How to Register a Charity in Toronto

Are you ready to make a difference in your Toronto community but unsure how to register a charity? You're not alone.

Many passionate individuals want to start charitable organizations but find the Canada Revenue Agency (CRA) registration process overwhelming. This guide breaks down every step you need to take to successfully register your charity in Toronto.

Whether you're starting from scratch or converting an existing nonprofit into a registered charity, you'll learn how to draft compliant charitable purposes, describe your activities, and navigate the CRA application process. Let's get started.

Understanding Charitable Registration in Canada

Before you begin the registration process, you need to understand what charitable registration means and how it works in Canada. This knowledge will help you determine if registering as a charity is the right choice for your organization.

What is a Registered Charity?

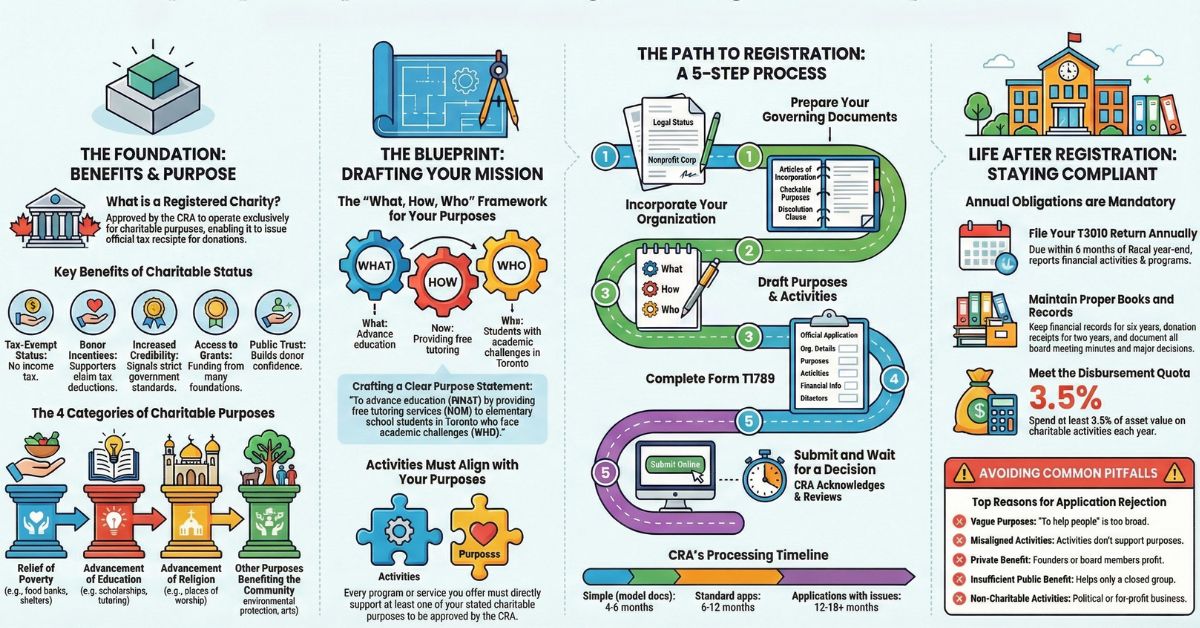

A registered charity is an organization that the CRA has approved to operate exclusively for charitable purposes. When you register your charity, you gain the legal ability to issue tax receipts for donations.

This status provides significant benefits for your organization:

- Tax-exempt status: Your charity doesn't pay income tax on its revenue

- Donor incentives: Supporters can claim tax deductions for their donations

- Increased credibility: Registration shows you meet strict government standards

- Access to grants: Many foundations only fund registered charities

- Public trust: The charitable status builds confidence with potential donors

However, registration also comes with responsibilities. You must file annual returns, maintain proper records, and follow all CRA regulations for charities.

Who Can Register a Charity in Toronto?

Not every organization qualifies for charitable registration. Your organization must meet specific criteria set by the CRA.

You can register a charity if your organization:

- Operates exclusively for charitable purposes

- Provides public benefit (not just private benefit to members)

- Has activities that directly support your charitable purposes

- Maintains proper governance structures

- Keeps detailed financial records

Most Toronto charities start as incorporated nonprofits under either federal or Ontario law. You can also establish a charitable trust, but incorporation is more common because it provides liability protection for your board members.

Your organization must be created before you can apply for charitable registration. If you haven't incorporated yet, you'll need to do that first.

The Four Categories of Charitable Purposes

The CRA recognizes only four categories of charitable purposes in Canada. Your organization must fit into at least one of these categories to qualify for registration. Understanding these categories helps you draft purposes that the CRA will approve.

1. Relief of Poverty

This category covers organizations that help people in financial need. Poverty relief doesn't just mean helping homeless individuals—it includes anyone facing economic hardship.

Toronto examples of poverty relief:

- Operating food banks in low-income neighbourhoods

- Providing emergency shelter services

- Offering free meals to those experiencing financial difficulty

- Distributing clothing to families in need

- Helping people access affordable housing

The CRA defines poverty broadly. Your beneficiaries don't need to be destitute—they just need to face genuine financial challenges that your charity helps address.

2. Advancement of Education

Educational charities promote learning and knowledge in the community. This category is broader than you might think.

What qualifies as educational advancement:

- Providing scholarships to Toronto students

- Operating tutoring programs for underserved communities

- Running workshops and training programs

- Creating educational resources and libraries

- Supporting research and academic programs

Your educational activities must have genuine educational value. Simply hosting lectures or publishing information isn't enough—you need to demonstrate how your activities advance learning.

3. Advancement of Religion

Religious organizations can register as charities when they promote religious worship, practice, and teaching. This includes places of worship like temples, mosques, and churches.

Key requirements for religious charities:

- Your beliefs must involve faith in a higher power

- You must have an identifiable form of worship

- Your religion must include a moral or ethical code

- You need a community of believers

If you're registering a religious organization, you'll need to provide detailed information about your beliefs, practices, and governance structure.

4. Other Purposes Benefiting the Community

This catchall category includes many other ways to benefit the public. The CRA calls these "other charitable purposes."

Common examples in Toronto:

- Public health: Running health clinics, promoting wellness programs

- Environmental protection: Conservation projects, sustainability education

- Arts and culture: Supporting galleries, music programs, cultural festivals

- Animal welfare: Operating rescue shelters, wildlife rehabilitation

- Sports and recreation: Youth sports programs (when they're truly charitable)

For this category, you must prove your purpose benefits the community in a way the law recognizes as charitable. Not every beneficial activity qualifies—the CRA evaluates each case carefully.

How to Draft Charitable Purposes and Activities

Writing your charitable purposes is the most critical part of your application. The CRA scrutinizes this language carefully because it defines what your charity can and cannot do.

Your governing documents must include both your purposes (why you exist) and your activities (what you'll do).

The What, How, and Who Framework

The CRA uses a simple framework to evaluate your purposes. Every purpose statement should clearly explain three elements.

The three essential elements:

- What: The charitable goal you're trying to achieve

- How: The methods you'll use to achieve it

- Who: The beneficiaries you'll serve

Here's an example for an educational charity:

"To advance education by providing free tutoring services to elementary school students in Toronto who face academic challenges."

- What: Advance education

- How: Providing free tutoring services

- Who: Elementary school students in Toronto with academic challenges

This framework ensures your purposes are specific enough for the CRA to understand and approve.

Describing Activities in Detail

After you draft your purposes, you need to describe your activities in detail. The CRA wants to understand exactly what your charity will do.

Include these details for each activity:

- The specific programs or services you'll offer

- How often you'll conduct these activities

- Where in Toronto (or beyond) you'll operate

- Who will benefit and how they'll benefit

- What resources you'll use to carry out the activities

Example of detailed activity description:

"We will operate a weekly homework club every Tuesday and Thursday evening from 4 PM to 6 PM at community centres in Scarborough and North York. Volunteer tutors will provide one-on-one academic support to students in grades 4-6 who are struggling with math and reading comprehension."

The more specific you are, the easier it is for the CRA to approve your application.

Ensuring Activities Align with Purposes

Every activity must directly support at least one of your charitable purposes. This alignment is crucial for CRA approval.

Activities that align properly:

- Your purpose is poverty relief → Your activity is providing free legal aid to low-income families

- Your purpose is education advancement → Your activity is offering scholarships to students

- Your purpose is community health → Your activity is running free vaccination clinics

Activities that don't align:

- Operating a commercial business that doesn't support your purposes

- Fundraising activities that become ends in themselves

- Political activities beyond what's permitted for charities

- Activities that benefit private individuals rather than the public

If you're unsure whether an activity aligns with your purposes, consult CRA guidance documents or speak with a charity lawyer before including it in your application.

Step-by-Step Process to Register Your Charity in Toronto

Now that you understand charitable purposes, let's walk through the actual registration process. Follow these steps carefully to increase your chances of approval.

Step 1: Incorporate Your Organization

Before you can register as a charity, your organization must have legal status. Most Toronto charities incorporate as nonprofit corporations.

You have two incorporation options:

Ontario incorporation:

- File with Ontario's Ministry of Public and Business Service Delivery

- Governed by the Ontario Not-for-Profit Corporations Act (ONCA)

- Best if you'll operate primarily in Ontario

- Costs approximately $155 for online filing

Federal incorporation:

- File with Corporations Canada

- Governed by the Canada Not-for-Profit Corporations Act

- Better if you plan to operate across provinces

- Costs approximately $200 plus name search fees

Choose the option that matches your geographic scope. Most Toronto-focused charities choose Ontario incorporation for simplicity.

Step 2: Prepare Your Governing Documents

Your governing documents (articles of incorporation or constitution) must include specific clauses that meet CRA requirements.

Essential clauses your documents need:

- Charitable purposes clause: Clear statement of your purposes using the framework above

- Dissolution clause: What happens to assets if your charity closes (must go to other charities)

- No private benefit clause: Confirms no individual benefits personally from your charity

- Activities clause: Description of how you'll achieve your purposes

- Board structure: How your board operates and makes decisions

The CRA provides model clauses in their guidance documents. Using these models helps ensure your documents meet their standards.

Step 3: Draft Charitable Purposes and Activities

Use the guidance from the previous section to write comprehensive purposes and activities. The CRA recommends reviewing their publication CG-019: How to Draft Purposes for Charitable Registration.

Tips for drafting success:

- Use clear, simple language (avoid legal jargon when possible)

- Be specific about your methods and beneficiaries

- Ensure every activity connects to a purpose

- Don't copy purposes from other charities—customize for your organization

- Have someone outside your organization read and understand them

Take your time with this step. Well-drafted purposes speed up the approval process significantly.

Step 4: Complete the Online Application

Complete your application online through the CRA's My Business Account portal. Since the digitization of the Charities Directorate, there is no longer a specific form number for this online application—it must be completed directly through the portal.

Key sections of Form T1789:

Supporting documents you'll need to attach:

- Copy of your articles of incorporation or constitution

- Bylaws (if applicable)

- Financial statements or projected budget

- Board resolution authorizing the application

- Any other relevant documents (leases, agreements, etc.)

The application typically takes several hours to complete thoroughly. Don't rush through it—accuracy matters more than speed.

Step 5: Submit Your Application to CRA

Once you've completed everything, submit your application through the CRA portal. There's no application fee, but you should keep copies of everything you submit.

After submission, you can expect:

- Acknowledgment: The CRA will confirm they received your application within a few weeks

- Processing time: Currently 6-12 months for most applications (sometimes longer)

- Questions: The CRA may contact you for clarification or additional information

- Decision: You'll receive written notification of approval or refusal

During the processing period, respond promptly to any CRA requests. Delays in your responses extend the overall timeline.

CRA Compliance and Guidelines

Registration is just the beginning. Once approved, you must maintain compliance with ongoing CRA requirements to keep your charitable status.

Staying Compliant with CRA Requirements

Your charity has legal obligations every year after registration. Missing these requirements can result in penalties or loss of charitable status.

Annual obligations include:

Filing Form T3010 (Annual Information Return):

- Due within six months of your fiscal year-end

- Reports all financial activities, programs, and organizational changes

- Required even if you had no financial activity

- Late filing results in automatic penalties

Maintaining proper books and records:

- Keep official donation receipts for at least two years

- Maintain financial records for six years

- Document board meeting minutes and major decisions

- Track all revenue sources and expenditures

Issuing valid donation receipts:

- Follow CRA requirements exactly for receipt content and format

- Only issue receipts for eligible gifts

- Keep copies of all receipts issued

- Report all receipts on your T3010

Spending requirements:

- Spend at least 3.5% of your charity's value on charitable activities annually

- This is called the "disbursement quota"

- Calculate it carefully based on CRA rules

Non-compliance can lead to serious consequences including fines, loss of privileges, or revocation of charitable status.

Key CRA Resources for Toronto Charities

The CRA provides extensive support for registered charities. Take advantage of these resources to stay informed and compliant.

Essential CRA resources:

CRA Charities Directorate:

- Phone: 1-800-267-2384

- Hours: Monday-Friday, 8 AM - 5 PM Eastern Time

- Email: Through your My Business Account portal

- They answer questions about registration and compliance

Online guidance:

- Charities Listings (search database of all registered charities)

- Guidance publications (detailed explanations of CRA requirements)

- Webinars and videos (educational materials)

- Form T3010 charity return

Key publications to bookmark:

- T4063: Registering a Charity for Income Tax Purposes

- CG-019: How to Draft Purposes for Charitable Registration

- CPS-019: What is a Related Business?

- T4033: Completing the Registered Charity Information Return

Review these resources regularly. The CRA updates requirements periodically, and staying informed helps you avoid compliance issues.

Modifying Your Charity's Purposes or Activities

As your charity grows, you may want to expand your purposes or start new activities. You can't make these changes without CRA approval.

When You Need CRA Approval

Not every change requires advance approval. Understanding which changes need permission helps you plan appropriately.

Major changes requiring CRA approval:

- Adding new charitable purposes to your governing documents

- Removing or significantly modifying existing purposes

- Starting activities that differ substantially from your registered activities

- Changing your legal structure (e.g., amalgamating with another charity)

- Operating outside your stated geographic area in a major way

Minor changes you can make without pre-approval:

- Adjusting how you deliver existing programs

- Expanding within your stated purposes and activities

- Adding new board members or staff

- Moving to a new location within your operating area

When in doubt, contact the CRA before making changes. It's better to ask first than to operate outside your registration.

How to Request Changes

If you need to modify your charitable purposes, follow this process carefully.

Steps for requesting changes:

- Amend your governing documents: Update your articles or constitution following your jurisdiction's process (Ontario or federal)

- Notify the CRA: Submit the amended documents through your My Business Account

- Provide explanation: Include a letter explaining why you're making changes and how new purposes are charitable

- Wait for review: The CRA will evaluate whether your changes still qualify as charitable

- Receive decision: You'll get written confirmation of approval or concerns to address

This process can take several months. Plan ahead if you have time-sensitive changes to make.

Don't start new activities or operate under new purposes until the CRA approves your changes. Operating outside your registration can jeopardize your charitable status.

Common Challenges When Registering a Charity in Toronto

Many applications face obstacles during the registration process. Understanding common challenges helps you avoid them.

Application Rejections and How to Avoid Them

The CRA rejects applications for specific, fixable reasons. Learning these common issues helps you strengthen your application from the start.

Top reasons for rejection:

Purposes too vague or broad:

- Problem: "To help people in Toronto" doesn't specify how or who

- Solution: Use the what-how-who framework with specific details

Activities don't align with purposes:

- Problem: Your purpose is education but activities focus on social events

- Solution: Ensure every activity directly supports stated purposes

Private benefit concerns:

- Problem: Board members or founders will personally benefit from the charity

- Solution: Include strong conflict of interest policies and demonstrate public benefit

Insufficient public benefit:

- Problem: Your charity helps only a small, closed group

- Solution: Show how the public at large can benefit from your work

Non-charitable activities included:

- Problem: Operating a business or engaging in prohibited political activities

- Solution: Limit activities to those the CRA recognizes as charitable

If your application is refused, the CRA will explain why. You can revise and reapply addressing their concerns.

Timeline and Processing Expectations

Understanding realistic timelines helps you plan your charity's launch appropriately.

Current processing times:

Factors that can delay approval:

- Incomplete applications or missing documents

- Unclear or problematic purposes and activities

- Complex organizational structures

- Related party transactions that need review

- Slow responses to CRA questions

How to check your application status:

- Log into your My Business Account portal

- Check for messages from the CRA

- Call the Charities Directorate if it's been longer than 6 months

- Don't assume silence means approval—wait for official notification

During the wait, you can prepare for operations. Develop your programs, recruit board members, and create systems for when you receive approval.

Working with Charity Law Professionals

Registering a charity involves complex legal and tax requirements. Professional guidance can save you time, money, and frustration.

When to Seek Legal Assistance

Not every organization needs a lawyer, but certain situations strongly benefit from professional help.

Consider legal assistance if:

- Your charitable purposes are complex or innovative

- You plan to operate in multiple jurisdictions

- Your charity involves significant real estate or assets

- You have related businesses or complex funding structures

- Your application was previously refused

- You're amalgamating multiple organizations

- You have questions about what's legally permitted

Simple, straightforward charities with standard purposes can often handle registration independently using CRA resources.

Benefits of Professional Guidance

Working with experienced charity lawyers provides several advantages throughout the registration process.

Key benefits include:

Avoiding costly mistakes:

- Lawyers familiar with CRA requirements spot potential issues early

- They prevent problems that delay approval or cause rejection

- Fixing mistakes after submission takes much longer than getting it right initially

Ensuring CRA compliance:

- Professionals stay current on changing regulations and CRA policies

- They draft purposes and activities that meet current standards

- They ensure your governing documents include all required clauses

Faster approval process:

- Well-prepared applications move through CRA review more quickly

- Complete, compliant applications rarely receive requests for additional information

- Professional drafting reduces back-and-forth with the CRA

Strategic planning:

- Lawyers help you structure your charity optimally from the start

- They advise on issues like related businesses and proper governance

- They help you plan for long-term compliance, not just initial registration

The cost of professional assistance is often recovered through time savings and avoiding compliance problems down the road.

Conclusion

Registering a charity in Toronto requires careful planning, detailed documentation, and patience throughout the CRA approval process. By understanding the four categories of charitable purposes, drafting clear and specific purposes and activities, and following the step-by-step registration process, you increase your chances of success significantly.

Remember these key points as you move forward:

Start by incorporating your organization and preparing compliant governing documents. Take time to draft purposes that clearly explain the what, how, and who of your charitable work. Complete Form T1789 thoroughly and accurately, attaching all required supporting documents.

After registration, maintain compliance by filing annual returns, keeping proper records, and seeking CRA approval before making major changes to your purposes or activities.

The journey to charitable registration can feel overwhelming, but the result—being able to issue tax receipts and operate as a fully registered charity—makes the effort worthwhile. Your Toronto community will benefit from the important work you're planning to do.

Get Expert Help With Your Charity Registration

Ready to start your charity registration but want professional guidance? Our experienced charity law lawyers helps Toronto organizations navigate the CRA process successfully.

Contact us today:

- Phone: 416-488-5888

- Email: ask@charitylawgroup.ca

- Free consultation: Schedule a complimentary strategy session where we'll answer all your questions about registering a charity in Toronto

We'll review your situation, explain your options, and provide clear next steps for your charitable registration.

Frequently Asked Questions

How long does it take to register a charity in Toronto?

The CRA typically takes 6-12 months to process charity registration applications. Simple applications using standard purposes may be approved in 4-6 months, while complex applications can take 12-18 months or longer. Your response time to any CRA questions affects the overall timeline.

How much does it cost to register a charity with the CRA?

There's no fee to submit your charity registration application to the CRA. However, you'll pay incorporation fees (approximately $155-$200 depending on whether you incorporate provincially or federally). If you use legal services, those costs vary based on your charity's complexity.

Can I register a charity without incorporating first?

No, you must establish your organization's legal structure before applying for charitable registration. Most Toronto charities incorporate as nonprofit corporations under either Ontario or federal law. You could alternatively establish a charitable trust, but incorporation provides better liability protection for your board members.

What's the difference between a charity and a nonprofit in Ontario?

A nonprofit organization operates for purposes beyond making profit, but not all nonprofits are charities. Only organizations with exclusively charitable purposes that meet CRA requirements can register as charities. Registered charities can issue tax receipts for donations, while regular nonprofits cannot.

Do I need a lawyer to register a charity in Toronto?

A lawyer isn't legally required, but professional assistance helps with complex applications. If your purposes are straightforward and you're comfortable using CRA guidance documents, you can complete the process yourself. However, lawyers help avoid mistakes that delay approval and ensure your governing documents meet all CRA requirements.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)