What is the Importance of an Annual General Meeting (AGM) for Canadian Charities and Nonprofits?

An Annual General Meeting (AGM) is a crucial event for any charity or nonprofit organization in Canada. This meeting provides a platform for transparency, accountability, and the overall functioning of the organization. If your organization is registered as a charity or nonprofit, understanding the purpose and requirements of an AGM is essential to staying compliant with Canadian laws and regulations. In this article, we will break down everything you need to know about AGMs, from their legal requirements to how they benefit your organization.

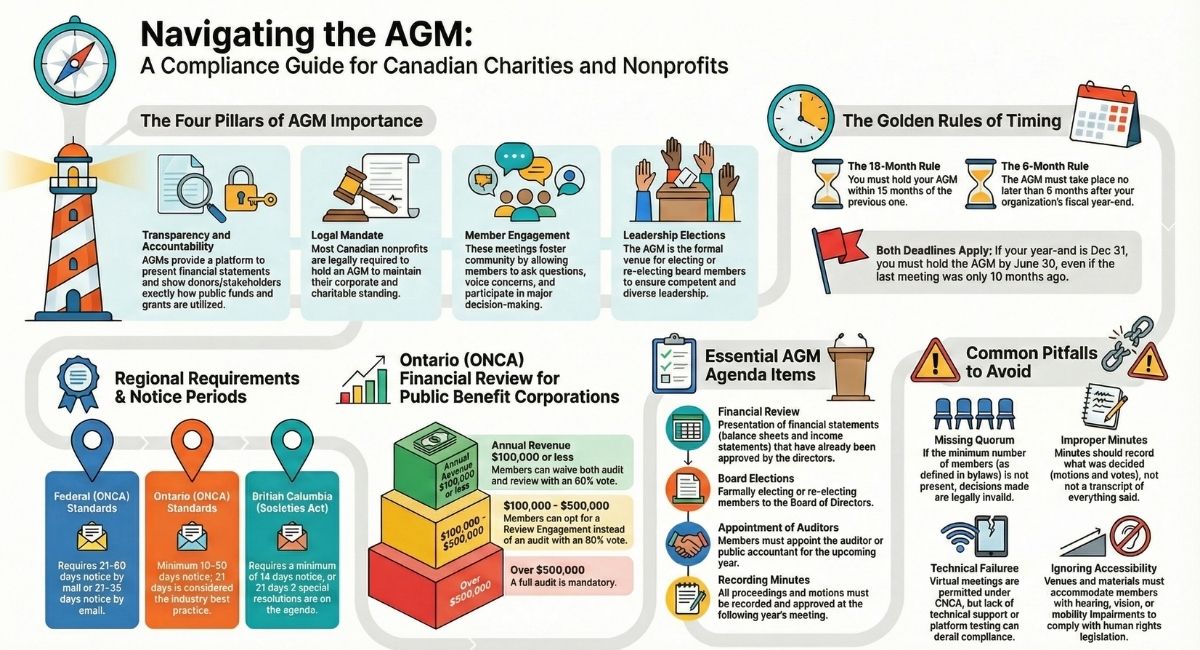

Quick AGM Requirements Summary

Key Requirements at a Glance:

- Timing: Hold your AGM within 15 months of your previous AGM AND within 6 months of your fiscal year-end

- Notice Period: Varies by jurisdiction and delivery method (see detailed requirements below)

- Essential Components: Financial statement review, board elections, member voting

- Virtual Meetings: Permitted under CNCA if bylaws allow

- Quorum: Required as specified in your bylaws

- Minutes: Must be recorded and approved

- Consequences of Non-Compliance: Legal penalties, potential loss of charitable status

- Provincial Variations: Requirements may differ between federal and provincial incorporation

This guide covers federal requirements under the Canada Not-for-profit Corporations Act (CNCA) and provincial requirements including Ontario's Not-for-Profit Corporations Act (ONCA). Always verify your specific jurisdiction's requirements.

What is an Annual General Meeting (AGM)?

An Annual General Meeting (AGM) is a formal meeting where the members of a nonprofit or charity gather to discuss the organization’s performance over the past year and its future direction. AGMs allow members to:

- Review financial statements presented by the board

- Elect or re-elect board members

- Approve major decisions and budgets for the upcoming year

- Discuss key developments, issues, or plans

For charities and nonprofits, this meeting is not just a good practice; it’s a requirement under Canadian law. The Canada Not-for-profit Corporations Act (CNCA) and various provincial regulations, including Ontario’s Ontario Not-for-Profit Corporations Act (ONCA), mandate AGMs for registered organizations.

Why Are AGMs Important for Canadian Charities and Nonprofits?

AGMs are vital for several reasons:

Transparency and Accountability

Charities and nonprofits handle public funds, donations, and grants, so it's important for these organizations to be transparent about how they use these resources. During the AGM, organizations present their financial statements, including income and expenditures, allowing members to understand how funds are being utilized.

Legal Requirement

Under the Canada Not-for-profit Corporations Act (CNCA), every charity or nonprofit in Canada must hold an AGM every year. There are two mandatory timing requirements you must meet:

- You must hold an AGM within 15 months of your previous AGM

- You must hold an AGM no later than 6 months after your organization's fiscal year-end

For example, if your fiscal year-end is December 31, you must hold your AGM by June 30, even if your last AGM was only 10 months ago. Missing either of these deadlines puts your organization in violation of the law.

Engagement with Members

AGMs offer an opportunity for members to engage with the board of directors and senior leadership. It allows them to ask questions, voice concerns, and participate in key decisions, fostering a sense of involvement and community within the organization.

Leadership Elections

The AGM is the place where board members are elected or re-elected. This is crucial for ensuring your charity or nonprofit has competent and engaged leadership. Elections also help maintain diversity and inclusion in leadership roles.

AGM Requirements by Organization Type

Requirements for AGMs can vary depending on how and where your organization is incorporated. Here's a comparison of key requirements across different jurisdictions and organization types:

Federal Incorporation (CNCA)

Notice Period:

- Mail or courier: 21 to 60 days before the meeting

- Electronic delivery (email): 21 to 35 days before the meeting

Quorum Requirements: As specified in bylaws; if not specified, a majority of members entitled to vote constitutes quorum

Financial Statements: Must be approved by directors (evidenced by director signatures) before presentation. Statements are then presented to members at the AGM for their receipt, not approval. Members appoint the auditor or public accountant.

Auditor/Review Requirements: Depends on annual revenue; organizations with revenue over $500,000 typically require an audit or review engagement

Key Distinction: Federal organizations must comply with CNCA regardless of which province they operate in. AGM must be held within 6 months of fiscal year-end.

Ontario (ONCA)

Notice Period:

- Statutory minimum: 10 to 50 days

- Many bylaws specify 21 days as best practice

- Method of delivery may affect timing

Quorum Requirements: As specified in bylaws; if silent, majority of members entitled to vote

Financial Statements: Must be approved by directors (evidenced by director signatures) and presented to members for their receipt

Auditor/Review Requirements for Public Benefit Corporations (all registered charities):

- $100,000 or less: Members can waive both audit and review by Extraordinary Resolution (80% vote)

- $100,000 to $500,000: Members can opt for Review Engagement instead of audit via Extraordinary Resolution (80% vote)

- Over $500,000: Audit is mandatory

Key Distinction: ONCA applies to Ontario-incorporated nonprofits. All registered charities are Public Benefit Corporations under ONCA and subject to stricter financial review requirements. AGM must be held within 6 months of fiscal year-end.

British Columbia (Societies Act)

Notice Period: Minimum 14 days for members; 21 days if special resolutions will be considered

Quorum Requirements: As specified in bylaws; if not specified, 3 members or 10% of voting members, whichever is greater

Financial Statements: Must be presented unless members have waived this requirement

Auditor/Review Requirements: Depends on revenue and whether members have waived the requirement

Key Distinction: BC allows members to waive certain requirements by unanimous consent

Alberta (Societies Act)

Notice Period: As specified in bylaws; minimum 7 days if bylaws are silent

Quorum Requirements: As specified in bylaws; commonly set at 10-20% of voting members

Financial Statements: Must be presented at AGM

Auditor/Review Requirements: Required unless members pass special resolution to waive

Key Distinction: Alberta has simpler requirements for smaller organizations

Quebec (Part III Companies Act or Civil Code)

Notice Period: As specified in bylaws or articles; typically 10-21 days

Quorum Requirements: As specified in bylaws

Financial Statements: Must be presented and received by members

Auditor/Review Requirements: Generally required unless specifically waived

Key Distinction: Quebec has unique corporate law framework; many organisations governed by Civil Code rather than specific nonprofit legislation

Member vs. Non-Member Organizations

Member Organizations: Must hold AGMs where members can vote on key decisions, elect directors, and receive financial statements. Members have specific rights under corporate legislation.

Directorship Organizations (Often called "Non-Member" Organizations): Under Canadian corporate law (CNCA/ONCA), a corporation must have members. In a "closed" or "directorship" model, the Directors serve as the only Members. These organizations must still hold a formal "Meeting of Members" (even if the attendees are the same people as the board meeting) to satisfy corporate law requirements to elect directors and receive financial statements. The meeting may be less formal than a traditional member-based organization, but the legal requirements still apply.

Incorporated vs. Unincorporated Organizations

Incorporated Nonprofits: Must comply with federal or provincial corporate legislation regarding AGMs. Failure to hold AGMs can result in dissolution or loss of corporate status.

Unincorporated Associations: Not legally required to hold AGMs under corporate law, but may be required by their constitution, bylaws, or funding agreements. Registered charities, whether incorporated or not, should hold AGMs as a governance best practice required by CRA.

What Are the Legal Requirements for an AGM?

As a Canadian charity or nonprofit, you need to follow specific legal guidelines when holding an AGM. These requirements may vary slightly depending on whether your organization is federally or provincially incorporated, but there are key things to know:

Timing of the AGM

The CNCA and ONCA mandate that an AGM be held at least once a year. You must meet two timing requirements:

- 15-Month Rule: Hold your AGM within 15 months of your previous AGM

- 6-Month Rule: Hold your AGM no later than 6 months after your organization's fiscal year-end

Both deadlines apply. If your fiscal year-end is December 31, you must hold the AGM by June 30, even if your last AGM was only 10 months ago. Missing either deadline puts your organization in violation of the law.

Notice of the AGM

A formal notice of the AGM must be sent to all members in advance. The notice period varies by jurisdiction and delivery method:

Federal (CNCA):

- Mail or courier: 21 to 60 days before the meeting

- Electronic delivery (email): 21 to 35 days before the meeting

Ontario (ONCA):

- Statutory minimum: 10 to 50 days

- Best practice: 21 days or as specified in bylaws

The notice should include the date, time, location, and agenda items that will be discussed, including when financial statements will be presented and elections held. Electronic notices are permitted, but you must ensure that all members have access to the meeting details.

Agenda

The agenda for the AGM typically includes:

- Presentation of the financial statements (approved by directors)

- Election or re-election of board members

- Appointment of auditors or public accountants, if applicable

- Discussion of the organization's activities over the past year

- Any other business (AOB) or issues raised by members

Quorum

In order to conduct official business at the AGM, a quorum (the minimum number of members present) is required. The quorum is usually outlined in the organization's bylaws. Without a quorum, decisions made during the meeting would not be valid.

Minutes of the Meeting

Every AGM must have minutes recorded to document the proceedings. These minutes should include who attended the meeting, any motions passed, and other important details. Minutes should be approved at the following AGM and made available to members.

What Happens if You Don’t Hold an AGM?

If your charity or nonprofit fails to hold an AGM, it can have serious consequences:

- Legal Penalties: Your organization could face penalties or even risk losing its charity status.

- Loss of Transparency: Without an AGM, members and stakeholders have no formal way to review the charity’s finances, leadership, or overall progress.

- Loss of Trust: Not holding an AGM may signal to your members, donors, and the public that the organization is not transparent or accountable, potentially undermining trust.

Common AGM Mistakes to Avoid

Even experienced boards sometimes make errors that can compromise their AGM's effectiveness or legality. Here are the most common mistakes and how to avoid them.

Insufficient Notice to Members

Many organizations send AGM notices exactly at the minimum notice period or even cut it close, not accounting for mail delivery time or ensuring electronic notices are actually received.

Best practice: Send notices well in advance—at least 25-30 days for CNCA organizations, and confirm that your delivery method complies with the specific timing rules. For electronic notices under CNCA, remember the maximum is 35 days, not 60. Confirm that email notices haven't bounced and provide multiple ways for members to access information.

Missing Quorum Requirements

Failing to adequately promote the AGM often results in poor attendance and missing quorum, which means no business can be conducted. Solution: Start promoting your AGM 6-8 weeks in advance. Send save-the-date notices, post on social media, include reminders in newsletters, and personally contact key members to encourage attendance. Consider offering virtual participation to increase attendance.

Inadequate Financial Documentation

Presenting financial statements without sufficient context or explanation leaves members confused and unable to provide meaningful oversight.

Solution: The treasurer should prepare both written and verbal explanations of the financial statements in plain language. Highlight key points, explain any unusual items, and be prepared to answer common questions. Provide comparison to budget or prior year to give context. Remember that the board has already approved these statements—your role is to present them clearly to members.

Failure to Record Minutes Properly

Minutes that are too brief fail to document important decisions, while minutes that are too detailed include strategic discussions that should remain confidential. Solution: Minutes should record what was decided, not what was said. Include: motions in exact wording, who moved and seconded, the vote result, and any required follow-up actions. Don't include full discussions or personal opinions.

Not Allowing Proper Member Participation

Rushing through the agenda or dismissing member questions creates resentment and defeats the purpose of the AGM. Solution: Budget adequate time for each agenda item, particularly financial statement review and questions. The chair should welcome questions and ensure all members feel heard. If detailed questions arise that will take significant time, offer to follow up after the meeting.

Ignoring Accessibility Requirements

Holding AGMs in locations that aren't wheelchair accessible or failing to provide accommodations for members with hearing or vision impairments violates human rights legislation. Solution: Choose accessible venues, provide sign language interpretation if requested, offer materials in large print or electronic formats, and ensure your virtual platform is compatible with assistive technologies.

Technical Failures in Virtual Meetings

Poor internet connections, unfamiliar platforms, or lack of technical support can derail virtual AGMs. Solution: Test your technology thoroughly before the meeting, have a technical coordinator managing the virtual platform, provide members with clear joining instructions and a practice session if needed, and have a backup plan (such as telephone conference line) if the primary platform fails.

Improper Voting Procedures

Using ambiguous language in motions, failing to clearly state what members are voting on, or not properly counting votes can invalidate decisions.

Solution: Ensure all motions are written out in advance and read clearly before voting. For contentious issues, use ballot voting rather than show of hands. Appoint scrutineers to count votes if needed. Record the exact vote count for special resolutions and Extraordinary Resolutions (which require 80% approval under ONCA for certain matters).

Conducting Business Without Proper Authority

Sometimes boards try to get decisions "rubber stamped" at AGMs without giving members genuine opportunity for input. Solution: Remember that members, not the board, are the ultimate authority in member-based organizations. Present proposals with honest pros and cons, allow genuine debate, and be prepared for members to vote differently than the board recommends.

Failing to Follow Up on AGM Decisions

Decisions made at AGMs are sometimes not implemented because no one was assigned responsibility. Solution: The board should review AGM decisions at its next meeting, assign responsibility for follow-up actions, and set deadlines. Report back to members on implementation of AGM decisions in your next newsletter or communication.

How to Prepare for Your AGM

Here are the steps to prepare for a successful AGM:

- Review Your Bylaws

Your organization’s bylaws will outline the rules for your AGM, including the number of directors required, the process for elections, and the quorum required. Familiarizing yourself with these rules is key. - Prepare Financial Statements

Ensure that your charity's financial statements are ready for board approval and member presentation. This includes the balance sheet, income statement, and any notes to the financial statements. The board of directors must approve the financial statements (evidenced by director signatures) before they are presented to members. If your charity requires an audit or review engagement based on its revenue and jurisdiction, arrange this well in advance of your fiscal year-end. - Notify Members

Send out notices of the AGM in accordance with your jurisdiction's requirements:- Federal (CNCA): 21-60 days for mail/courier, 21-35 days for electronic

- Ontario (ONCA): 10-50 days statutory minimum, or as specified in bylaws

- Plan for Elections

If board members are up for re-election, make sure nominations are collected well before the meeting. Voting can be done by members present, or in some cases, via proxy if allowed by the bylaws. - Prepare for Questions

Be ready to answer questions about your charity’s finances, activities, and plans for the future. The AGM is a time for transparency, so ensure your board and leadership team are prepared to discuss any concerns.

Conclusion

The Annual General Meeting is a vital tool for Canadian charities and nonprofits to ensure they are operating legally and ethically. Holding an AGM is not only a legal requirement but also an opportunity to engage with your members, foster transparency, and make key decisions about the future of your organization. By following the guidelines outlined in this blog, you can ensure that your AGM runs smoothly and effectively, setting the stage for another year of success.

By holding an effective AGM, your charity or nonprofit will build trust with its members, remain compliant with Canadian laws, and continue making a positive impact on your community.

Frequently Asked Questions

If you run or volunteer with a charity or nonprofit in Canada, you might have questions about annual general meetings. These meetings are an important part of running your organization legally and keeping your members informed. Here are answers to common questions about AGMs.

What is the purpose of an annual general meeting (AGM)?

An annual general meeting is a formal gathering where members of a nonprofit or charity come together once a year to review what the organization has accomplished. During this meeting, members look at financial reports, vote on important decisions, and discuss plans for the future.

What is the purpose of an AGM for a charity?

For charities in Canada, the AGM allows the charity to show members and donors how donation money is being spent. Members can review financial statements and elect board members who will lead the organization. Canadian law requires charities to hold an AGM every year within 15 months of the previous meeting and within 6 months of fiscal year-end to stay in good standing and maintain their charitable status.

Why is an AGM important?

AGMs create transparency and accountability when charities handle public donations and grants. It is also a legal requirement under the Canada Not-for-profit Corporations Act. Organizations must hold an AGM within 15 months of their last meeting and within 6 months of their fiscal year-end. Missing either requirement can lead to penalties or even loss of charity status.

What is the main objective of the meeting?

The main objective of an AGM is to keep members informed and involved in how the charity operates. The board presents the organization's financial health, activities, and future plans. Members get to ask questions, raise concerns, and vote on major decisions.

What are the four reasons for meetings?

AGMs provide transparency by presenting financial statements. They fulfill legal requirements set by Canadian law. They engage members by giving them a voice in important decisions. They also handle leadership elections to ensure the charity has qualified board members.

What is the basic AGM agenda?

A typical AGM agenda includes a presentation of financial statements from the past year (which the board has already approved). It covers the election or re-election of board members. The meeting includes a review of activities and accomplishments. There is also time for members to bring up other business or questions. All members must receive notice of the agenda in accordance with your jurisdiction's timing requirements (typically 21 days or more in advance).

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)