What Is a Charity Registration Number in Canada?

Becoming a registered charity in Canada is a significant achievement for nonprofit organizations, granting them access to valuable benefits while requiring strict compliance with regulations. A key component of this status is obtaining a registered charity number, officially known as a Business Number (BN) with the RR0001 suffix.

This comprehensive guide covers everything you need to know about registered charity numbers in Canada, including:

- What a registered charity number is and why it matters

- How to get a registered charity number from the CRA

- The benefits and obligations of registered charity status

- How to verify a charity’s registration using its charity registered number

What is a Registered Charity (Business) Number in Canada?

A registered charity number is a unique 15-digit identifier assigned by the Canada Revenue Agency (CRA) to approved charitable organizations. It follows the format: 123456789RR0001, where the RR0001 suffix confirms the organization’s status as a registered charity.

This number serves two key purposes:

- Proof of Legitimacy – It verifies that the charity is officially recognized by the CRA.

- Tax Receipt Issuance – Only charities with a CRA-registered charity number can issue official donation receipts for tax credits.

Who Needs a Registered Charity Number?

Not every nonprofit organization needs or qualifies for a registered charity number in Canada. Understanding whether your organization should pursue charity registration is crucial before investing time and resources in the application process.

Organizations That Should Consider Charity Registration:

You likely need charity registration if your organization:

- Wants to issue official donation receipts that allow donors to claim tax credits

- Plans to apply for government grants that require registered charity status

- Seeks foundation funding (most foundations only grant to registered charities)

- Operates exclusively for charitable purposes under Canadian law

- Has primarily public benefit activities (not private benefit to members)

- Requires the credibility and trust that comes with CRA oversight

Types of Organizations That Commonly Register:

- Religious organizations and places of worship

- Social service agencies and community support organizations

- Educational institutions and scholarship programmes

- Healthcare facilities and medical research organizations

- Arts and cultural organizations

- Environmental conservation groups

- International development and relief organizations

- Private and public foundations

- Animal welfare organizations

When Registration May NOT Be Necessary:

Your organization might not need charity registration if you:

- Operate as a social club, sports club, or recreational organization

- Provide services primarily to members rather than the public

- Don't need to issue tax receipts (donors don't expect them)

- Operate as a business with profits distributed to members

- Operate as a business or social enterprise with profits distributed to members

- Work outside Canada without sufficient Canadian presence or control

Quick Decision Checklist:

Consider charity registration if you answer YES to most of these:

☑ Our purposes are exclusively charitable (relief of poverty, advancement of education, advancement of religion, or other purposes beneficial to the community)

☑ We serve the public or a sufficient section of the public

☑ We need to issue tax receipts to donors

☑ We want access to grants requiring registered charity status

☑ We can commit to annual CRA filing and compliance requirements

☑ Our activities are exclusively charitable (no political campaigning, no private benefit)

A nonprofit organization may be more appropriate if:

☐ You serve primarily members rather than the public

☐ You operate business activities for profit

☐ You don't need to issue tax receipts and don't meet the requirements for charitable status

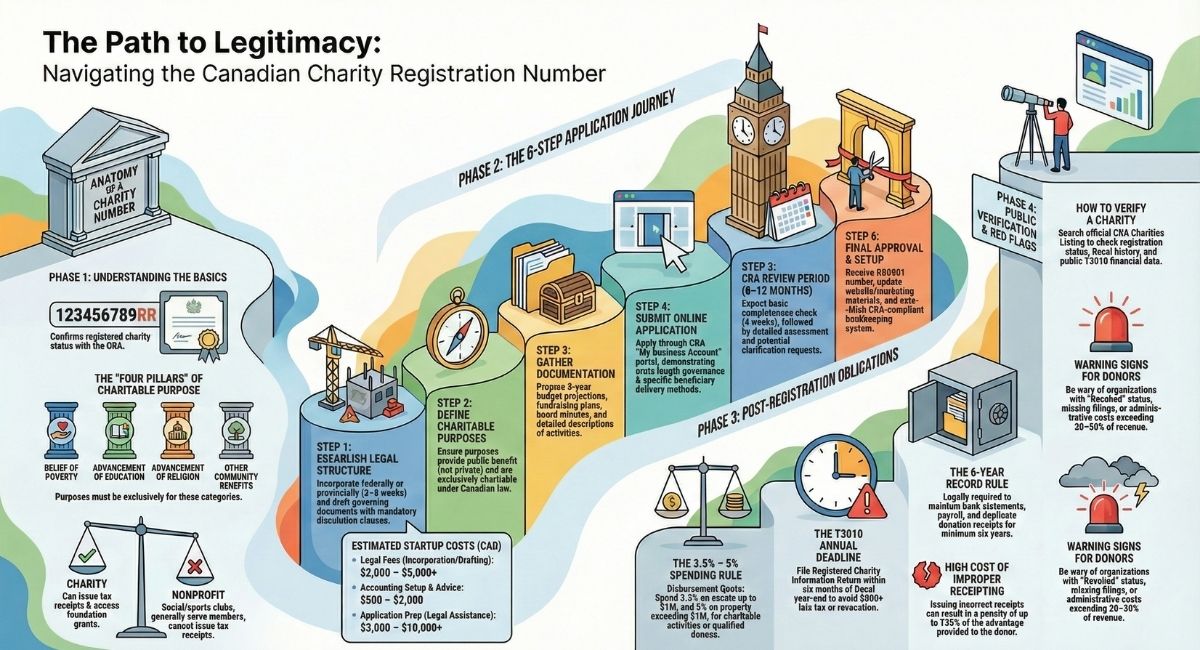

How to Apply for a Registered Charity Number: Step-by-Step Process

Obtaining a registered charity number requires careful preparation and patience. The process is rigorous, and the CRA thoroughly reviews each application to ensure compliance with Canadian charity law.

Step 1: Establish a Legal Structure

Before applying for charity registration, you should establish a legal structure for your organization. While incorporation is highly recommended for liability protection, the CRA can register charities under different legal structures:

Legal structures that can be registered:

- Incorporated nonprofits (federal or provincial)

- Unincorporated associations (with a constitution or governing document)

- Charitable trusts (with a trust deed)

What you need:

- Choose federal incorporation (under the Canada Not-for-profit Corporations Act) or provincial incorporation (varies by province, such as Ontario's Corporations Act or the Ontario Not-for-Profit Corporations Act - ONCA)

- Draft articles of incorporation with exclusively charitable purposes

- Ensure your governing documents meet CRA requirements

- Include proper dissolution clauses (assets must go to qualified donees upon dissolution)

Timeline: 2-8 weeks depending on jurisdiction

Step 2: Develop Qualifying Charitable Purposes

Your organization's purposes must fit within one or more of the four categories of charity recognised under Canadian law:

- Relief of poverty – Assistance to those in financial need

- Advancement of education – Formal or informal learning and training

- Advancement of religion – Promoting religious worship and doctrine

- Other purposes beneficial to the community – Activities the courts have recognised as charitable

Critical requirements:

- Purposes must be exclusively charitable (no mixed charitable and non-charitable purposes)

- Purposes must provide public benefit

- Purposes cannot provide private benefit to founders, directors, or members

- Purposes must be legal and not contrary to public policy

Step 3: Prepare Required Documentation

Before starting your application, gather all necessary documentation:

Essential documents:

- Articles of incorporation and bylaws

- Detailed description of proposed activities

- Organizational structure chart

- Three-year budget projections

- Fundraising plans

- List of initial directors and their qualifications

- Description of how you'll achieve your charitable purposes

- Banking information

- Board meeting minutes (if already operating)

Step 4: Complete the Application to Register a Charity

The CRA uses an online application system through the My Business Account portal.

Application components:

- Organizational information – Legal name, address, contact details, incorporation details

- Purposes and activities – Detailed explanation of what you'll do and how it's charitable

- Governance structure – Information about your board and decision-making processes

- Financial information – Revenue sources, expense projections, fundraising methods

- Programmes and services – Specific details about beneficiaries and delivery methods

Important tips:

- Be thorough and specific – vague applications are often rejected

- Clearly explain how each activity achieves your charitable purposes

- Demonstrate public benefit in everything you do

- Show arm's length relationships with any related organizations

- Explain any relationships with non-qualified donees or foreign organizations

Step 5: Submit and Wait for CRA Review

Once submitted, the CRA's Charities Directorate will review your application.

What to expect:

- Initial review: 2-4 weeks for basic completeness check

- Detailed assessment: CRA may request additional information or clarification (this is normal)

- Response time: You typically have 60 days to respond to CRA questions

- Total processing time: Currently 8-12 months on average, though complex applications may take longer

During the waiting period:

- Respond promptly to any CRA requests for information

- Don't operate as if you're already registered (don't issue receipts)

- Continue building your organization and governance capacity

- Keep detailed records of all activities

Step 6: Receive Your Charity Registration Number

If approved, the CRA will issue your Business Number with the RR0001 designation.

You'll receive:

- Official registration letter with your charity registration number

- Effective date of registration (usually the date of application)

- Instructions for filing annual T3010 returns

- Information about issuing donation receipts

- Access to CRA's My Business Account for charities

Next steps after approval:

- Update your website and materials with your registration number

- Set up proper bookkeeping and receipt systems

- Plan for your first annual T3010 filing

- Notify funders and stakeholders of your registered status

- Begin issuing official donation receipts

Application Costs

The CRA does not charge a fee to apply for charity registration. However, you should budget for:

- Legal fees for incorporation and document drafting: $2,000-$5,000+

- Accounting setup and advice: $500-$2,000

- Application preparation assistance (if using a lawyer): $3,000-$10,000+

How to Find a Registered Charity Number

✅ Issue tax receipts

✅ Access grant funding

✅ Enjoy income tax exemptions

Benefits of Having a Registered Charity Number

✔ Tax-Deductible Receipts– Donors can claim tax credits on their tax returns..

✔ Tax Exemptions– No income tax on eligible activities.

✔ Credibility & Trust– Donors and funders preferCRA-registered charities.

✔ Eligibility for Grants– Many foundations only fund registered charities.

Obligations of Registered Charities

With the benefits of charity registration come significant compliance obligations. Failure to meet these requirements can result in penalties or revocation of charity status.

Annual Filing Requirements

📌 File the T3010 Registered Charity Information Return

Every registered charity must file an annual T3010 return within six months of its fiscal year-end.

The T3010 includes:

- Financial statements (revenue, expenses, assets, liabilities)

- Details of all programmes and activities

- Information about directors and officers

- Compensation paid to employees and contractors

- Political activities (if any)

- Gifts to qualified donees

- Foreign activities and expenditures

Late filing penalties:

- $500 for returns up to 3 months late

- Additional $100 per complete month late after 3 months

- Possible revocation for persistent non-compliance

Disbursement Quota Requirement

📌 Spend Required Amounts on Charitable Activities

Charities with assets over $100,000 must spend a minimum amount annually on their own charitable activities or gifts to qualified donees. This is called the disbursement quota (DQ).

Current disbursement quota:

- 3.5% of the average value of property not used in charitable activities or administration up to $1 million

- 5% of the average value of property exceeding $1 million

These rates came into effect January 1, 2023.

Consequences of failing to meet DQ:

- Penalties and potential revocation

- Required to explain shortfalls to CRA

- May need to increase spending or reduce assets

Books and Records

📌 Maintain Proper Financial Records

Charities must keep detailed books and records for six years, including:

- All donation receipts issued (both copies)

- Bank statements and cancelled cheques

- Invoices and receipts for all expenses

- Payroll records

- Board meeting minutes

- Financial statements

- Contracts and agreements

Donation Receipt Rules

📌 Issue Receipts According to CRA Guidelines

When issuing official donation receipts, charities must:

- Include all required information (charity name, registration number, donor name, date, amount, signature, etc.)

- Only receipt eligible gifts (must be voluntary transfers of property with no advantage to donor)

- Follow proper valuation rules for non-cash gifts

- Keep a duplicate copy of every receipt issued

Penalties for improper receipting:

- Up to 125% of the value of any advantage received by the donor

- Suspension of receipting privileges

- Potential revocation

Governance and Operations

📌 Follow CRA Compliance Rules

Registered charities must:

- Operate exclusively for charitable purposes

- Ensure political activities are non-partisan Public Policy Dialogue and Development Activities (PPDDAs) that relate to the charity's stated purposes

- Avoid providing private benefit to directors, members, or related parties

- Ensure all activities further charitable purposes

- Maintain proper governance (functioning board, conflict of interest policies, etc.)

- Report changes to legal structure, purposes, or activities

Prohibited activities include:

- Partisan political activities (supporting or opposing political parties or candidates)

- Conducting business activities that are not substantially related to charitable purposes

- Providing undue benefits to founders, directors, or members

- Lending money or other resources to non-qualified donees without proper safeguards

Specific Penalty Examples

Understanding the real consequences of non-compliance helps charities prioritise proper administration:

Late T3010 Filing Penalties:

- Example: A charity with a March 31 year-end must file by September 30. If they file on December 15 (2.5 months late), they owe $500. If they file on February 1 (4 months late), they owe $500 + $100 = $600.

Improper Receipting Penalties:

- Example: A charity issues a $1,000 receipt to a donor who received $300 in goods or services. The CRA determines a $300 advantage was provided. The penalty could be up to $375 (125% of $300).

Revocation Statistics:

The CRA revokes approximately 200-300 charity registrations annually for various compliance failures, including:

- Failure to file annual returns (most common reason)

- Operating outside charitable purposes

- Providing private benefit

- Inadequate books and records

- Improper donation receipting

Once revoked, re-registration is difficult and requires demonstrating that issues have been resolved.

How to Verify a Charity's Registration

Before donating or partnering with a charity, confirming its legitimacy protects you from fraud and ensures your donation qualifies for tax credits.

Method 1: Search the CRA Charities Listings

The CRA maintains a publicly searchable database of all registered charities.

How to search:

- Visit the CRA Charities Listings at https://www.canada.ca/charities-giving

- Enter the charity's name or registration number

- Review the charity's status and information

What you'll find:

- Official registered name

- Business Number (with RR0001 designation)

- Registration date

- Status (registered, revoked, or annulled)

- Fiscal period information

- Contact information

- Link to most recent T3010 return (publicly available)

Red flags:

- Charity is "revoked" or "annulled"

- No results found for the name provided

- Registration number doesn't match the charity's claims

- Significantly out-of-date T3010 filings

Method 2: Request the Charity's Registration Number Directly

Legitimate charities will readily provide their registration number.

What to ask for:

- Full 15-digit Business Number (format: 123456789RR0001)

- Confirm it matches information on their website and materials

- Request a copy of their most recent T3010 if conducting due diligence

Warning signs:

- Charity refuses to provide registration number

- Number provided doesn't appear in CRA database

- Charity claims to be registered but can't prove it

- Number format doesn't match standard (doesn't end in RR0001)

Method 3: Review Their T3010 Annual Returns

All registered charities' T3010 returns are publicly available on the CRA website.

What to review:

- Financial information – Revenue sources, programme spending, administrative costs

- Programmes and activities – What the charity actually does

- Compensation – How much is paid to staff and contractors

- Related parties – Relationships with other organizations

- Foreign activities – Work done outside Canada

Red flags in T3010 filings:

- Excessive administrative costs (over 20-30% of revenue)

- Very high compensation relative to organization size

- Missing or very late filings

- Minimal programme spending relative to revenue

- Unclear or vague descriptions of activities

Additional Verification Tools

🔍 Check for Complaints or Warnings:

- Search online for the charity's name plus "complaint" or "scam"

- Check Better Business Bureau charity reviews (if available)

- Review charity watchdog websites

- Look for media coverage or investigations

🔍 Contact the Charity Directly:

- Ask questions about their programmes and impact

- Request annual reports or impact statements

- Inquire about governance and oversight

- Evaluate their transparency and responsiveness

🔍 Assess Their Online Presence:

- Professional website with clear information

- Active social media showing real programmes and activities

- Transparent financial information

- Contact information and physical address

- Photos and stories demonstrating actual work

Final Thoughts

Obtaining a registered charity number in Canada is a crucial step for nonprofit organizations seeking tax benefits, donor trust, and funding opportunities. Whether you're applying for a CRA registered charity number or verifying one, understanding the process, benefits, obligations, and compliance requirements ensures long-term success and impact.

The journey from incorporation through application to maintaining registered status requires dedication, proper governance, and ongoing attention to CRA requirements. While the process can take 8-12 months and requires significant documentation, the benefits of charity registration—from issuing tax receipts to accessing grants and building public trust—make it worthwhile for organizations genuinely committed to charitable purposes.

For expert guidance on charity registration and compliance, consult an experienced charity lawyer or nonprofit tax professional who can help navigate the complexities of Canadian charity law.

Need help with your charity registration application? Contact B.I.G. Charity Law Group for professional assistance with every step of the process.

Frequently Asked Questions

Have questions about charity registration numbers in Canada? Find quick answers below to help you understand and locate the registration information you need.

What is a CRA registration number?

A CRA registration number is a unique number the Canada Revenue Agency gives to businesses and organizations. It helps the CRA track and identify them for tax purposes. Different types of organizations get different registration numbers depending on what they do.

What is a charity registration number?

A charity registration number is a 9-digit Business Number (BN) assigned to the legal entity, followed by a program account identifier. For registered charities, this identifier is "RR" followed by a 4-digit program account number (usually 0001). The complete registration number appears as: 123456789RR0001.

Charities must include this number on donation receipts so donors can claim tax credits.

How do I find out if a charity is registered in Canada?

You can search for registered charities on the CRA website using their "List of Charities" search tool. Go to the CRA's Charities and Giving page and enter the charity's name or registration number. The search will show you if the charity is currently registered and in good standing.

How do I find my charity reference number?

You can find your charity registration number on any official donation receipt the charity gave you. It's also listed on the CRA's website when you search for the charity by name. If you're part of the charity organization, check your CRA correspondence or your official charity documents.

What is the registration number of Canada?

Canada doesn't have a single registration number. Different registrations exist for different purposes. Businesses get business numbers, charities get charity registration numbers, and there are other types like GST/HST numbers. The specific number depends on what type of registration you need.

What is the format of registration number?

For charities, the format is a 9-digit number followed by RR (for most charities) and a 4-digit program number. For example: 123456789RR0001. Business numbers are 9 digits, sometimes followed by a 2-letter program identifier and 4 digits for specific accounts. The format varies depending on the type of registration.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)