Form T3010 New Version: What Canadian Charities Need to Know

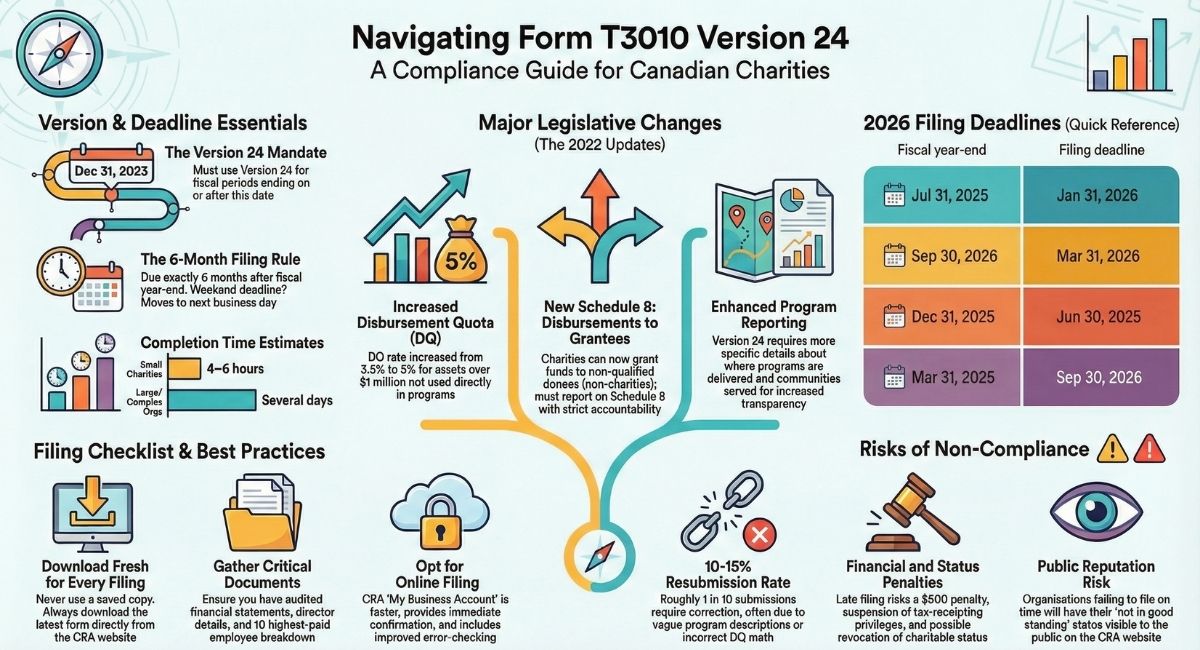

If you run a registered charity in Canada, you need to know about Form T3010 Version 24. This updated form launched in January 2024 and changes how you report your charity's activities to the Canada Revenue Agency (CRA).

The new version reflects important changes to charitable spending rules that started in 2022. Understanding which version to use and how to file correctly will help you stay compliant and avoid filing problems.

In this guide, you'll learn everything about the Form T3010 update, including who needs to use it, what's changed, and how to file correctly.

Quick Reference Guide

Before diving into the details, here's what you need to know right now:

Current Version: Form T3010 Version 24 (required for all fiscal years ending on or after December 31, 2023)

Filing Deadline: 6 months after your fiscal year end

Where to File:

- Online: CRA My Business Account (recommended)

- Paper: Mail to CRA Charities Directorate

Penalties for Late Filing:

- Fixed $500 penalty (required for re-registration if revoked for failure to file)

- Possible loss of registered charitable status

- Suspension of tax receipting privileges

Time to Complete:

- Small charities: 4-6 hours

- Medium charities: 1-2 days

- Large/complex charities: Several days

Most Common Mistakes:

- Using an old saved copy of the form

- Choosing the wrong version based on fiscal year end

- Missing required financial information

- Incorrect disbursement quota calculations

- Filing after the deadline

What's New for the 2026 Filing Season

As we begin 2026, all Canadian registered charities are now using Form T3010 Version 24. Here's what you need to know for the current filing season.

Current Filing Landscape

Version 24 has now been in use for over two years, and the CRA has refined its review processes based on thousands of submissions. Charities are reporting smoother filing experiences as accountants and administrators become familiar with the updated requirements.

The transition to Version 24 is now complete, with Version 23 only used in exceptional cases for very delayed filings from 2023 fiscal years.

Key Dates for 2026 Filings

If your charity has one of these common fiscal year ends, here are your upcoming deadlines:

January to June 2026 Deadlines:

- January 31, 2026: Charities with July 31, 2025 fiscal year end

- February 28, 2026: Charities with August 31, 2025 fiscal year end

- March 31, 2026: Charities with September 30, 2025 fiscal year end

- April 30, 2026: Charities with October 31, 2025 fiscal year end

- May 31, 2026: Charities with November 30, 2025 fiscal year end

- June 30, 2026: Charities with December 31, 2025 fiscal year end

July to December 2026 Deadlines:

- July 31, 2026: Charities with January 31, 2026 fiscal year end

- August 31, 2026: Charities with February 28, 2026 fiscal year end

- September 30, 2026: Charities with March 31, 2026 fiscal year end

- October 31, 2026: Charities with April 30, 2026 fiscal year end

- November 30, 2026: Charities with May 31, 2026 fiscal year end

- December 31, 2026: Charities with June 30, 2026 fiscal year end

Early 2027 Deadlines:

- January 31, 2027: Charities with July 31, 2026 fiscal year end

- February 28, 2027: Charities with August 31, 2026 fiscal year end

- March 31, 2027: Charities with September 30, 2026 fiscal year end

Important Note About Deadlines: Your filing deadline is exactly six months after your fiscal period end. If your deadline falls on a weekend or statutory holiday, it moves to the next business day. For example, if your deadline falls on a Saturday, you must file by the following Monday.

Recent CRA Guidance Updates

The CRA continues to provide updated guidance on disbursement quota calculations and programme reporting. Make sure you review the latest instructions on the CRA website before filing.

The CRA has also improved its online filing portal with better error checking and clearer validation messages. Online filers now receive more detailed feedback if information is missing or calculations don't match.

Compliance Statistics

CRA data shows that charities have successfully adapted to Version 24. The rejection rate has decreased significantly as filers become more familiar with the new requirements. However, approximately 10-15% of submissions still require resubmission, with the most common issues being incomplete disbursement quota calculations and vague programme descriptions.

What is Form T3010?

Form T3010 is the annual information return that every registered charity in Canada must file with the CRA.

Understanding the Registered Charity Information Return

Form T3010 is officially called the Registered Charity Information Return. You must complete this form every year to maintain your charity's registered status.

Think of it as your charity's annual report to the government. It shows what your organization did, how much money you received, and how you spent it.

Who Must File Form T3010:

- All registered charities in Canada

- Registered Canadian Amateur Athletic Associations (RCAAAs)

- Organizations with registered charity status under the Income Tax Act

Important Distinction: While registered charities and RCAAAs both file Form T3010, they are legally distinct under the Income Tax Act. RCAAAs have specific requirements that differ slightly from registered charities, though both are qualified donees.

Key Filing Requirements:

- You must file within six months after your fiscal period ends

- The form must be complete with all required information

- You need to use the correct version based on your fiscal year end

- Missing the deadline can result in penalties or loss of charitable status

Your Form T3010 helps the CRA ensure your charity operates according to Canadian charity law. It also provides transparency for donors and the public who want to see how charities use their funds.

Background: Why Form T3010 Was Updated

The federal government introduced new rules in 2022 to increase charitable spending in local communities across Canada.

2022 Legislative Changes to Charitable Spending

In 2022, the Canadian government announced major changes to how charities must spend their funds. These changes aimed to get more charitable dollars working directly in communities.

The main update was to the disbursement quota rules. These rules determine how much money your charity must spend on charitable activities each year.

What Changed in 2022:

- Increased disbursement quota from 3.5% to 5% for assets over $1 million

- New rules allowing charities to make grants to non-qualified donees (non-charities) with proper accountability requirements

- Enhanced reporting requirements for qualifying disbursements

- Changes to how charities can hold and spend funds

- Increased focus on community impact and transparency

The government gave charities time to adjust to these new rules. Form T3010 Version 24 is the result of those changes finally being reflected in the official reporting requirements.

This update ensures that the information you provide matches the new legal framework. It helps the CRA track whether charities are meeting the updated spending requirements.

Key Changes in Form T3010 Version 24

Version 24 includes important updates that affect how you report your charity's financial information and activities.

Fiscal Period Requirements: Which Version to Use

Your fiscal period end date determines which version of Form T3010 you must use. This is one of the most important things to understand about the update.

Here's the simple rule:

- Fiscal period ending on or after December 31, 2023: You must use Form T3010 Version 24

- Fiscal period ending on or before December 30, 2023: You must use Form T3010 Version 23

Let's look at some examples to make this clear.

Example 1: Your charity's fiscal year ends on March 31, 2024. Since this is after December 31, 2023, you must use Version 24.

Example 2: Your charity's fiscal year ends on December 31, 2023. You must use Version 24 because your fiscal period ends "on or after" December 31, 2023.

Example 3: Your charity's fiscal year ends on December 30, 2023. You use Version 23 because your fiscal period ends before December 31, 2023.

Chart: Which Form T3010 Version Should You Use?

Enhanced Transparency and Reporting Requirements

Version 24 includes new sections that reflect the 2022 legislative changes. These updates help the CRA better understand how your charity operates.

New and Updated Sections:

- Enhanced disbursement quota reporting fields with specific rates (3.5% for the first $1 million of property not used in charitable programs, and 5% for amounts exceeding $1 million)

- More detailed questions about charitable programs

- New Schedule 8: Disbursements to grantees – tracks grants made to non-qualified donees (organizations that are not registered charities)

- Additional information about accountability requirements when making grants to non-charities

- Improved tracking of administrative versus charitable spending

Major 2022 Legislative Change: One of the most significant updates in Version 24 is the ability for charities to provide resources to non-qualified donees (non-charities). This was previously prohibited, but charities can now make these grants provided they meet strict accountability requirements outlined in CRA guidance document CG-032.

The form now asks for more specific information about where and how you deliver charitable programs. You'll need to provide clearer details about the communities you serve.

There are also new questions about how you calculate your annual spending requirements. These align with the updated disbursement quota rules from 2022, which increased the disbursement rate from 3.5% to 5% for property exceeding $1 million.

The goal is to give the CRA and the public a clearer picture of your charity's impact. While this means more detailed reporting, it also helps demonstrate your organization's value to donors and stakeholders.

How to File Form T3010 Version 24 Correctly

Filing your Form T3010 correctly starts with making sure you have the right version and complete information.

Downloading the Correct Version

Always download Form T3010 directly from the official CRA website. This is the only way to guarantee you have the current, correct version.

Important: Do not use old copies saved on your computer. The CRA will reject outdated forms, which means you'll need to resubmit and could face late filing penalties.

How to Get the Correct Form:

- Go to the official CRA Forms and Publications page

- Search for "Form T3010"

- Download the form each time you need to file

- Check the version number on the form to confirm it matches your fiscal year requirements

You can file Form T3010 online through the CRA's Charities Directorate portal, or you can print and mail a paper copy. Online filing is faster and you'll get confirmation of receipt right away.

Pro tip: Save the form with your fiscal year in the filename, like "T3010_FY2024.pdf" so you know which year it's for.

Common Filing Mistakes to Avoid

Many charities make simple mistakes that delay their filing or cause rejection. Here are the most common problems and how to avoid them.

Mistake 1: Using an Old Saved Copy

Don't use a form you saved last year. Always download a fresh copy for each filing period.

Mistake 2: Choosing the Wrong Version

Double-check your fiscal year end date against the version requirements. If you're unsure, use the chart provided earlier in this article.

Mistake 3: Missing Required Information

The form has mandatory fields that must be completed. Review the entire form before submitting to ensure nothing is blank.

Mistake 4: Incorrect Calculations

Your financial totals must match your financial statements. Double-check all math, especially disbursement quota calculations.

Mistake 5: Filing After the Deadline

Mark your calendar for six months after your fiscal year end. Set a reminder for one month before to give yourself time to prepare.

Mistake 6: Not Keeping Supporting Documents

Keep all receipts, financial statements, and supporting documents for at least six years. The CRA may request them during a review.

What Information Does Form T3010 Require?

Understanding what information you need to provide helps you prepare your filing efficiently.

Required Details for Your Charity Information Return

Form T3010 asks for comprehensive information about your charity's operations. You'll need several documents ready before you start.

Organizational Information:

- Your charity's legal name and business number

- Mailing address and contact information

- Names and addresses of directors and trustees

- Your charity's main activities and purposes

Financial Information:

- Total revenue from all sources

- Breakdown of revenue by category (donations, grants, investments, etc.)

- Total expenditures for the fiscal year

- Assets and liabilities at year end

- Detailed program spending information

Charitable Activities:

- Description of programs you operated

- Locations where you delivered services

- Number of people or communities served

- Details about grants made to other organizations

Compensation Information:

- Details about the 10 highest-paid employees or contractors

- Board member compensation (if any)

- Benefits provided to staff and volunteers

Important Legal Note on Director Compensation: In many Canadian jurisdictions, particularly Ontario under the Charities Accounting Act, directors of charities are generally prohibited from being compensated for their services as directors unless they have obtained a specific court order or comply with strict regulations under Ontario Regulation 4/01. Before reporting director compensation, ensure your charity complies with applicable provincial laws regarding payments to directors.

Disbursement Quota Calculations:

- Your charity's disbursement quota for the year

- How much you spent on charitable activities

- Whether you met your spending requirements

- Any amounts carried forward from previous years

You should have your audited or reviewed financial statements ready. Your accountant or bookkeeper can help you gather the correct figures.

Important Deadlines and Compliance Requirements

Meeting your filing deadline is crucial for maintaining your registered charity status.

Filing Timeline for Form T3010 Version 24

You have six months from the end of your fiscal year to file Form T3010. Missing this deadline can have serious consequences.

Your Filing Deadline:

Take your fiscal year end date and add six months. That's your deadline.

Examples:

- Fiscal year ends March 31, 2024 → File by September 30, 2024

- Fiscal year ends December 31, 2023 → File by June 30, 2024

- Fiscal year ends June 30, 2024 → File by December 31, 2024

What Happens If You File Late:

- Your charity may lose its registered status

- You'll receive a non-compliance letter from the CRA

- If your charity is revoked for failure to file, you must pay a fixed $500 penalty as a requirement for re-registration

- Your charity's information on the CRA website will show you're not in good standing

- You could lose your ability to issue donation receipts (the CRA may suspend your tax-receipting privileges)

How to Request an Extension:

In rare cases, you can request a filing extension. You must contact the CRA Charities Directorate before your deadline and explain why you need more time.

The CRA doesn't automatically grant extensions. You need a valid reason, such as a natural disaster, serious illness, or major organizational crisis.

CRA Review and Acceptance Process

After you submit Form T3010, the CRA reviews your information to ensure it's complete and accurate.

What Happens After Submission:

- The CRA receives your form

- Staff review it for completeness

- They check calculations and cross-reference financial data

- They may contact you if they need clarification

- They update your charity's public record

Processing Times:

Online submissions usually process within a few weeks. Paper submissions can take several months.

You'll receive a confirmation notice once the CRA accepts your return. Keep this notice with your charity's records.

If Your Form Is Rejected:

The CRA will send you a letter explaining what's wrong. Common reasons include using the wrong version, missing information, or incorrect calculations.

You'll need to correct the issues and resubmit. Do this quickly to avoid penalties for late filing.

If you disagree with the CRA's assessment, you have the right to appeal. Contact the Charities Directorate or consult a charity lawyer for guidance.

Resources and Support for Filing Form T3010

You don't have to navigate Form T3010 alone. Several resources can help you file correctly.

Where to Find Help

The CRA provides comprehensive guidance for charities filing Form T3010. Take advantage of these free resources.

Official CRA Resources:

- CRA Charities and Giving website: Complete guides and instructions

- Form T3010 instruction guide: Step-by-step filing help

- CRA Charities Directorate phone line: 1-800-267-2384

- My Business Account: Online portal for filing and tracking

- CRA webinars and workshops: Free training sessions throughout the year

Professional Support:

Sometimes you need expert help, especially if your charity has complex finances or unusual situations.

- Charity lawyers: Can advise on legal compliance issues

- Accountants specializing in nonprofits: Help with financial reporting and calculations

- Charity consultants: Provide comprehensive filing support

- Volunteer management programs: Some offer free or low-cost assistance to small charities

Filing Software and Tools:

Several software programs can simplify the Form T3010 filing process. These tools help you organize information, perform calculations automatically, and submit electronically.

Popular options include specialized nonprofit accounting software that integrates with CRA systems. Check with your accountant about which tools they recommend.

Community Resources:

Local nonprofit support organizations often provide workshops on CRA compliance. Your provincial or territorial nonprofit association may offer training sessions on Form T3010.

Staying Compliant with Form T3010 Version 24

Understanding and correctly filing Form T3010 Version 24 protects your charity's registered status and builds trust with donors.

The key points to remember are simple. First, check your fiscal year end date to determine which version you need. Always download a fresh copy from the official CRA website each time you file.

Give yourself plenty of time before the six-month deadline. Gather your financial statements, program information, and supporting documents early in the process.

Double-check all calculations and ensure every required field is complete. If you're unsure about anything, reach out to the CRA or consult a professional before submitting.

Understanding Your Disbursement Quota: Make sure you correctly calculate your charity's disbursement quota using the current rates: 3.5% for the first $1 million of property not used in charitable programs, and 5% for the portion of property exceeding $1 million. If you're making grants to non-qualified donees (non-charities), ensure you complete Schedule 8 and follow the accountability requirements outlined in CRA guidance document CG-032.

Accurate and timely filing demonstrates your commitment to transparency and good governance. It shows donors, funders, and the public that your charity operates responsibly.

The updated Form T3010 may seem complex at first, but it ultimately serves an important purpose. It helps ensure charitable dollars reach the communities and causes that need them most.

Take time to understand the changes, use the correct version, and file on time. Your charity's compliance and reputation depend on it.

Frequently Asked Questions

What is the difference between Form T3010 Version 23 and Version 24?

Version 24 includes updated sections that reflect the 2022 legislative changes to disbursement quota rules. It has new fields for reporting charitable spending and enhanced questions about program delivery. The main difference is how you report your charity's spending requirements and community impact.

When should I use Form T3010 Version 24?

You must use Version 24 if your charity's fiscal period ends on or after December 31, 2023. This applies to fiscal years ending on December 31, 2023, and any date in 2024 or later.

Where can I download the official Form T3010?

Download Form T3010 directly from the CRA's official Forms and Publications page at canada.ca. Search for "Form T3010" and always download a fresh copy each time you need to file. Never use old saved versions from previous years.

Can my charity make grants to organizations that aren't registered charities?

Yes. Following legislative changes in 2022, Canadian registered charities can now provide resources to non-qualified donees (organizations that are not registered charities) provided they meet strict accountability requirements. You must complete Schedule 8 (Disbursements to grantees) on Form T3010 Version 24 to report these grants. Review CRA guidance document CG-032 for complete requirements on making grants to non-qualified donees.

What happens if I file an outdated version of Form T3010?

The CRA will reject your filing if you submit the wrong version. You'll need to complete and resubmit the correct version, which could cause you to miss your filing deadline and face penalties. Always verify you're using the right version before submitting.

How long does it take to complete Form T3010?

Completion time varies based on your charity's size and complexity. Small charities with straightforward finances might spend 4-6 hours. Larger organizations with multiple programs and complex finances may need several days. Start early to give yourself plenty of time.

Can I file Form T3010 electronically?

Yes, you can file Form T3010 online through the CRA's Charities Directorate portal using your My Business Account. Electronic filing is faster and provides immediate confirmation of receipt. You can also mail a paper copy if you prefer.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)