Do Nonprofits Have to File Tax Returns in Canada? What Every Canadian Organization Should Know

If you run or are starting a nonprofit in Canada, you might wonder: "Do we need to file a tax return if we don't pay taxes?" The short answer is yes. Most nonprofits do have to file a return with the Canada Revenue Agency (CRA), even if they don't owe any tax. This guide explains everything you need to know, written in plain language.

What Is a Nonprofit in Canada?

In Canada, a nonprofit organization (NPO) is a group that operates for a purpose other than to make a profit. Common examples include:

- Sports clubs

- Community groups

- Social or cultural organizations

- Religious organizations that are not registered as charities

Note: A registered charity is a special type of nonprofit that has extra benefits and responsibilities. Not all nonprofits are registered charities.

Nonprofits can be structured as:

- Incorporated organizations (federally or provincially incorporated)

- Unincorporated associations (groups without formal incorporation)

The way your nonprofit is structured affects which tax forms you need to file.

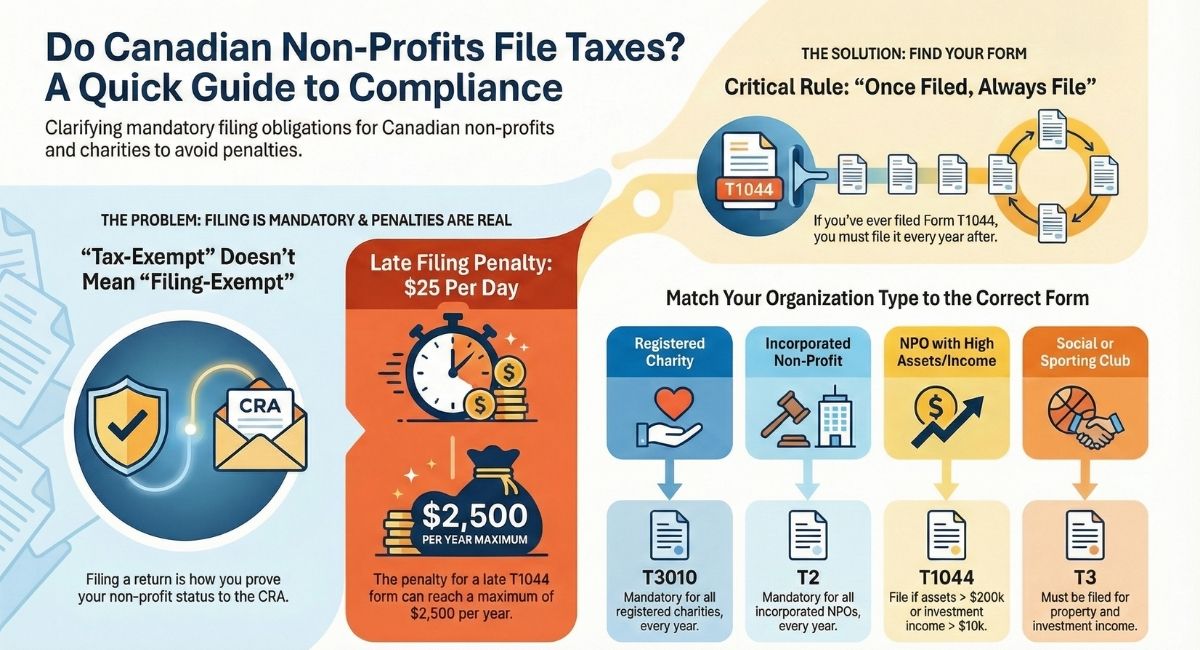

Do Nonprofits Have to File a Tax Return?

Most nonprofits must file, but there are some exceptions.

Nonprofits That MUST File:

- Incorporated nonprofits (federal or provincial)

- Nonprofits earning more than $10,000 from investments, rentals, royalties, or interest

- Nonprofits with assets worth more than $200,000 at any time during the year

- All registered charities (they file T3010, not T1044)

- Social or sporting clubs whose main purpose is to provide dining, recreational, or sporting facilities (these organizations must file T3 Trust returns)

Possible Exceptions:

- Very small unincorporated groups that don't meet the income or asset thresholds

- Some member-funded clubs that operate only for their members

Important: Even if you think you're exempt, it's safer to file. The CRA recommends filing to maintain your tax-exempt status and keep proper records.

Quick Decision Tree: Do You Need to File?

Are you a registered charity?

→ Yes: File Form T3010

→ No: Continue

Is your nonprofit incorporated?

→ Yes: You must file Form T2 (possibly T2 Short) every year, regardless of whether you owe tax. You may also need to file T1044 if you meet the income or asset thresholds.

→ No: Continue

Is your nonprofit a social or sporting club (golf club, curling club, etc.) that provides dining, recreational, or sporting facilities?

→ Yes: You must file Form T3 Trust Income Tax and Information Return and pay tax on investment income exceeding $2,000 → No: Continue

Did you earn more than $10,000 from investments, rent, royalties, or interest?

→ Yes: File Form T1044

→ No: Continue

Do you have assets worth more than $200,000?

→ Yes: File Form T1044

→ No: You may not be required to file, but consider filing anyway to maintain good standing

Have you ever filed a T1044 in any previous year?

→ Yes: You must continue to file T1044 every year, even if your income and assets now fall below the thresholds → No: Continue

Understanding Your Nonprofit's Tax-Exempt Status

Many people ask: "If we don't pay taxes, why do we need to file a tax return?" Here's what you need to understand about tax-exempt status in Canada.

What Does "Tax-Exempt" Mean?

Tax-exempt means your nonprofit doesn't have to pay income tax on most of its revenue, as long as that revenue is used for your nonprofit purposes. According to the CRA, nonprofits can qualify for tax exemption under the Income Tax Act if they meet certain conditions.

Tax-Exempt vs. Tax-Free: What's the Difference?

- Tax-exempt: Your organization doesn't pay tax on income related to your nonprofit activities

- Tax-free: No taxes apply at all (this is rare)

Most nonprofits are tax-exempt, not completely tax-free.

When Might a Nonprofit Owe Taxes?

Your nonprofit might have to pay tax or lose its tax-exempt status in these situations:

- Business activities operated for profit: Under Canadian law (Section 149(1)(l) of the Income Tax Act), if an NPO operates a business for the purpose of earning profit—even if that profit is used for a good cause—it risks losing its entire tax-exempt status for that year. This is different from American tax law. In Canada, it's not just "tax on the business part"; the organization may be deemed a for-profit entity for that entire period.

- Investment income for social/sporting clubs: If your nonprofit's main purpose is to provide dining, recreational, or sporting facilities (like golf or curling clubs), you must pay tax on investment income exceeding $2,000 per year.

- Property income in certain cases: Depending on your organization's structure and activities.

Important: The concept of "unrelated business income" that applies in the United States does not exist in Canadian nonprofit law. In Canada, the test is whether the organization is operating for profit, which can jeopardize the entire tax-exempt status.

Why File If You Don't Owe Taxes?

Filing a return:

- Proves your tax-exempt status to the CRA

- Shows you're operating according to nonprofit rules

- Helps you qualify for grants and funding

- Maintains your good standing for banking and contracts

- Creates an official record of your activities

Think of it like this: filing a return is how you demonstrate to the CRA that you deserve to keep your tax-exempt status.

Which Tax Return Do Nonprofits File?

Form T1044 – Non-Profit Organization Information Return

Nonprofits that are not registered charities must file Form T1044 if they meet either of these conditions:

- They earned more than $10,000 in the year from dividends, rentals, royalties and interest, or

- They owned assets worth more than $200,000 at any point in the year.

Critical "Once Filed, Always File" Rule: Under Canadian law, once a nonprofit has filed a T1044 for any fiscal year (because they hit the threshold), they are legally required to file it every single year thereafter, even if their assets or income drop below the thresholds in future years. This is a permanent filing obligation once triggered.

Source: CRA Guide T4117: Income Tax Guide to the Non-Profit Organization Information Return

Form T2 – Corporation Income Tax Return

All incorporated nonprofits must file a T2 corporate tax return every year, regardless of whether they owe any tax or have any activity. This is not optional. Under the Income Tax Act, all Canadian resident corporations (except registered charities and a few specific exemptions) must file a T2 return annually.

In some cases, incorporated nonprofits file a T2 Short Return plus the T1044 (if they meet the T1044 thresholds or have filed it previously).

Source: CRA: Who has to file a T2 return?

Form T3 – Trust Income Tax and Information Return

Under Section 149(5) of the Income Tax Act, nonprofits whose main purpose is to provide dining, recreational, or sporting facilities (such as golf clubs, curling clubs, or social clubs) are deemed to be trusts for their property income. These organizations must:

- File a T3 Trust Income Tax and Information Return annually

- Pay tax on investment income exceeding $2,000

This is a special rule that applies specifically to social and sporting clubs, even if they otherwise qualify as nonprofits.

What About Registered Charities?

Registered charities in Canada do not file the T1044. Instead, they must file an annual T3010 – Registered Charity Information Return. This return is required even if the charity has no income or expenses. It includes:

- Financial information

- Activities for the year

- Information on directors and trustees

Missing this return can lead to revocation of charity status, meaning the charity can no longer issue donation receipts.

What Happens If a Nonprofit Doesn’t File?

If a nonprofit fails to file its required forms:

- The CRA may revoke its tax-exempt status

- The organization will face specific penalties:

- For T1044: $25 per day late, with a minimum penalty of $100 and a maximum of $2,500 per year. If an NPO misses 5 years of filing, they could face $12,500 in penalties even if they never earned any profit.

- Source: Income Tax Act Section 162(7)

- It may have trouble getting grants, funding, or even opening a bank account

- Late or missing filings create red flags if the organization ever wants to become a registered charity in the future

Filing Deadlines

Understanding deadlines helps you avoid penalties and maintain compliance.

T1044 and T2 Filing Deadlines

Deadline: 6 months after your organization's fiscal year-end

Examples:

- Fiscal year ends December 31, 2024 → File by June 30, 2025

- Fiscal year ends March 31, 2025 → File by September 30, 2025

- Fiscal year ends June 30, 2024 → File by December 31, 2024

Important: The deadline is 6 months after your specific fiscal year-end, NOT the calendar year-end.

T3010 Filing Deadlines (Registered Charities)

Deadline: 6 months after the charity's fiscal year-end

Same calculation as above.

Additional note for charities: Your T3010 information becomes public about 6-8 weeks after the CRA processes it.

What If the Deadline Falls on a Weekend or Holiday?

When the filing deadline falls on a Saturday, Sunday, or public holiday, your return is considered on time if the CRA receives it or it is postmarked on the next business day.

Extension Requests

Can you get an extension?

Generally, the CRA does not grant extensions for T1044, T2, or T3010 filing deadlines.

Exception: In cases of extreme circumstances (natural disasters, serious emergencies), you can request consideration.

Better approach: File on time, even if information is incomplete, then file an amended return if needed.

Setting Up Reminders

Recommended timeline:

4 months before deadline:

- Begin gathering financial information

- Start preparing financial statements

3 months before deadline:

- Complete financial statements

- Begin filling in tax return forms

2 months before deadline:

- Complete return draft

- Review for errors

- Have board member review

1 month before deadline:

- Finalize and submit return

- Keep confirmation of filing

- Update records

Pro tip: Set recurring calendar reminders based on your fiscal year-end to stay on track.

Summary: Filing Rules for Canadian Nonprofits

Even if your nonprofit doesn’t make a profit, you still have legal filing responsibilities. Knowing what forms to file—and when—can help you stay in good standing with the CRA and avoid unnecessary penalties. If you’re not sure which forms apply to your group, it’s a good idea to speak with an accountant or charity lawyer familiar with Canadian nonprofit rules.

Need Help Starting or Managing a Nonprofit or Charity in Canada?

Even if your nonprofit doesn't make a profit, you still have legal filing responsibilities. Knowing what forms to file—and when—can help you stay in good standing with the CRA and avoid unnecessary penalties.

Our team helps Canadian organizations register as charities or nonprofits and stay compliant—from incorporation to annual filings. We can assist with:

- Determining which forms you need to file

- Preparing and reviewing tax returns

- Maintaining tax-exempt status

- Resolving CRA compliance issues

- Transitioning to charitable status

Reach out to learn more. Email us at ask@charitylawgroup.ca or call 416-488-5888. We're excited to help.

Frequently Asked Questions

Get quick answers to common questions about nonprofit finances and tax requirements in Canada.

Do nonprofits have to disclose financials to the public in Canada?

It depends on the type of nonprofit. Registered charities must make their financial statements available to the public through the Canada Revenue Agency (CRA). You can view these on the CRA's website. Other nonprofits that aren't registered charities don't have to share their finances publicly, but they may need to report to their members or provincial regulators. Some provinces have their own rules about financial disclosure for incorporated nonprofits.

Who is required to file a tax return in Canada?

You must file a tax return if you owe taxes to the CRA. You should also file if you want to claim benefits like the GST/HST credit or Canada Child Benefit, even if you don't owe taxes. Self-employed people need to file returns. If the CRA asks you to file, you must do so. It's a good idea to file even if you're not required to, as you might get a refund or qualify for credits.

Does non profit organization file tax return?

Yes, most nonprofits file tax returns in Canada. Registered charities must file a T3010 Charity Information Return every year. Nonprofit organizations that aren't charities may need to file a T2 Corporation Income Tax Return, even if they don't owe taxes. The specific requirements depend on whether the nonprofit is incorporated and if it has taxable income. Filing on time helps maintain good standing with the CRA.

How to check my tax return status in Canada?

You can check your tax return status online through My Account on the CRA website. Sign in and look for "Tax Returns" to see the status. You can also use the MyCRA mobile app. Another option is to call the CRA's Tax Information Phone Service at 1-800-959-8281. Wait at least eight weeks after filing a paper return or two weeks after filing online before checking. The CRA will show if your return is received, being processed, or assessed.

Do non-profits have to file tax returns in Canada?

Yes, non-profits usually have to file tax returns in Canada. Registered charities file a T3010 form each year with details about their activities and finances. Other nonprofits typically file a T2 Corporation Income Tax Return if they're incorporated, even if they don't owe taxes. Filing deadlines vary based on the organization's year-end. Not filing can result in penalties or loss of registered status for charities. Check with the CRA to confirm what your specific nonprofit needs to file.

Legal Sources & References

- CRA Guide T4117: Income Tax Guide to the Non-Profit Organization Information Return

- CRA: Who has to file a T2 return?

- CRA Income Tax Folio S7-F1-C1: Non-Profit Organizations

- ITA Section 162(7)

- Income Tax Act, s. 149(5)

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)