How Do You Register Your Federal Nonprofit or Charity as an Extra-Provincial Corporation in Ontario?

Are you planning to operate your federally incorporated nonprofit or charity in Ontario? If so, you’ll need to register it as an extra-provincial corporation with the Ontario Business Registry. This step ensures that your organization follows provincial laws, avoids penalties, and can operate, fundraise, and grow within Ontario legally.

This guide explains what extra-provincial registration means, how to do it, and also answers common questions like:

- How much does it cost to register a nonprofit in Ontario?

- What’s the difference between a nonprofit and a charity?

- Can you start a nonprofit by yourself in Canada?

- Is there a difference between “nonprofit” and “not-for-profit” in Ontario?

Let’s break it down.

Understanding Federal Versus Provincial Incorporation

When deciding between federal and provincial incorporation for a nonprofit or charity, it's important to understand the legal frameworks and operational realities involved.

Each option offers distinct benefits and responsibilities that affect how we manage and expand our organization in Ontario and across Canada.

Key Differences Between CNCA and ONCA

The Canada Not-for-profit Corporations Act (CNCA) governs federal incorporation and provides a national standard.

It allows us to operate across all provinces without needing to re-incorporate. In contrast, the Ontario Not-for-profit Corporations Act (ONCA) applies only to Ontario-based nonprofits.

Under CNCA, our organization's name is protected nationwide after approval. With ONCA, name protection applies only within Ontario.

Federal corporations must still register as extra-provincial when working in another province. Provincial corporations generally don’t have this national reach without extra registration.

These two acts also differ in meeting and reporting requirements. CNCA has detailed rules for member rights and annual filings.

ONCA has more flexibility but applies only within Ontario’s jurisdiction.

Wondering how federal nonprofits and charities can operate in Ontario? Learn more about CNCA vs. ONCA and explore our guide to extra-provincial registration.

Advantages of Federal Incorporation

Federal incorporation through Corporations Canada offers key advantages for nonprofits wanting broader reach.

It grants name protection across all provinces and territories, reducing the risk of similar names in other jurisdictions.

Federal incorporation makes it easier to open branches or conduct fundraising activities nationwide without forming new corporations.

It also enhances recognition; federally incorporated nonprofits are often seen as more credible by funders and partners outside Ontario.

Additionally, Corporations Canada provides online services to file documents and pay fees. This streamlines administrative work for organizations managing activities in multiple provinces.

Implications of Provincial Registration

Even federally incorporated nonprofits operating in Ontario must register as extra-provincial corporations under Ontario law.

This means filing documents with the Ontario government to obtain permission to carry out activities here.

Without this extra-provincial registration, we risk penalties or legal issues. The process includes submitting forms, paying fees, and keeping up with Ontario’s reporting rules.

Provincial incorporation under ONCA avoids the extra-provincial step if we work only in Ontario.

However, expanding outside Ontario requires registration in every other province where we operate. This can add complexity and costs.

Balancing extra-provincial requirements with our operational goals helps us choose the best path for managing our nonprofit or charity.

What is Extra-Provincial Registration in Ontario?

If your nonprofit or charity is incorporated federally or in another province, and you want to carry out activities in Ontario (like fundraising or hosting events), you must register as an extra-provincial corporation.

This registration tells the Ontario government that you’re doing business in the province and agree to follow its rules for nonprofits and charities.

Why You Need to Register

Registering your organization as an extra-provincial corporation allows you to:

- Legally operate and fundraise in Ontario

- Build trust with donors, volunteers, and grant providers

- Avoid fines or penalties for non-compliance

If you skip registration, your nonprofit may not be allowed to open a bank account, apply for grants, or sign contracts in Ontario.

Step-by-Step: How to Register Your Federal Nonprofit or Charity in Ontario

Here’s a simple guide to help you through the process:

1. Confirm Federal Incorporation

Your organization must already be incorporated federally through Corporations Canada. This allows you to operate in any province, but each province—including Ontario—has extra steps to complete.

2. Gather Your Documents

You’ll need the following:

- Certificate of Incorporation from Corporations Canada

- Articles of Incorporation showing your purpose and structure

- Certificate of Good Standing (proof that your nonprofit is following federal rules), when applicable

3. Complete the Ontario Application

Go to the Ontario Business Registry and fill out the Extra-Provincial Corporation application. Make sure the name and information match exactly what’s on your federal documents.

4. Appoint an Agent for Service in Ontario

You must list someone who lives in Ontario and can receive legal documents on your behalf. This can be:

- A board member

- A lawyer

- A trusted person with a physical address in Ontario

5. Submit Your Application

Once you complete the form and upload your documents, submit everything online through the Ontario Business Registry.

6. Get Your Registration Details

After approval, you’ll receive:

- An Ontario Corporation Number (OCN)

- Your entity’s registered name

- A transaction number

These will be needed for banking, grant applications, and other official uses.

How Much Does It Cost to Register a Nonprofit in Ontario?

The cost to register as an extra-provincial nonprofit in Ontario is currently free (as of 2025), when done through the Ontario Business Registry and where the nonprofit is incorporated federally. However, you may also have small additional costs for legal help or document preparation, or where the nonprofit is incorporated in a different province.

You should also factor in yearly maintenance costs, such as annual filings or professional assistance to keep your organization in good standing.

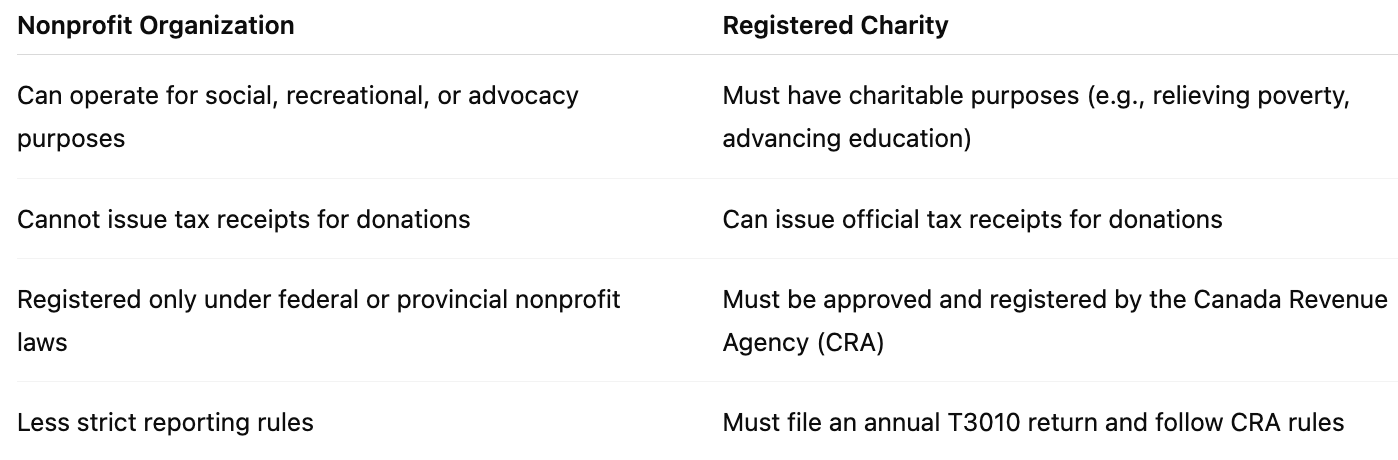

What’s the Difference Between a Nonprofit and a Charity in Canada?

Understanding the difference between a nonprofit and a charity in Canada is crucial before registering your organization as an extra-provincial corporation in Ontario, as each type has distinct registration requirements and procedures.

Many people use these terms interchangeably, but they’re not the same.

So, all charities are nonprofits, but not all nonprofits are charities.

What’s the Difference Between “Nonprofit” and “Not-for-Profit” in Ontario?

In Ontario, the terms nonprofit and not-for-profit mean the same thing. Both refer to organizations that do not operate to make a profit for owners or shareholders. Instead, they use their income to support their mission.

Can I Start a Nonprofit by Myself in Canada?

Yes, you can! Many people start nonprofits on their own, especially at the federal level. However, to legally incorporate your nonprofit in Ontario and most provinces, you’ll need to list at least three directors who are over 18 years old and not bankrupt. On the federal level, you can incorporate a nonprofit with just 1 director.

You can be one of the directors and bring in trusted friends, family members, or colleagues who share your vision.

Tips for a Smooth Registration

- Double-Check Everything: Make sure all names, dates, and addresses match exactly with your federal records.

- Stay Compliant: After registration, you must file annual returns in both Ontario and with Corporations Canada to keep your nonprofit active.

- Get Help If Needed: A lawyer or nonprofit consultant can help you avoid mistakes and delays.

Benefits of Extra-Provincial Registration

Registering your federally incorporated nonprofit or charity in Ontario gives you:

- Access to Ontario grants and provincial partnership programs

- Legal status to fundraise and host events

- Increased trust from donors and community members

- Room to grow your programs across Canada’s largest province

Compliance and Ongoing Obligations After Registration

Registering as an extra-provincial corporation in Ontario is just the beginning.

We must stay up to date with ongoing reporting, keep our corporate information current, and maintain any necessary permits or tax accounts.

These steps help us comply with provincial rules and keep our nonprofit in good standing with the Ontario Business Registry.

Annual Return and Reporting

We have to file an annual return with the Ontario Business Registry to maintain our registration as an extra-provincial corporation.

This return confirms our organization’s details and shows we are active in Ontario.

Typically, the annual return includes updates on the corporation’s directors, address, and contact information.

Failing to file the annual return on time can result in penalties or even the cancellation of our registration.

We must also continue filing any required reports federally with Corporations Canada.

Together, these filings keep us compliant with both provincial and federal regulations.

Updating Corporate Information

When any key changes happen—like amendments to our articles of incorporation, changes in directors, or a new registered agent in Ontario—we need to update the Ontario Business Registry.

Keeping our corporate information accurate is essential for legal notices and official communications.

We should submit updates promptly to avoid non-compliance.

The Registry requires updated forms and may charge fees for some changes.

Designating a reliable agent for service in Ontario ensures someone is always available to receive legal documents on our behalf.

Permits, Licences, and Tax Accounts

Operating legally in Ontario may require permits or licences depending on our activities.

We need to check municipal and provincial requirements to hold any necessary permissions, especially if we fundraise or hold events.

We also must keep any tax accounts in good standing, including those related to the Canada Revenue Agency and the Ontario Ministry of Finance.

This includes registering for charitable tax exemptions if applicable and remitting any required filings.

Staying on top of these ensures we avoid fines and protect our organization’s reputation.

Professional Support and Resources for Nonprofits

Navigating the registration of a federal nonprofit as an extra-provincial corporation in Ontario can involve complex legal and procedural requirements.

Expert advice, reliable service providers, and trustworthy resources can make this process smoother and help maintain ongoing compliance with Ontario’s laws.

Legal and Compliance Advisory

We recommend consulting knowledgeable legal advisors who specialize in nonprofit and charity law.

They ensure your application meets all Ontario requirements and help avoid costly errors.

Legal experts can explain the differences between nonprofit and charity statuses, guide you on appointing directors, and review your governing documents.

Organizations like B.I.G. Charity Law Group offer tailored services to handle registration paperwork correctly.

They also provide ongoing compliance advice, such as annual filing requirements and how to manage legal obligations after registration.

Though legal help is not mandatory, it significantly reduces the risk of delays or rejection of your application.

Using Intermediaries and Service Providers

We often use intermediaries or service providers that specialize in nonprofit registrations.

These services can handle your Ontario Business Registry filings, collect necessary documents, and liaise with provincial authorities on your behalf.

Using trusted intermediaries saves time and reduces stress.

They ensure your federal incorporation details match exactly in the Ontario application.

Some providers also offer packages that include guidance for future annual reports or changes to your corporation’s structure.

Choosing well-reviewed firms or groups with experience in Ontario’s nonprofit sector adds confidence.

This is especially useful if your team lacks familiarity with extra-provincial registration procedures.

Where to Find Additional Guidance

Official government sites and nonprofit-focused organizations provide up-to-date information. The Ontario Business Registry website serves as the main portal for submitting extra-provincial registration applications.

It offers guides and FAQs to explain steps and document requirements. The Canada Revenue Agency and Corporations Canada websites give details on federal incorporation and charity status.

Ontario nonprofits often consult professional groups like B.I.G. Charity Law Group for legal insights. These groups support charities and nonprofits across Canada.

Joining local nonprofit associations or networks connects you with peers and experts. You can receive informal advice and learn from shared experiences.

Final Thoughts

Registering your federal nonprofit or charity as an extra-provincial corporation in Ontario may seem like just another task, but it’s a key step toward growth, compliance, and success.

Whether you’re starting small or expanding into new regions, this registration will help your organization reach more people, access new resources, and make a greater impact across Ontario.

Need Help?

If you're unsure about how to register your federal nonprofit or charity as an extra-provincial corporation in Ontario, we’re here to help. We’ve helped hundreds of organizations expand legally and confidently into Ontario

Call us at 416-488-5888

Email us at ask@charitylawgroup.ca

We’ve received more than 835+ 5-star Google reviews from charities and nonprofits across Canada who trust us to get it right.

Let us take care of the paperwork so you can focus on your mission.

Frequently Asked Questions

We answer common questions about incorporating nonprofits in Ontario and how extra-provincial registration works. We also explain when you need to register and the steps involved.

Costs linked to extra-provincial registration for nonprofits are also covered.

Should I incorporate federally or provincially in Ontario?

Federal incorporation allows your nonprofit to operate across Canada. Provincial incorporation limits your activities to Ontario.

If you want to work outside Ontario, federal incorporation gives you more flexibility. Provincial incorporation may be simpler if you only plan to work within Ontario.

What is extra-provincial registration in Canada?

Extra-provincial registration means you register a corporation from one jurisdiction to operate in another. For nonprofits, this involves registering your federally or out-of-province incorporated organization in Ontario to meet provincial requirements.

When is extra-provincial registration required for a nonprofit or charity in Ontario?

If your federally incorporated nonprofit or charity plans to operate in Ontario, such as fundraising or hosting events, you must register as extra-provincial. This registration tells Ontario your organization is active there and ensures you follow provincial laws.

Without registration, you may face penalties or restrictions on banking and contracts.

What does it mean to register as an extra-provincial corporation in Ontario?

Registering as an extra-provincial corporation means your nonprofit agrees to follow Ontario’s legal rules while operating in the province. This status lets you fundraise, open bank accounts, apply for grants, and enter contracts in Ontario.

What steps must be taken to register as an extra-provincial corporation in Ontario?

First, confirm your federal incorporation status. Next, gather your federal documents, such as your Certificate of Incorporation and Articles of Incorporation.

Then, fill out the application online through the Ontario Business Registry. You must also appoint an agent for service in Ontario, who has a physical Ontario address to receive legal documents.

Finally, submit your application with all required documents and wait for approval.

Is there a cost associated with extra-provincial registration for nonprofits in Ontario?

As of 2025, you can register federally incorporated nonprofits as extra-provincial corporations in Ontario for free through the Ontario Business Registry.

If you hire legal help or your nonprofit is incorporated in another province, you may have extra expenses.

Yearly filing fees and maintenance costs may also apply.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)