Can You Pay Yourself a Salary in a Non-Profit in Canada?

Running a non-profit organization (NPO) or registered charity in Canada comes with unique compensation rules. Many founders and directors wonder: Can you pay yourself a salary in a non-profit in Canada? The answer is yes, but with important restrictions - especially for directors of charities situated in Ontario.

[Note that the material provided in this blog post, as is all material on this website, is for information purposes only. It is not intended to be legal advice. You should not act or abstain from acting based upon such information without first consulting an experienced charity legal professional. Email or phone correspondence with B.I.G. Charity Law Group or reading this website does not constitute a client-solicitor relationship until formally retained by a signed engagement letter.]

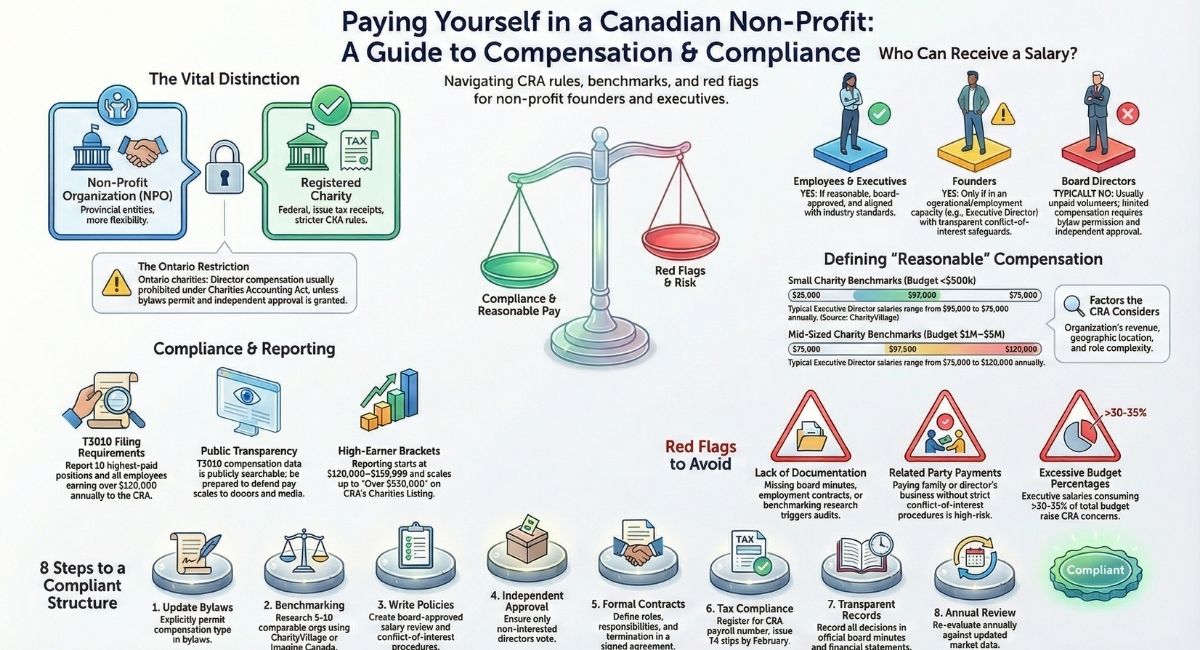

Non-Profit vs. Registered Charity: Understanding the Difference

Before diving into compensation rules, it's important to understand that "non-profit" and "registered charity" are not the same thing in Canada—and this distinction matters for salary rules.

Non-profit organizations are typically incorporated provincially under laws like Ontario's Not-for-Profit Corporations Act or similar provincial legislation. These organizations don't distribute profits to members but aren't necessarily registered with the Canada Revenue Agency (CRA) as charities. They generally have more flexibility when it comes to compensating directors and staff.

Registered charities, on the other hand, are federally registered with the CRA and must operate exclusively for charitable purposes. They face much stricter rules about compensation, governance, and how funds are used. In exchange, they can issue tax receipts for donations. If your organization is a registered charity, you'll face tighter restrictions on paying yourself—particularly if you serve as a director.

Throughout this article, we'll cover rules that apply to both types of organizations, with special attention to the stricter requirements for registered charities.

Recent Changes Affecting Non-Profit Compensation (2025-2026)

The charitable sector has seen several developments affecting compensation practices:

Increased CRA scrutiny on executive compensation: Following recent audits of major charities, the CRA has intensified review of compensation arrangements. In 2024-2025, several organizations faced penalties for inadequate documentation of executive pay decisions.

ONCA compliance deadlines: Organizations incorporated under Ontario's Not-for-Profit Corporations Act must comply with new governance requirements by October 2025. This includes updated conflict-of-interest policies that directly impact compensation approval processes.

Inflation-adjusted benchmarks: With inflation rates of 3-4% in 2024-2025, many charities are updating salary scales. When reviewing compensation, ensure your benchmarking data is current—pre-pandemic salary surveys may no longer reflect market realities.

Enhanced transparency expectations: Donors and funders increasingly expect detailed compensation disclosures beyond legal requirements. Many organizations now voluntarily publish compensation policies and ranges to build trust.

What this means for your organization: Review your compensation approval processes now. Ensure your bylaws are ONCA-compliant if you're in Ontario, update salary benchmarks with 2024-2025 data, and strengthen documentation of all compensation decisions.

Understanding Compensation in Canadian Non-Profits

Who Can Be Paid in a Non-Profit?

- Employees and Executives

- Can receive salaries if compensation is:

- Reasonable and justifiable for the work performed

- Aligned with industry standards (use resources like CharityVillage or Imagine Canada reports)

- Approved by the board and properly documented

- Can receive salaries if compensation is:

- Founders

- May receive salaries if:

- They serve in an employment capacity

- Compensation is transparent and avoids conflicts of interest

- May receive salaries if:

- Directors (Special Rules Apply)

- Typically serve as unpaid volunteers

- May receive limited compensation if:

- Bylaws explicitly permit it (and Articles of Incorporation don't prohibit it)

- Payments are approved by non-interested directors, avoid conflicts of interest, and amounts are reasonable and properly documented. Note to check your provincial guidelines or speak with a nonprofit and charity lawyer, as some provinces may prohibit directors from receiving compensation.

What Does "Reasonable Compensation" Actually Mean?

The CRA doesn't provide a specific dollar amount for "reasonable" compensation—instead, they assess whether salaries are appropriate based on several factors.

Reasonable compensation typically means:

- Comparable to what similar organizations pay for similar roles

- Proportionate to your organization's budget and size

- Justified by the responsibilities and time commitment required

- Documented with market research and board approval

Real-world benchmarks: According to CharityVillage salary surveys, an Executive Director of a small Canadian charity (budget under $500,000) might earn between $55,000-$75,000 annually. Mid-sized organizations (budgets $1-5 million) typically pay $75,000-$120,000. Large national charities often pay significantly more.

The CRA considers factors like your organization's annual revenue, geographic location, sector, and the position's complexity. A Toronto-based arts charity will have different compensation norms than a rural Alberta food bank. When determining salary ranges, compare your position to organizations with similar budgets, missions, and geographic locations—not to unrelated sectors or for-profit companies.

Ontario-Specific Rules for Charity Compensation of Directors

See here how Can a Canadian Charity Located in Ontario Pay its Directors.

When Directors Can Receive Compensation

- Bylaw Permission Required: Your organization's bylaws must explicitly allow director compensation (most charities prohibit this)

- Independent Approval Needed: Any payments must be approved by directors who aren't receiving compensation (see more requirements in the above-referenced link).

- Permissible Benefits Include:

- Expense reimbursements (travel, training) with proper receipts

What to Avoid

- Excessive payments that could jeopardize charitable status

- Undisclosed compensation that violates transparency rules

- Conflicts of interest in approval processes

Provincial Differences: What Other Provinces Should Know

While federal registered charities must comply with CRA regulations across Canada, each province also has its own legislation governing non-profit corporations. These provincial rules can create additional restrictions or requirements.

British Columbia: Under the BC Societies Act, directors can be compensated if the bylaws permit it, but there are strict conflict-of-interest provisions. Directors voting on their own compensation must disclose their interest and may be prohibited from voting.

Alberta: The Alberta Non-profit Corporations Act allows director compensation if authorized by bylaws, but registered charities still face CRA restrictions. Alberta organizations must ensure compensation doesn't constitute "private benefit" under charitable law.

Quebec: Quebec's laws governing non-profits (Part III of the Companies Act or the new Not-for-profit Legal Persons Act) have unique requirements. Directors may receive compensation, but registered charities must still comply with federal CRA rules, which are often more restrictive.

Other provinces: Saskatchewan, Manitoba, and the Atlantic provinces have similar frameworks—generally permitting director compensation if bylaws allow it, but with registered charities facing additional CRA oversight. Always consult your provincial legislation and, if you're a registered charity, ensure any compensation complies with both provincial and federal rules.

Common Scenarios: When Can You Pay Yourself?

Understanding the rules is easier when you see how they apply to real situations. Here are common scenarios non-profit leaders encounter:

Scenario 1: "I'm the founder and Executive Director" Answer: Yes, you can receive a salary. If you're working as the Executive Director or in another staff position, you're an employee—not acting in your capacity as a founder. Your salary must be reasonable, approved by the board, and properly documented. Many founders successfully transition from volunteer roles to paid positions as their organizations grow. Just ensure the board approves your compensation independently and that it aligns with similar organizations.

Scenario 2: "I'm a board member who wants to be paid for 20 hours/week of work" Answer: Generally no, especially for charities. Board service is typically voluntary. If you're doing substantial work beyond governance, you might transition to a paid staff role—but you'd likely need to resign from the board to avoid conflicts of interest. In Ontario charities, director compensation is heavily restricted. Consider whether the work you're doing is truly board governance (unpaid) or operational management (which could be a paid staff position).

Scenario 3: "I'm a director who's also a lawyer/accountant—can I bill for professional services?" Answer: Possibly, with strict safeguards. Some organizations hire directors to provide professional services through separate contracts. However, this must be handled carefully: the contract must be at fair market rates, approved by non-interested directors, disclosed transparently, and comply with your bylaws and conflict-of-interest policies. For registered charities, CRA scrutiny is intense. This is an area where legal advice is essential.

Scenario 4: "I founded the charity years ago and now want to become paid staff"Answer: Yes, with proper process. Many founders successfully transition to paid roles as their organizations mature. You'll need to: resign from the board (or ensure your bylaws permit staff to serve as directors), have the remaining board approve your employment and salary, ensure compensation is market-appropriate, and document everything thoroughly. The transition should be transparent and follow proper governance procedures.

Key Compliance Requirements Across Canada

- CRA Guidelines

- Salaries must be "reasonable" based on comparable positions

- Registered charities face stricter rules than non-profits

- All compensation must be reported (T4 slips for employees)

- Governance Best Practices

- Document all compensation decisions in board minutes

- Disclose executive salaries in financial statements

- Recuse interested parties from compensation votes

- Tax Implications

- Salaries are taxable income

- Proper payroll deductions must be made

- Contractors require T4A slips if paid over $500

T3010 Reporting Requirements for Compensation

Registered charities must report specific compensation details annually on Form T3010:

What must be reported:

- All employees earning over $120,000 annually (reported by compensation bracket, not by name)

- Total compensation paid to the 10 highest-paid positions

- Number of employees in various salary ranges

- Whether directors received compensation

- Related party transactions involving compensation

Reporting brackets for high earners:

- $120,000 to $159,999

- $160,000 to $199,999

- $200,000 to $249,999

- $250,000 to $299,999

- $300,000 to $349,999

- $350,000 and above

What's publicly accessible: Once your T3010 is filed, compensation information becomes searchable on the CRA's Charities Listing. Donors, media, and the public can access this data. Ensure your compensation is defensible before it becomes public record.

Why this matters: Transparent reporting builds donor trust and demonstrates responsible stewardship. However, it also means high salaries will face public scrutiny. Organizations should prepare communications explaining how executive compensation aligns with organizational size and impact.

Consequences of Non-Compliance

The stakes are high when it comes to improper compensation in Canadian charities and non-profits. Understanding the potential consequences can help your organization stay compliant.

Loss of charitable status: The CRA can revoke your charity's registration if compensation is deemed excessive or improperly approved. This means losing the ability to issue tax receipts—often devastating for fundraising. Revocation also triggers a revocation tax on remaining assets.

CRA penalties and audits: Even without full revocation, the CRA can impose financial penalties, require repayment of improper compensation, or conduct intensive audits. These processes are time-consuming, expensive, and damage donor confidence.

Personal director liability: In some cases, directors who approve inappropriate compensation can be held personally liable. This is particularly true if they breach their fiduciary duties or fail to act in the organization's best interests. Directors' and officers' insurance may not cover intentional misconduct.

Reputational damage: News of compensation scandals spreads quickly in the charitable sector. Donors, funders, and the public expect non-profits to use resources responsibly. Even if you avoid legal penalties, reputational harm can be long-lasting and affect your ability to fundraise effectively.

Red Flags That Attract CRA Attention

The CRA audits compensation arrangements that raise concerns. Avoid these warning signs:

🚩 Compensation without documentation: No written employment contracts, missing board approval minutes, or lack of benchmarking research.

🚩 Related party payments: Paying family members, directors, or founder's businesses without proper conflict-of-interest procedures and independent approval.

🚩 Compensation exceeding organizational revenue: Executive salaries that consume excessive percentages of total budget (generally over 30-35% raises concerns).

🚩 Unusual benefit arrangements: Non-standard perks like personal vehicle use, housing allowances, or loans to staff without proper documentation and CRA reporting.

🚩 Retroactive salary increases: Approving pay raises after the fact without prior board authorization.

🚩 Inadequate board independence: Directors voting on their own compensation or compensation for family members.

🚩 Failure to report high earners: Not disclosing compensation over $120,000 on T3010 (charities only).

🚩 Contractor misclassification: Treating employees as contractors to avoid payroll obligations.

🚩 Inconsistent pay structures: Wildly different compensation for similar roles without documented justification.

🚩 Missing conflict-of-interest declarations: No written disclosure when staff or directors have personal financial interests in compensation decisions.

If your organization has any of these issues, address them immediately with legal and accounting professionals.

Step-by-Step Guide: Implementing Compliant Non-Profit Compensation

Step 1: Review and Update Your Bylaws

- Verify whether your bylaws permit director or founder compensation

- Check for conflicts between bylaws and Articles of Incorporation

- If amendments are needed, follow proper member approval process

- For Ontario charities, ensure bylaws comply with Charities Accounting Act

Step 2: Conduct Salary Benchmarking Research

- Identify 5-10 comparable organizations (similar budget, location, mission)

- Use resources like: CharityVillage salary surveys, Imagine Canada reports, sector-specific association data, and Statistics Canada nonprofit wage data

- Document salary ranges for similar positions

- Consider cost-of-living adjustments for your region

Step 3: Develop Written Compensation Policies

- Create clear approval processes for staff salaries

- Establish conflict-of-interest procedures for related-party compensation

- Define "reasonable" compensation criteria specific to your organization

- Include expense reimbursement policies with dollar limits

- Set review timelines (annual reviews recommended)

Step 4: Establish Independent Approval Process

- Ensure non-interested directors vote on compensation decisions

- Require written documentation of approval rationale

- Have board chair or independent director sign off on executive compensation

- Create paper trail showing market research informed decisions

Step 5: Create Employment Contracts

- Include clear salary amounts and payment schedules

- Define roles, responsibilities, and performance expectations

- Specify benefits, vacation, and termination clauses

- Have lawyer review contracts before signing

Step 6: Implement Proper Payroll and Tax Compliance

- Set up CRA business number for payroll deductions

- Register for Canada Pension Plan (CPP) and Employment Insurance (EI)

- Calculate and remit source deductions properly

- Issue T4 slips to employees by February deadline

- Issue T4A slips to contractors paid over $500

Step 7: Maintain Transparent Documentation

- Record all compensation decisions in board meeting minutes

- Disclose executive salaries in annual financial statements

- Keep benchmarking research and approval documents on file

- Prepare for T3010 reporting requirements (charities)

- Update compensation schedules in personnel files

Step 8: Conduct Annual Reviews

- Review all compensation against current market data

- Assess whether roles have evolved to justify increases

- Evaluate organizational financial health before approving raises

- Document review process and decisions in board minutes

Need Help with Non-Profit Compensation Compliance?

Navigating compensation rules for Canadian non-profits and charities can be complex—especially when balancing CRA regulations, provincial legislation, and your organization's bylaws. Making mistakes can put your charitable status at risk.

B.I.G. Charity Law Group specializes in helping non-profits and registered charities across Canada with compensation compliance. Our services include reviewing your bylaws for compensation provisions, developing proper approval processes and conflict-of-interest policies, benchmarking salaries against comparable organizations, and ensuring full CRA compliance.

Whether you're considering paying yourself for the first time, transitioning a founder to a paid role, or updating your compensation policies, we can provide the legal guidance you need to stay compliant and protect your organization.

Contact B.I.G. Charity Law Group today for a consultation on your non-profit's compensation structure. Call us at (416-488-5888), email dov.goldberg@charitylawgroup.ca, or book a consultation online.

Final Thoughts

While Canadian non-profits can pay salaries to employees and executives, director compensation is much more restricted—especially in Ontario. The key is maintaining transparency, reasonableness, and compliance with:

- Your organization's bylaws

- CRA regulations

- Provincial laws (like Ontario's Charities Accounting Act)

The material provided on this website is for information purposes only. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. Email contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor-client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

Frequently Asked Questions

Can the founder of a non-profit receive a salary?

Yes, if the founder is employed in an operational role (like Executive Director) rather than serving only as a board member. The salary must be reasonable, approved by the board, and properly documented.

How much can a non-profit executive director make in Canada?

Compensation varies widely based on organization size, location, and sector. Small charities (under $500,000 budget) typically pay $55,000-$75,000, while mid-sized organizations ($1-5 million budget) pay $75,000-$120,000. Always benchmark against comparable organizations.

Can board members be paid in Ontario?

For registered charities in Ontario, director compensation is heavily restricted under the Charities Accounting Act. Directors typically serve as volunteers, though they can receive expense reimbursements. Bylaws must explicitly permit any compensation, and strict approval processes apply.

What happens if a charity pays excessive compensation?

The CRA may revoke charitable status, impose penalties, or require repayment. Directors could face personal liability. "Excessive" means compensation that's unreasonably high compared to similar positions in comparable organizations.

Do I need CRA approval to pay myself?

No pre-approval is required, but the CRA reviews compensation during audits and annual filings. If you're a registered charity, ensure all compensation is reasonable, properly approved, and documented before making payments.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)