Do Non-Profits Pay Taxes in Canada?

If you’re starting or running a non-profit organization, one of the most common questions is: “Do non-profits pay taxes in Canada?”

It’s a great question—and the answer isn’t just yes or no. It depends on a few things, like what your organization does, whether it's registered as a charity, and how it handles its money.

In this blog post, we’ll break it down in a way that’s simple, clear, and relevant to real Canadian nonprofits and charities. Whether you're helping youth in your community, operating an animal rescue charity, running a church, mosque or temple, or supporting a cultural group, this guide is for you.

What Is a Non-Profit Organization?

Before we talk about taxes, let’s understand what a non-profit organization (NPO) actually is.

A non-profit is a group that exists to support a cause or serve a community, not to make a profit for owners or shareholders. Any money it earns goes back into the organization’s mission.

Examples:

- A soccer club that runs youth leagues in your town.

- A local arts centre that offers free art classes.

- A food bank that supports low-income families.

These organizations aren’t trying to get rich—they’re trying to help.

Types of Non-Profit Organizations in Canada

Not all non-profits are the same. In Canada, you'll typically see:

- Non-Profit Organizations (NPOs): Community groups, sports clubs, social organizations

- Registered Charities: Organizations approved by CRA for charitable purposes

- Non-Profit Corporations: Incorporated entities with legal status

- Charitable Organizations: Must spend funds on charitable activities

- Public Foundations and Private Foundations: Grant-making entities

Understanding which category your organization falls into helps determine your tax obligations.

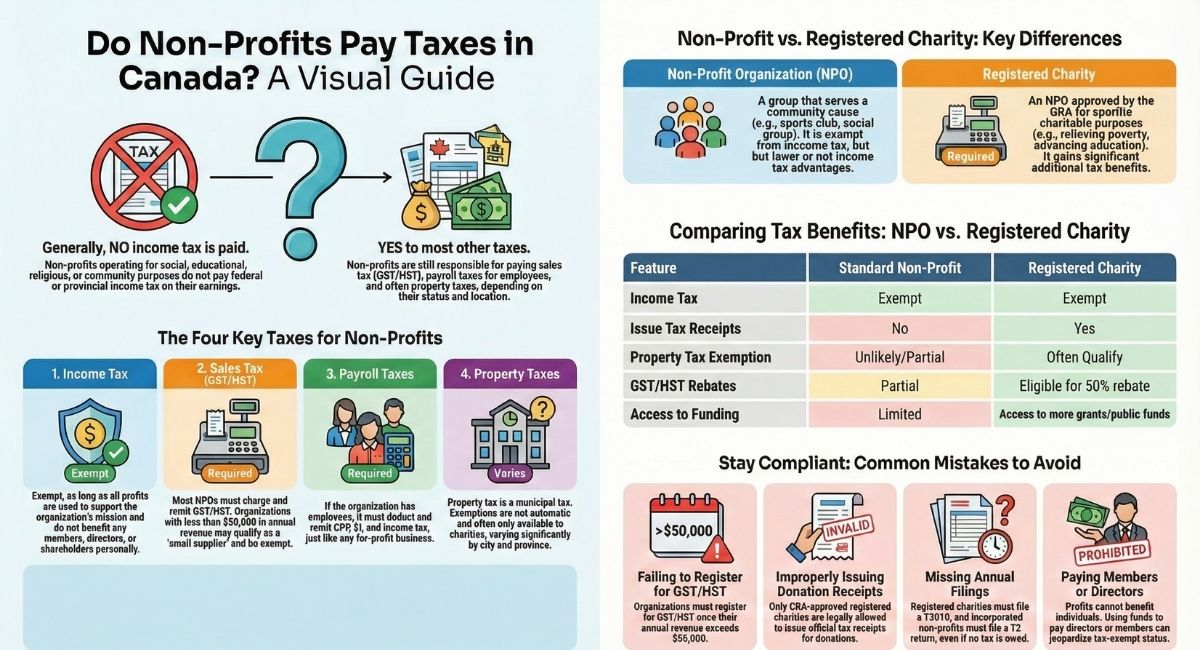

Do Non-Profits Pay Taxes in Canada?

In general, non-profits do not pay income tax, as long as:

- They operate only for social, educational, religious, or community purposes, and

- None of their profits benefit members, directors, or shareholders.

If your nonprofit sticks to its purpose and uses its money to serve its mission—not individuals—you likely won’t owe federal or provincial income tax.

BUT—and this is important—not all taxes are off the table.

Provincial Tax Guide for Non-Profits by Province

Tax obligations vary significantly across Canada. Here's what you need to know for each province:

Ontario

Property Tax Exemptions:

- Registered charities may qualify for exemptions under the Assessment Act

- Must apply to local municipality (not automatic)

- Exemption covers property used exclusively for charitable purposes

- Municipal Property Assessment Corporation (MPAC) reviews applications

Sales Tax:

- HST at 13% (5% federal + 8% provincial)

- No separate PST

Key Contacts:

- MPAC Property Tax Exemptions

- Municipal tax departments for specific exemption applications

British Columbia

Property Tax Exemptions:

- Permissive tax exemptions available through local governments

- Must apply annually to your municipality

- Exemption rates vary by municipality (often 50-100%)

- BC Assessment handles property classifications

Sales Tax:

- GST at 5%

- PST at 7% (separate provincial sales tax)

- PST exemptions available for registered charities on certain purchases

Key Contacts:

- BC Assessment

- Local municipal offices for exemption applications

- Provincial Sales Tax Information

Alberta

Property Tax Exemptions:

- Charitable organisations may qualify for municipal exemptions

- Varies significantly by municipality

- Calgary and Edmonton have specific application processes

Sales Tax:

- GST at 5% only

- No provincial sales tax (PST-free province)

- Significant advantage for non-profits operating in Alberta

Key Contacts:

- Municipal tax departments in your city

- Alberta Registries for corporate matters

Quebec

Property Tax Exemptions:

- Registered charities may qualify for municipal exemptions

- Must apply to local municipality

- Exemptions typically cover buildings used for charitable purposes

Sales Tax:

- GST at 5%

- QST (Quebec Sales Tax) at 9.975%

- Combined rate of 14.975%

- Registered charities can claim rebates on both GST and QST

Special Requirement:

- Must register separately for QST with Revenu Québec

- Different filing requirements than other provinces

Key Contacts:

- Revenu Québec

- Municipal tax departments

Manitoba

Property Tax Exemptions:

- Exemptions available for registered charities

- Must apply to local municipality

- Varies by municipal bylaws

Sales Tax:

- GST at 5%

- PST at 7%

- Some PST exemptions for registered charities

Key Contacts:

- Manitoba Taxation Division

- Municipal offices for property tax exemptions

Saskatchewan

Property Tax Exemptions:

- Exemptions available for charitable organisations

- Must apply to local municipality

- Assessment and tax relief vary by location

Sales Tax:

- GST at 5%

- PST at 6%

- Registered charities may qualify for PST exemptions

Key Contacts:

- Saskatchewan Ministry of Finance

- Local municipal offices

Atlantic Provinces (NS, NB, PEI, NL)

Property Tax Exemptions:

- All four provinces offer exemptions for registered charities

- Application processes vary by province and municipality

- Generally favourable to charitable organisations

Sales Tax:

- All use HST at 15% (highest rate in Canada)

- Registered charities eligible for 50% rebate

Special Consideration:

- Higher HST rate means rebates are more valuable

- Important to track and claim all eligible expenses

Territories (YT, NT, NU)

Property Tax Exemptions:

- Limited property tax infrastructure

- Charitable exemptions available in larger communities

- Contact territorial governments directly

Sales Tax:

- GST at 5% only

- No territorial sales taxes

Tax Requirements by Major Canadian Cities

Understanding city-specific rules helps you navigate local compliance:

Toronto, Ontario

Property Tax:

- Registered charities must apply for exemption through City of Toronto

- Application reviewed annually

- Exemption only applies to property used exclusively for charitable purposes

- Leased properties generally don't qualify for exemption

Business Licensing:

- Some non-profit activities require business licences

- Check with Municipal Licensing & Standards

Municipal Contacts:

- Revenue Services: 416-392-7277

- City of Toronto Property Tax Information

Vancouver, British Columbia

Property Tax:

- Permissive tax exemptions available

- Must apply annually by January 31

- Exemptions typically 50-100% depending on use

- Non-profit housing often gets favourable treatment

Additional Requirements:

- BC Societies Act compliance

- BC Corporate Registry annual filings

Municipal Contacts:

- Property Tax Department: 604-829-2007

- City of Vancouver Non-Profit Property Tax Exemptions

Calgary, Alberta

Property Tax:

- Non-profit exemptions more limited than charities

- Registered charities may qualify for exemptions

- Assessment Services reviews applications

Tax Advantages:

- No provincial sales tax (major benefit)

- Lower overall tax burden for non-profits

Municipal Contacts:

- Assessment & Tax: 403-268-2888

- City of Calgary Property Tax Information

Montreal, Quebec

Property Tax:

- Exemptions available for registered charities

- Must apply to City of Montreal

- Property must be used for charitable purposes

Special Requirements:

- Must maintain registration with Registraire des entreprises du Québec

- Separate QST registration and filings

- Bilingual documentation often required

Municipal Contacts:

- Property Assessment: 514-872-2943

- Ville de Montréal Tax Information

Ottawa, Ontario

Property Tax:

- Federal capital with unique considerations

- Registered charities may qualify for exemptions

- Some federal government programs available for non-profits

Additional Benefits:

- Proximity to federal funding opportunities

- Access to federal non-profit support programs

Municipal Contacts:

- Revenue Services: 613-580-2444

- City of Ottawa Property Taxes

GST/HST for Non-Profits: What You Need to Know

Most non-profits in Canada must charge and collect GST/HST on taxable supplies, currently at:

- 5% (GST) in Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan, and Yukon

- 13% (HST) in Ontario

- 15% (HST) in New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island

However, registered charities can claim a 50% rebate on GST/HST paid, and qualifying non-profits may be eligible for similar rebates.

If your non-profit has revenues under $50,000 annually, you may qualify as a small supplier and not need to register for GST/HST.

Do Nonprofits Pay Local Taxes?

Well, sometimes.

Even if your nonprofit doesn’t pay income tax, you may still be on the hook for other taxes, such as:

- Property Taxes: These are set by local governments. Some cities only offer exemptions to registered charities, not all nonprofits. And some municipalities offer only a partial property tax rebate to nonprofits and charities.

- Payroll Taxes: If you have employees, you’re responsible for things like CPP, EI, and withholding income tax, just like any other employer.

- GST/HST: Most nonprofits still pay sales tax, though most are eligible for partial rebates.

So when people ask, “Do nonprofits pay local taxes?” The answer is: It depends on your location and status.

Provincial Tax Differences for Non-Profits

While federal tax rules are consistent across Canada, provincial taxes vary:

Property Tax: Exemptions differ by province and municipality. For example:

- Ontario offers property tax exemptions for registered charities under the Assessment Act

- British Columbia provides exemptions through permissive tax exemptions

- Alberta has specific charitable organization property tax exemptions

Provincial Sales Tax: Only applies in provinces without HST (currently British Columbia, Saskatchewan, and Manitoba have PST).

Check with your provincial government and local municipality to understand your specific obligations.

What About Registered Charities?

A registered charity is a special type of nonprofit that’s been approved by the Canada Revenue Agency (CRA) to carry out certain charitable purposes, like:

✅ Helping people in poverty

✅ Promoting education

✅ Supporting religion

✅ Benefiting the community in a legally recognized way

Once approved, registered charities get more tax advantages than regular nonprofits.

Tax Benefits for Registered Charities:

✅ Can issue official donation receipts (which attract more donations)

✅ May qualify for property tax exemptions

✅ Eligible for GST/HST rebates

✅ Access to more grants and public funding

Becoming a registered charity is a great option for organizations with a public benefit focus, but it comes with more rules, annual filings, and stricter oversight.

Payroll Taxes: Do Non-Profits Pay CPP and EI?

Yes. If your non-profit has employees, you must:

✅ Deduct and remit Canada Pension Plan (CPP) contributions

✅ Deduct and remit Employment Insurance (EI) premiums

✅ Deduct and remit income tax from employee paycheques

✅ Pay the employer's portion of CPP and EI

This applies to both regular non-profits and registered charities. Volunteers are not considered employees and don't trigger payroll tax obligations.

Annual Tax Compliance Checklist for Canadian Non-Profits

Stay organised with this comprehensive checklist:

Monthly Tasks

Payroll Obligations:

- ☐ Remit CPP, EI, and income tax deductions to CRA by the 15th

- ☐ Record all payroll expenses in accounting system

- ☐ Update year-to-date payroll totals

- ☐ Verify correct deduction rates are being applied

Financial Tracking:

- ☐ Reconcile bank accounts

- ☐ Review monthly expenses and categorise properly

- ☐ Track GST/HST collected and paid

- ☐ Record all donations and issue acknowledgments

- ☐ Review budget vs. actual expenses

Documentation:

- ☐ File all receipts and invoices

- ☐ Scan important documents for digital backup

- ☐ Update donor database

Quarterly Tasks

GST/HST (if registered):

- ☐ File GST/HST return (due one month after quarter-end)

- ☐ Remit any GST/HST owing

- ☐ Track GST/HST paid for rebate claims

- ☐ Reconcile GST/HST accounts

Financial Review:

- ☐ Review quarterly financial statements

- ☐ Compare actual vs. budgeted revenue and expenses

- ☐ Assess cash flow projections

- ☐ Update forecasts for remainder of year

Compliance Check:

- ☐ Review if approaching $50,000 GST/HST threshold

- ☐ Ensure all board meeting minutes are documented

- ☐ Review and update risk register

- ☐ Verify insurance coverage is current

Semi-Annual Tasks

Financial Planning:

- ☐ Review first half financial performance

- ☐ Adjust budget if necessary

- ☐ Assess fundraising progress

- ☐ Plan for second half cash flow needs

Governance:

- ☐ Review policies and procedures

- ☐ Update conflict of interest disclosures

- ☐ Assess board composition and skills gaps

- ☐ Plan for board recruitment if needed

Compliance:

- ☐ Review charitable activities vs. stated purposes

- ☐ Ensure activities align with CRA requirements

- ☐ Assess any needed changes to programmes

Annual Tasks

Tax Filings (within 6 months of fiscal year-end):

- ☐ For Registered Charities: File T3010 (Registered Charity Information Return)

- ☐ For Incorporated Non-Profits: File T2 Corporation Income Tax Return (even if nil)

- ☐ For Unincorporated Non-Profits claiming exemption: File T1044 (Non-Profit Organisation Information Return)

- ☐ Prepare audited or reviewed financial statements (if required)

- ☐ File annual return with provincial corporate registry

Payroll Year-End (by end of February):

- ☐ Issue T4 slips to all employees

- ☐ File T4 Summary with CRA

- ☐ Issue T4A slips to contractors (if applicable)

- ☐ Reconcile annual payroll remittances

- ☐ Prepare Record of Employment (ROE) for departing employees

GST/HST:

- ☐ File annual GST/HST return (if annual filer)

- ☐ Apply for GST/HST Public Service Bodies Rebate (Form GST66)

- ☐ Reconcile annual GST/HST collected vs. paid

Property Tax:

- ☐ Apply for property tax exemption (deadlines vary by municipality)

- ☐ Renew exemption applications if required annually

- ☐ Provide documentation to support exemption claims

Financial Statements:

- ☐ Prepare annual financial statements

- ☐ Complete audit or review engagement (if required)

- ☐ Present financial statements to board for approval

- ☐ Make statements available to members

Corporate Registry:

- ☐ File annual return with provincial corporate registry (Ontario: $60 fee)

- ☐ Update director information if changed

- ☐ Verify registered office address is current

Governance:

- ☐ Hold Annual General Meeting (AGM)

- ☐ Elect or re-elect board members

- ☐ Approve financial statements

- ☐ Appoint auditor for next year (if required)

- ☐ Review and update bylaws if necessary

Documentation:

- ☐ Archive previous year's records

- ☐ Ensure 7-year retention of tax documents

- ☐ Update organisational policies

- ☐ Review and renew insurance coverage

Strategic Planning:

- ☐ Conduct annual programme evaluation

- ☐ Review and update strategic plan

- ☐ Set goals and budget for upcoming year

- ☐ Assess fundraising strategy effectiveness

As Needed

Organisational Changes:

- ☐ Notify CRA within 90 days of name change

- ☐ Update address immediately if office location changes

- ☐ Report director changes on next annual return

- ☐ Submit amendments to governing documents for CRA approval

Programme Changes:

- ☐ Notify CRA of significant changes to charitable activities

- ☐ Request advance ruling if unsure about new activity

- ☐ Update programme descriptions on T3010

Staff Changes:

- ☐ Complete new employee onboarding paperwork

- ☐ Set up payroll for new hires

- ☐ Issue ROE for departing employees

- ☐ Update signing authorities as needed

Recommended Tools & Resources

Accounting Software:

- QuickBooks Online (non-profit discount available)

- Wave (free for small non-profits)

- Xero (integrates well with bank accounts)

Payroll Software:

- Wagepoint (designed for Canadian non-profits)

- Rise (formerly PaymentEvolution)

- ADP (full-service option)

CRA Accounts:

- My Business Account (for organisation)

- Represent a Client (for accountants)

- CRA email notifications for important deadlines

Calendar Reminders:

- Set reminders 2 months before all filing deadlines

- Schedule quarterly board meetings to review compliance

- Block time monthly for financial reconciliation

Red Flags That Indicate You Need Help

Seek professional assistance if:

- ⚠️ You've missed any filing deadlines

- ⚠️ You've received letters from CRA you don't understand

- ⚠️ Your revenue has suddenly increased significantly

- ⚠️ You're unsure whether activities are charitable

- ⚠️ You're considering significant organisational changes

- ⚠️ You have outstanding payroll remittances

- ⚠️ Your bookkeeping is more than 3 months behind

When Do Non-Profits Pay Income Tax in Canada?

While most non-profits don't pay income tax, there are exceptions:

Unrelated Business Income: If your non-profit earns income from activities unrelated to its mission (like running a commercial business), that income may be taxable.

Example: A youth sports league that operates a restaurant open to the public would likely owe tax on restaurant profits.

Investment Income: Certain types of investment income may be taxable for non-profits.

For-Profit Activities: If a non-profit starts operating more like a for-profit business, CRA may revoke its tax-exempt status.

The key is keeping your activities aligned with your stated non-profit purpose.

Real-Life Example

Let’s say there’s a community group in Toronto that offers free tutoring to newcomer students. At first, they’re just a nonprofit—they don’t pay income tax, but they do pay GST and partial property tax on their rented space.

Later, they apply to become a registered charity. Once approved:

- They remain exempt from income tax.

- They can issue tax receipts, which encourages more donations.

- Their municipality may give them a full property tax exemption.

- They qualify for new government grants and CRA rebates.

Their costs go down, their donations go up, and they’re better able to grow their programs.

Common Tax Mistakes Non-Profits Make in Canada

Avoid these costly errors:

❌ Not registering for GST/HST when required (over $50,000 in revenue)

❌ Issuing donation receipts before becoming a registered charity (only registered charities can do this)

❌ Mixing personal and organizational expenses

❌ Failing to file annual returns (charities must file T3010; non-profits may need T1044 or T2)

❌ Not keeping proper receipts and documentation

❌ Paying directors or members from organizational funds inappropriately

Staying compliant protects your tax-exempt status and keeps your organization in good standing with CRA.

What Are the Benefits of a Non-Profit Organization in Canada?

Whether you’re a registered charity or not, there are many advantages to running a nonprofit in Canada:

✅ Tax Relief : Most nonprofits don’t pay income tax, and charities get even more exemptions.

✅ Legal Protection : If you incorporate, your organization becomes a separate legal entity. That means directors and volunteers are usually protected from personal liability.

✅ Public Trust : Nonprofits and charities are seen as more trustworthy, especially when their finances and goals are transparent.

✅ Funding Opportunities : Many funders—especially governments and large foundations—only fund nonprofits or registered charities.

✅ Volunteer and Donor Support : People are more likely to volunteer or donate to causes that are officially structured and recognized.

To sum it up:

Do non-profits pay taxes in Canada?

Mostly no—they don’t pay income tax if they operate properly and for public purposes.

Do nonprofits pay local taxes?

Sometimes, they may still owe property tax unless they’re a registered charity with exemptions.

Need Help Getting Started?

Starting a nonprofit or applying for charitable status can feel confusing. That’s where we come in.

At B.I.G. Charity Law Group, we help Canadians register nonprofits and charities with clear, fixed-fee legal support—no hidden costs, no confusion. Just a fast, simple, and reliable path to get your organization off the ground and officially registered with the CRA.

🎯 Book a complimentary consultation to find out the best and fastest way to register your nonprofit or charity in Canada.

Contact Us

☎️ 416-488-5888

✉️ ask@charitylawgroup.ca

Let’s make your mission official.

Frequently Asked Questions

Can a non-profit make a profit in Canada?

Yes, non-profits can generate surplus revenue, but it must be used to further the organization's mission, not distributed to members or directors.

Do non-profit board members pay taxes on their involvement?

Board members typically serve as volunteers and don't receive taxable income. If they're paid (which is uncommon), that income is taxable.

How much can a non-profit make before paying taxes?

There's no specific revenue limit. The key is that income must be used for the non-profit's stated purpose, not for private benefit.

Do religious organizations pay taxes in Canada?

Most religious organizations operate as registered charities and are exempt from income tax. They may still pay GST/HST and payroll taxes.

What's the difference between tax-exempt and tax-deductible?

Tax-exempt means the organization doesn't pay tax. Tax-deductible means donors can claim donations on their personal taxes (only possible with registered charities).

Do I need an accountant for my non-profit?

While not legally required, having an accountant familiar with non-profit tax rules is highly recommended to ensure compliance.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)