage is less than the $440 maximum, you can issue the receipt.

What the Receipt Should Show

The official donation receipt you provide to the purchaser should include:

- Your charity's registered name and registration number

- The purchaser's full name and address

- The date of the donation (auction date)

- The eligible amount: $150

- A statement that this is an official receipt for income tax purposes

- Your authorized signature

Note that the receipt shows $150, not the full $550 the person paid. Only the amount exceeding the fair market value qualifies as a charitable donation.

When You Cannot Issue Auction Receipts

Understanding when you cannot issue receipts is just as important as knowing when you can. Recognizing these situations helps you avoid CRA compliance issues.

You cannot issue a charitable donation receipt in these circumstances:

The advantage exceeds 80% of the amount paid

If someone bids $450 for the bicycle worth $400, the advantage percentage would be 88.9%. This exceeds the 80% threshold, so no receipt can be issued.

The bid is below 125% of fair market value

If the winning bid was $480 for the $400 bicycle, it falls below the $500 minimum (125% of FMV). No receipt can be issued even though the bid exceeds the item's value.

Fair market value wasn't disclosed before bidding

If you forgot to display the FMV before the auction, you cannot issue receipts for that item. Retroactive disclosure doesn't satisfy CRA requirements.

The purchaser received additional benefits

If the auction package included extras not factored into the FMV calculation, you must recalculate the advantage. This might disqualify the receipt.

Handling Receipt Denials Professionally

When you can't issue a receipt, communicate clearly with the purchaser. Explain the CRA rules that prevent receipting in their specific situation.

Most supporters understand when you provide a clear explanation. Many are simply happy to support your cause regardless of the tax benefit.

Common Mistakes Charities Make with Auction Receipting

Avoiding common errors helps you maintain CRA compliance and protects your charity's registered status. Here are the most frequent mistakes charities make:

Failing to determine FMV before the auction

Some charities estimate fair market value after the auction ends. This violates CRA requirements and invalidates any receipts issued.

Issuing receipts for purchases that fail the 80% test

The intention to give threshold isn't optional. You must apply it to every auction purchase, even when it disappoints generous supporters.

Using inflated fair market valuations

Setting artificially low FMV amounts to make more bids receipt-eligible is non-compliant. The CRA expects honest, reasonable valuations.

Poor documentation and record-keeping

Without proper documentation, you cannot defend your receipting decisions during a CRA audit. Maintain detailed records for every auction item.

Receipting for items purchased by the donor

If someone donates an item and then purchases it themselves, special rules apply. Generally, no receipt should be issued for the purchase amount.

Issuing receipts without proper authority

Only authorized individuals should sign donation receipts. Ensure your receipting procedures include proper approval processes.

CRA Compliance Checklist for Charity Auction Receipting

Use this checklist to ensure your auction receipting meets CRA standards:

Before the auction:

- [ ] Determine fair market value for all auction items

- [ ] Obtain appraisals for items valued over $1,000

- [ ] Display FMV clearly on all auction materials

- [ ] Set minimum bids at 125% of FMV (if desired)

- [ ] Brief volunteers and staff on receipting rules

- [ ] Prepare receipt templates with mandatory information

During the auction:

- [ ] Ensure FMV remains visible to all bidders

- [ ] Announce FMV during live auction presentations

- [ ] Record winning bids and purchaser information accurately

- [ ] Note any special circumstances requiring review

After the auction:

- [ ] Calculate advantage and eligible amounts for each purchase

- [ ] Apply the 80% threshold test

- [ ] Verify the 125% minimum bid requirement

- [ ] Prepare receipts only for qualifying purchases

- [ ] Issue receipts within required timeframes

- [ ] Store all documentation for CRA audit purposes

Record-keeping requirements:

- [ ] Donor information and contact details

- [ ] Item descriptions and FMV determinations

- [ ] Appraisal documents when applicable

- [ ] Winning bid amounts and dates

- [ ] Advantage and eligible amount calculations

- [ ] Copies of all issued receipts

Following this checklist helps you maintain compliance while maximizing the benefits for your supporters.

Special Considerations for Different Auction Types

Different auction formats may require adapted approaches to receipting while maintaining CRA compliance.

Silent Auctions

Silent auctions require clear FMV display on bid sheets. Include a brief explanation of how receipting works so bidders understand the tax implications.

Place a notice near each item explaining that receipts are only issued when bids exceed 125% of the stated fair market value.

Online Auctions

For online charity auctions, include FMV in item descriptions. Your auction platform should clearly display this information before bidders place offers.

Consider adding automatic minimum bids at 125% of FMV to ensure all winning bids qualify for receipts.

Live Auctions

During live auctions, announce the fair market value when presenting each item. Your auctioneer should understand receipting requirements and communicate them to attendees.

Include FMV in your auction program so attendees can review values before bidding begins.

Best Practices for Charity Auction Receipting

Implementing strong receipting procedures protects your charity and supports your donors. These best practices help you navigate auction receipting confidently.

Educate your donors and bidders

Create simple handouts explaining how auction receipting works. Many supporters appreciate understanding the rules before they bid.

Train your volunteers and staff

Everyone involved in your auction should understand basic receipting principles. This ensures consistent application of CRA rules.

Use technology to simplify calculations

Auction management software can automatically calculate eligible amounts and flag purchases that don't qualify for receipts.

Document everything

When in doubt, over-document rather than under-document. Detailed records protect you during CRA reviews.

Seek professional guidance

Consult with charity law experts when you're uncertain about receipting complex auction scenarios. Professional advice prevents costly mistakes.

Review your procedures annually

CRA guidance evolves over time. Review your auction receipting procedures each year to ensure continued compliance.

Conclusion

Issuing proper tax receipts for auction items demonstrates your charity's commitment to transparency and CRA compliance. While the rules may seem complex at first, they become straightforward once you understand the key principles.

Remember these essential points:

- Always determine and disclose fair market value before auctions begin

- Apply the 80% threshold test to every auction purchase

- Only issue receipts when bids exceed 125% of FMV

- Maintain detailed documentation for all auction items and transactions

- Seek professional guidance when you encounter unusual situations

Following these guidelines protects your charitable status while maximizing the benefits for your generous supporters. Your donors deserve accurate receipting that reflects their true charitable contributions.

When you handle auction receipting properly, everyone wins. Your charity raises more funds, your donors receive appropriate tax recognition, and you maintain excellent standing with the CRA.

Need Help with Charity Auction Receipting?

Navigating charity auction receipting rules can be challenging, especially when applying the 80/20 threshold or determining fair market values. If you have questions about auction compliance, B.I.G. Charity Law Group can help. Our team specializes in guiding Canadian registered charities through CRA requirements.

Contact us at 416-488-5888, email dov.goldberg@charitylawgroup.ca, or visit CharityLawGroup.ca to discuss your auction procedures and receipting questions.

Schedule a FREE Consultation today and ensure your charity's fundraising auctions are fully CRA-compliant.

Frequently Asked Questions About Charity Auction Tax Receipts

Have questions about tax receipts and charity auctions in Canada? Here are answers to the most common questions about auction receipting and CRA compliance.

Are auction items tax deductible?

Auction items can be partially tax deductible when you purchase them at a charity auction. You can receive a charitable tax receipt for the amount you pay above the item's fair market value. For example, if you bid $600 on an item worth $400, you may receive a receipt for $200. However, your bid must meet CRA thresholds—it must be at least 125% of the fair market value, and the item's value cannot exceed 80% of your total payment.

Do I have to pay taxes on auction items?

You don't pay income tax on items you win at charity auctions because they're considered purchases, not income. However, you do need to pay GST or HST on auction items depending on your province. The charity collects and remits these sales taxes when required. The charitable tax receipt you might receive is separate from sales tax obligations.

Do you get a tax receipt for a silent auction?

You can get a tax receipt for silent auction purchases when CRA requirements are met. The item's fair market value must be displayed before bidding, your winning bid must be at least 125% of that value, and the advantage you receive cannot exceed 80% of what you paid. If your bid qualifies, you'll receive a receipt for the difference between what you paid and the item's fair market value.

Does an auction have tax?

Charity auctions in Canada are subject to GST or HST on most items sold. The charity must collect sales tax on taxable goods and services, just like any other sale. This sales tax is separate from charitable donation receipts. You might pay GST/HST on the full purchase price and separately receive a charitable tax receipt for the eligible donation portion.

Do you pay GST on auction items?

GST or HST applies to most auction items sold by Canadian charities. The charity charges the applicable sales tax on your full bid amount, not just the charitable portion. For example, if you win an item for $500 in Ontario, you'd pay $65 in HST (13%), bringing your total to $565. If you also qualify for a charitable tax receipt, that amount is calculated separately from the sales tax.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)