Donation vs Sponsorship: How Should Businesses Fund Charities

Lately, businesses are contributing significant amounts to charities, sometimes reaching tens or even hundreds of thousands of dollars. This raises an important question: are these payments donations or sponsorships? Understanding the difference between the two is crucial for both businesses and charities.

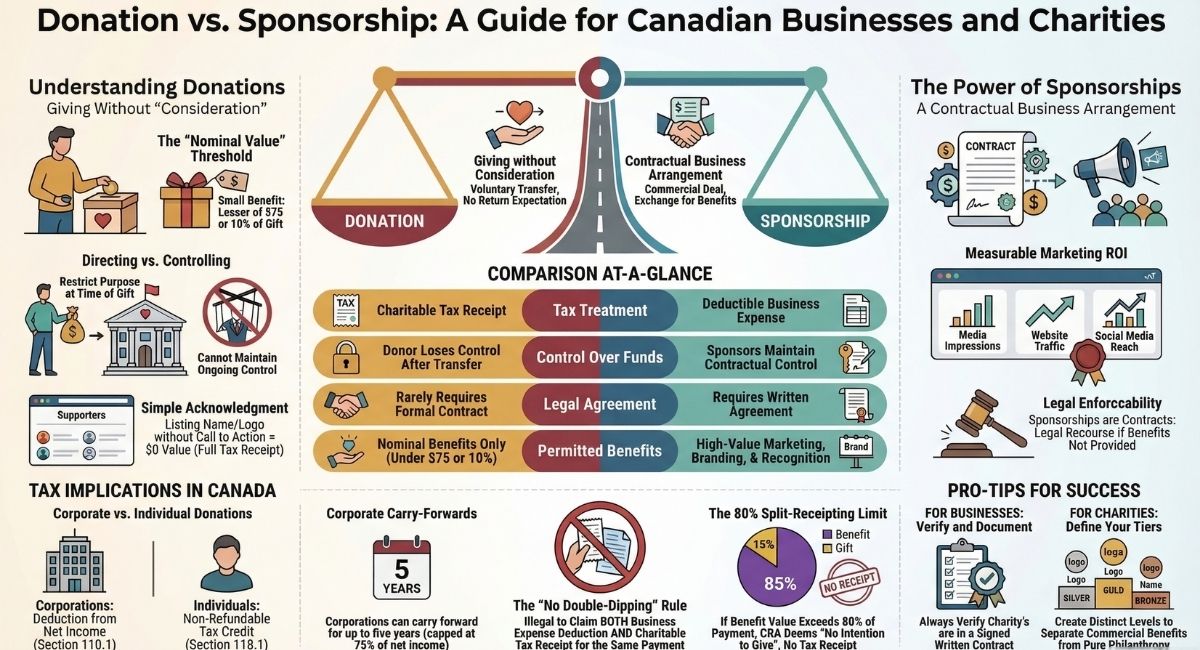

The main difference between a donation and a sponsorship lies in the benefits and control associated with the funds. Let's explore these concepts in detail.

Donations vs. Sponsorships: What's the Difference?

Before diving into the details, here's a quick overview of how donations and sponsorships differ:

What is a Donation?

A donation is a transfer of property or money without expecting anything in return. Legally, this is called giving without "consideration." For example, if a business donates $10,000 to a charity, the charity can use the money as it sees fit.

However, a donor may legally direct how a gift is used at the time of the gift — for example, by restricting it to a specific program, project, or endowment fund. If the charity accepts this restricted gift, it is legally bound to use it for that stated purpose. This is known as a restricted fund or directed gift. What a donor cannot do is maintain ongoing control over the funds after the gift has been made.

Donations are eligible for charitable tax receipts, but the tax benefit depends on whether the donor is an individual or a corporation. Individuals do not receive a "deduction" from income; instead, they receive a non-refundable tax credit under Section 118.1 of the Income Tax Act. Corporations, on the other hand, receive a deduction from net income under Section 110.1 of the Income Tax Act. The distinction matters — an individual cannot reduce their taxable income dollar-for-dollar the way a corporation can.

CRA allows for a small benefit of nominal value — specifically, the lesser of $75 or 10% of the gift amount — without affecting the charitable status of the donation. If the advantage received by the donor stays within this threshold, the full amount may still be receipted.

What is a Sponsorship?

A sponsorship, on the other hand, is a contractual agreement. This means that the sponsor transfers money or other assets to the charity but can set specific terms and conditions for the transfer. For instance, a sponsor might require their logo to be displayed at a charity event or have control over the guest list at a hosted party.

In a sponsorship, the sponsor can enforce the terms of the agreement through legal action, which is not possible with donations. Sponsorship payments cannot receive a charitable tax receipt. However, businesses can often deduct sponsorship expenses as business expenses under "promotion."

However, not all logo or name recognition automatically makes a payment a sponsorship. CRA distinguishes between "advertising" and "simple acknowledgment." If a charity merely lists a business's name or logo in a program or on a website as part of a list of supporters — without making specific promotional claims or including a call to action — CRA generally treats this as having no fair market value (an advantage of $0). In that case, a full charitable donation receipt can typically still be issued.

Additionally, where a payment involves both a charitable gift and a sponsorship benefit, the split-receipting rules may apply. Under these rules, the charity can issue a receipt for the "eligible amount" — that is, the total payment minus the fair market value of the benefit (the "advantage") received by the sponsor. However, if the advantage exceeds 80% of the total payment, no receipt can be issued, as CRA considers there to be no genuine "intention to give" at that level.

This means sponsorship payments are not automatically excluded from receiving any charitable tax receipt. Each arrangement must be assessed on its own facts.

For clearly commercial arrangements where the benefit is substantial — such as prominent event naming rights, exclusive audience access, or contractual deliverables — no charitable tax receipt should be issued, and the sponsor may deduct the payment as a promotional business expense.

Why the Distinction Matters

Understanding whether a payment is a donation or a sponsorship is important for several reasons:

- Control and Enforcement: Donors have no legal control over the use of their donations, while sponsors can enforce their agreements.

- Tax Implications: Donations can result in tax receipts for the donor, while sponsorships can be deducted as business expenses.

- Legal and Financial Reporting: Donations and sponsorships are reported differently in financial records and may have different implications for the charity's financial statements and compliance with regulations.

Practical Considerations for Businesses and Charities

When engaging with potential donors or sponsors, it's essential to clarify the nature of the payment. Here are some tips:

- Communicate Clearly: Ensure that both parties understand whether the payment is a donation or a sponsorship.

- Discuss Expectations: Talk openly about what the business expects in return for their contribution. This can help avoid misunderstandings and conflicts later.

- Document Agreements: For sponsorships, having a written contract outlining the terms and conditions is crucial. This ensures both parties are clear on their obligations and expectations.

How Canadian Businesses Should Structure Charitable Giving

When engaging with potential donors or sponsors, it's essential to clarify the nature of the payment. Here are some tips:

For Businesses:

Define Your Goals - Decide whether you want pure philanthropy (donation) or marketing benefits (sponsorship) before approaching the charity. This clarity will help you choose the right structure and set appropriate expectations.

Request Written Agreements - For sponsorships, ensure all terms are documented in writing, including logo placement, event access, deliverables, timelines, and termination clauses. This protects both parties.

Understand Tax Implications - Consult with your accountant to determine which structure provides better tax advantages for your business. In some cases, a business expense deduction may be more valuable than a charitable tax receipt.

Ask About Recognition Options - If you want visibility, clarify upfront what recognition the charity can provide without converting your donation into a sponsorship. Many charities can offer acknowledgment within CRA guidelines.

Verify Charity Registration - Always confirm the organization is a CRA-registered charity before making a donation. You can verify registration status on the CRA website.

For Charities:

Be Transparent About Benefits - Clearly communicate what recognition or benefits you can offer without jeopardizing donation receipts. Honesty prevents misunderstandings and maintains CRA compliance.

Separate Sponsorship Packages - Create distinct sponsorship tiers with defined benefits (Bronze, Silver, Gold levels) so businesses understand exactly what they're receiving for their investment.

Document Everything - Use written agreements for sponsorships and gift acknowledgment letters for donations. Proper documentation protects your organization and ensures tax compliance.

Know CRA Guidelines - Stay current on what constitutes "nominal value" benefits that won't disqualify a donation receipt. The rules can change, so regular review is essential.

Train Your Team - Ensure fundraising staff understand the distinction between donations and sponsorships so they can communicate accurately with potential supporters.

Why Corporate Sponsorships Are Attractive for Canadian Businesses

Sponsorships can be attractive for several reasons:

Marketing and Visibility - Your company logo appears on event materials, websites, social media posts, and promotional items, increasing brand awareness among the charity's supporters and the broader community.

Targeted Audience Access - Sponsorships connect you with specific demographics who align with your customer base, such as healthcare professionals at hospital galas, environmental advocates at conservation events, or arts patrons at cultural festivals.

Corporate Social Responsibility - Visible charitable involvement enhances your company's reputation and demonstrates community commitment to customers, employees, and stakeholders. This can differentiate your brand in competitive markets.

Networking Opportunities - Sponsorships often include VIP access to events, allowing you to network with other sponsors, community leaders, board members, and potential clients in a meaningful setting.

Employee Engagement - Supporting causes through sponsorships can boost employee morale and pride in their workplace, especially when staff can participate in sponsored events or volunteer opportunities.

Measurable Return on Investment - Unlike donations, sponsorships provide tangible marketing deliverables you can track, such as media impressions, event attendance numbers, social media reach, or website traffic from sponsor listings.

Long-Term Partnerships - Sponsorships can evolve into multi-year relationships that build lasting brand associations with respected charitable organizations.

Tax Implications for Canadian Businesses: Donations vs Sponsorships

Understanding how each option affects your business taxes is crucial for making informed decisions.

Donations:

- Individuals receive a non-refundable tax credit under Section 118.1 of the Income Tax Act — not a deduction from income

- Federal credit: 15% on the first $200, 29% on amounts exceeding $200 (33% on amounts exceeding $235,675 for high-income earners)

- Provincial credits vary by province, ranging from approximately 4% to 24%

- Corporations receive a deduction from net income under Section 110.1 of the Income Tax Act

- Must be made to CRA-registered charities (verify registration number)

- No business expense deduction allowed if a tax receipt is issued

- Corporations can carry forward unused donation deductions for five years

- Maximum claim is generally 75% of net income for corporations

Sponsorships:

- Deductible as promotional business expenses under Section 9 of the Income Tax Act

- No tax receipt issued by the charity

- Must demonstrate legitimate business purpose and benefit (not pure philanthropy)

- Expenses must be reasonable in relation to benefits received

- Requires proper documentation of the commercial arrangement

- Can be more tax-efficient for businesses in higher tax brackets

- No limit on deduction amount (as long as expenses are reasonable)

- Must be incurred for the purpose of earning income

Important Note: You cannot claim both a business expense deduction and a charitable tax receipt for the same payment. The CRA strictly prohibits double-dipping.

Common Mistakes to Avoid

Both businesses and charities should be aware of these frequent errors:

For Businesses:

Requesting a Tax Receipt for a Sponsorship Agreement - If you're receiving marketing benefits, you cannot receive a charitable tax receipt. Requesting one puts the charity in a difficult compliance position.

Failing to Document Sponsorship Terms in Writing - Verbal agreements lead to misunderstandings. Always have a signed sponsorship contract outlining deliverables, timelines, and obligations.

Claiming Both a Business Expense and a Tax Receipt - This is illegal and can result in CRA penalties. Choose one tax treatment method and stick with it.

Not Verifying the Charity's Registered Status with CRA - Always confirm the organization is a registered charity before making a donation. Non-registered organizations cannot issue tax receipts.

Assuming All Charitable Payments Are Donations - Many businesses accidentally structure sponsorships as donations, missing out on valuable marketing benefits or proper tax treatment.

For Charities:

While sponsorships involving substantial commercial benefits cannot receive a full charitable tax receipt, charities should assess whether the split-receipting rules allow a partial receipt to be issued. Issuing no receipt when one is legitimately available is a missed opportunity for donors.

Promising Benefits That Exceed CRA's "Nominal Value" Threshold - Offering benefits worth more than $50 or 10% of the donation amount disqualifies the donation receipt.

Not Having Clear Sponsorship Agreements - Without written contracts, disputes can arise over deliverables, recognition, and payment terms.

Misrepresenting Sponsorships as Donations to Attract Donors - Be honest about what businesses are receiving. Transparency builds trust and ensures compliance.

Failing to Track and Report Non-Receipted Contributions - Even though sponsorships don't require tax receipts, you should still track them for financial reporting and relationship management.

The Appeal of Sponsorships

Sponsorships can be attractive for several reasons:

- Tax Benefits for Businesses: Sponsorship expenses can often be deducted as business expenses, providing tax relief.

- Control Over Use of Funds: Sponsors can set specific terms for how their contributions are used, ensuring their brand is promoted effectively.

- No Need for Charitable Receipts: Charities do not need to issue tax receipts for sponsorships, simplifying their administrative processes.

As businesses increasingly support charities with significant payments, understanding the distinction between donations and sponsorships is more important than ever. Clear communication and documentation can help ensure that both businesses and charities benefit from their arrangements. By addressing these issues early on, organizations can avoid potential conflicts and make the most of their partnerships. Understanding whether a payment is a donation or a sponsorship is crucial for both businesses and charities. By being clear about expectations and documenting agreements, both parties can ensure a successful and beneficial relationship.

Do you own or direct a Canadian business looking to donate to charity? Speak to one of the experienced charity lawyers at our firm about the best way to structure the donation for maximum benefit to the corporation and the charity.

Conclusion

As businesses increasingly support charities with significant payments, understanding the distinction between donations and sponsorships is more important than ever. Clear communication and documentation can help ensure that both businesses and charities benefit from their arrangements. By addressing these issues early on, organizations can avoid potential conflicts and make the most of their partnerships. Understanding whether a payment is a donation or a sponsorship is crucial for both businesses and charities. By being clear about expectations and documenting agreements, both parties can ensure a successful and beneficial relationship.

Do you own or direct a Canadian business looking to donate to charity? Speak to one of the experienced charity lawyers at our firm about the best way to structure the donation for maximum benefit to the corporation and the charity.

Frequently Asked Questions

Learn the key differences between donations and sponsorships when your business supports charitable causes. These FAQs explain how each funding method works, their tax implications, and help you choose the right approach for your business giving strategy.

What is the difference between a sponsor and a charity?

A sponsor is a business or individual that provides financial support in exchange for recognition or marketing benefits. A charity is a registered organization that receives donations and sponsorships to fund its charitable activities and can issue tax receipts to donors.

What is the difference between sponsorship and fundraising?

Sponsorship involves businesses paying for marketing benefits like logo placement or event naming rights. Fundraising focuses on soliciting donations from individuals, corporations, and foundations primarily for charitable purposes rather than commercial benefits.

How do charity sponsors work?

Charity sponsors provide money, goods, or services to charitable organizations in exchange for promotional opportunities like brand visibility, audience access, or corporate social responsibility benefits. The arrangement is typically formalized through sponsorship agreements.

What is a sponsored donation?

A sponsored donation occurs when a business covers the cost of someone else's charitable donation, often as part of employee giving programs or customer engagement campaigns. The business pays but the donation may be attributed to the employee or customer.

How do sponsors make money?

Sponsors don't directly make money from sponsorship but gain marketing value, brand exposure, customer goodwill, employee engagement, and potential business opportunities. These benefits can lead to increased sales, customer loyalty, and positive brand reputation.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)