Charity Revocation: What You Need to Know

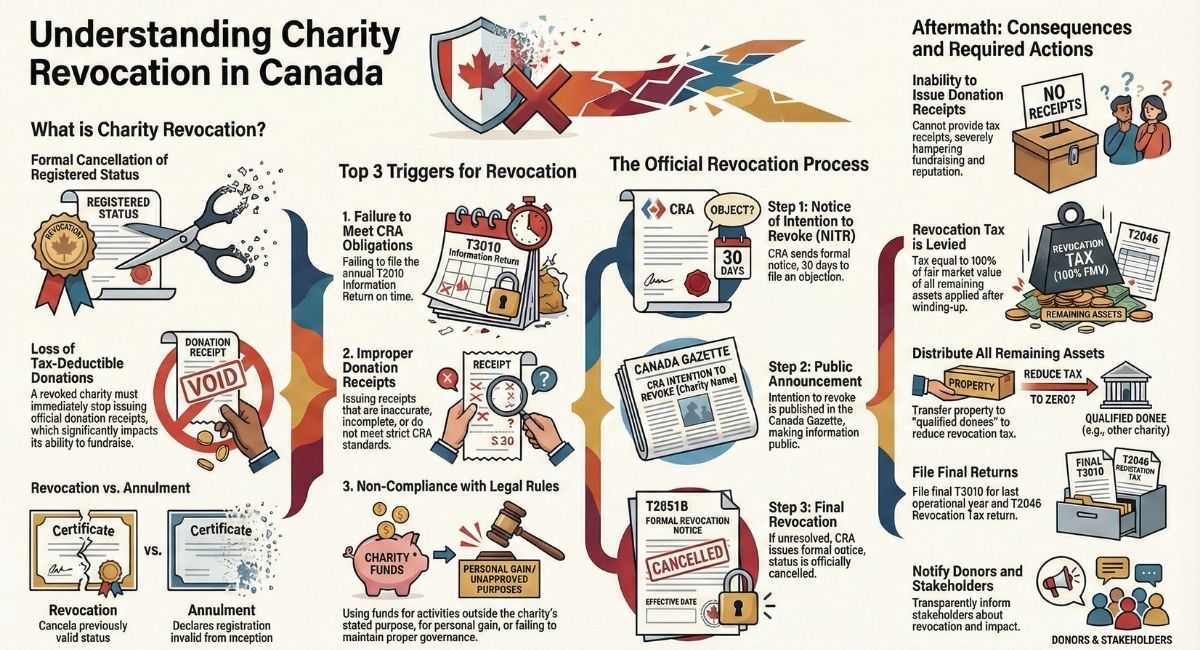

Charity revocation happens when a registered charity loses its official status with the Canada Revenue Agency (CRA).

This means the charity no longer receives tax benefits and must stop issuing official donation receipts.

Revocation can happen for several reasons, including failure to file required forms, non-compliance with CRA rules, or voluntary closure.

When a charity’s status is revoked, the final financial return must be filed.

The revocation becomes public information.

It is important for charities to understand the steps involved and the consequences they face after revocation.

Managing the process properly helps protect their reputation.

Knowing what triggers revocation and how to respond can help charities avoid serious problems.

This article explains what charity revocation means, how it affects the organization, and what actions to consider if revocation occurs.

What Is Charity Revocation?

Charity revocation cancels a registered charity’s status, removing legal benefits and tax privileges.

It happens when a charity no longer meets government rules or fails to comply with requirements.

Understanding what revocation means and why maintaining registered status matters is crucial for any charitable organization.

Definition and Overview

Charity revocation is the formal cancellation of a charity’s registered status by the Canada Revenue Agency (CRA).

Once revoked, the charity loses its privileges, including the ability to issue donation receipts for tax purposes.

The revocation is publicly recorded, often published in official government documents like the Canada Gazette.

After revocation, the charity must file a final return for its last operational year.

It can no longer operate as a registered charity, which affects fundraising and tax benefits.

Revocation can occur voluntarily, through non-compliance issues such as failing to file returns, or as a result of CRA audits.

Difference Between Revocation and Annulment

Revocation and annulment both end a charity’s registered status, but they differ in cause and process.

Revocation usually follows actions by the CRA when a charity breaks rules or fails obligations.

Annulment happens when registration was granted in error or based on false information.

Revocation means the charity once had valid registered status that was later removed.

Annulment cancels registration retroactively, as if it never existed.

The effects on the charity’s operations and reporting can vary, but both result in losing the legal recognition needed to operate as a charitable entity.

Importance of Registered Charity Status

Registered charity status grants legal and financial benefits essential for fundraising and community impact.

It allows a charity to issue official donation receipts, making gifts tax-deductible, which encourages donor support.

It also provides access to certain tax exemptions and government programs.

Losing this status through revocation limits a charity’s ability to operate effectively and damages its reputation.

Registered status also imposes responsibilities such as filing annual returns and following laws related to charitable activities.

Maintaining compliance is necessary to keep these privileges and avoid legal or financial risks.

Why Charities Lose Their Registered Status

Charities may lose their registered status for specific reasons related to their obligations, legal compliance, and how they handle donations.

These causes affect their standing with the Canada Revenue Agency (CRA) and can lead to revocation.

Understanding these reasons helps charities avoid risks and maintain their registration.

Failure to Meet CRA Obligations

The most common reason for losing registered status is failing to file the annual T3010 Information Return.

This form is crucial for the CRA to monitor the charity’s activities and finances.

Even a single missed or late filing can result in revocation.

Charities must also respond promptly to CRA communications and audits.

Ignoring these requests or failing to provide required information can trigger revocation.

The CRA expects full transparency to ensure the charity operates according to the rules.

Maintaining accurate records and submitting all required documents on time is essential.

The CRA uses these reports to verify compliance and confirm that the charity remains eligible for tax-exempt status.

Issues With Donation Receipts

Registered charities must issue official donation receipts that meet CRA standards.

These receipts allow donors to claim tax credits.

If a charity issues improper or misleading receipts, it risks losing its status.

The CRA strictly enforces rules regarding what information must appear on receipts.

This includes the charity’s name, registration number, date, and amount donated.

Inaccurate or incomplete receipts may be considered non-compliance.

Repeated errors or misuse of donation receipts can lead to investigations and eventual revocation.

Charities must track receipts carefully and ensure they align with CRA guidelines.

Non-Compliance With Legal Requirements

Charities must follow all laws related to their registration, including operating within their stated purposes.

Using funds for activities outside their mandate is a common cause of revocation.

The CRA reviews how charities spend their money.

If funds are used improperly, such as for personal gain or unrelated business activities, the charity risks losing its registered status.

Other legal requirements include maintaining proper governance, avoiding political campaigning, and meeting reporting deadlines.

Failure to meet these legal rules signals non-compliance, which can lead to revocation by the CRA.

Types of Charity Revocation

Charity revocation means the official cancellation of a charity’s registration with the Canada Revenue Agency (CRA).

This can happen in different ways depending on the charity’s situation.

Some charities choose to end their registration voluntarily, while others face revocation due to CRA compliance actions.

There is also a formal annulment process that affects the charity’s status.

Voluntary Revocation

Voluntary revocation occurs when a charity requests its registration be cancelled.

This can happen if the charity has finished its work, merged with another organisation, or no longer has the resources to continue.

To start voluntary revocation, the charity must send a signed request to the CRA, usually by a person with signing authority, such as a trustee or director.

The CRA then sends a Notice of Intention to Revoke (T2051A), including the proposed revocation date.

The charity should distribute its remaining assets to eligible donees before the final revocation date.

After this notice, asset transfers must only be made to qualified donees according to CRA rules.

Voluntary revocation does not protect a charity from ongoing compliance reviews or actions.

Revocation by CRA

The CRA can revoke a charity’s registration for several reasons, mainly due to non-compliance.

The most common reason is failure to file the required annual return (T3010) within the specified time.

If this return is not submitted within six months after the fiscal year-end, the CRA sends a warning notice.

The charity has 90 days to respond or object.

If the charity does not respond, the CRA issues a formal revocation notice (T2051B), stating the effective date.

Revocation can also result from audits that find non-compliance with CRA rules, such as improper use of funds, poor record keeping, or loss of control over resources.

The CRA provides a chance to object within 90 days of notification before revoking.

Annulment of Charitable Registration

Annulment is a separate, less common process where registration is declared invalid from the start.

This can happen if the CRA finds a charity never met the requirements for registration.

In such cases, the charity’s status is retroactively cancelled, and they lose any benefits from the time of registration.

The CRA may issue a notice explaining the annulment and the charity’s rights to object.

Annulment stops a charity from operating as a registered charity and affects its tax and reporting obligations immediately.

It typically follows serious issues about eligibility or misrepresentation on the original application.

The Charity Revocation Process

The revocation process involves formal steps taken by the Canada Revenue Agency (CRA) to end a charity’s registered status.

This includes official notices and public announcements.

Charities have chances to respond and communicate with the CRA to address concerns before revocation is final.

Notice of Intention to Revoke

The process usually starts when the Minister of National Revenue sends a Notice of Intention to Revoke (NITR) to the charity.

This notice outlines the reasons the CRA considers revoking the registration.

It includes details of compliance failures or other issues found during audits or reviews.

The charity has 30 days from the date of the notice to file any objections or provide additional information.

This window allows the charity to explain its position or correct mistakes.

If they miss this deadline, revocation may proceed without further input.

Publication in the Canada Gazette

Once the revocation process is underway, the intent to revoke is announced in the Canada Gazette.

This publication serves as an official public notice.

Its purpose is to inform the public and stakeholders about the charity’s changing status.

The Canada Gazette notice includes the charity’s name, registration number, and the effective date of revocation.

This step helps maintain transparency and accountability in the charity sector.

Communication With the Charities Directorate

Throughout the revocation process, the charity can communicate directly with the CRA’s Charities Directorate.

The Directorate manages compliance and enforces regulations for registered charities.

They provide guidance and may offer a chance to resolve issues before revocation.

Effective communication can involve submitting required documents, responding to queries, or requesting extensions for objections.

The Charities Directorate can also explain the consequences of revocation, such as tax implications and reporting requirements during the winding-up period.

Consequences of Losing Charity Status

Losing registered charity status affects a charity’s operations and finances in several important ways.

It impacts the ability to issue official donation receipts, creates financial obligations like revocation tax, and requires adhering to strict rules about what happens to the charity’s remaining assets.

Impact on Donation Receipts

Once a charity loses its registered status, it cannot issue official donation receipts for gifts it receives.

This means donors who give after revocation will not be able to claim tax credits for those donations.

This change can reduce charitable giving since donors often depend on receipts for tax purposes.

It also limits the charity’s appeal to funders and reduces transparency in fundraising activities.

The charity’s loss of ability to provide receipts may also hurt its public reputation.

This makes future fundraising even more difficult.

Revocation Tax and Financial Implications

When a charity is revoked, it must pay a revocation tax on the fair market value of any remaining assets at that time.

The amount of this tax depends on what the charity does with its assets.

If it transfers assets to an eligible donee during the winding-up period, the revocation tax could be reduced to zero.

Failing to pay this tax adds financial strain and legal consequences.

The charity also loses its exemption from income tax and GST/HST status.

This can affect its tax calculations and refund claims.

Asset Distribution to Qualified Donees

After revocation, the charity must transfer all its remaining assets to qualified donees, usually other registered charities or approved organizations.

Using assets for charitable purposes beyond revocation is not allowed without proper transfer.

Improper distribution can result in penalties or increased revocation tax.

This transfer ensures that funds continue to serve the public benefit, aligning with the original purpose of the charity even after its registration ends.

Steps to Take After Charity Revocation

When a registered charity loses its status, it must follow specific steps to properly end its operations and meet legal requirements.

These steps include dissolving the organization, informing donors and stakeholders, and addressing ongoing responsibilities set by the Charities Directorate and CRA.

Dissolving the Organization

Once revocation happens, the charity must complete the winding-up process.

This means paying debts and distributing remaining assets according to the rules set by the CRA.

Assets must be transferred only to qualified donees, such as other registered charities.

The charity must also file a final return for the last operating year.

This includes the T2046 tax return if applicable.

Proper documentation during dissolution is essential to avoid legal or financial penalties.

The board or trustees must approve all steps in the dissolution.

They should keep clear records in case the Charities Directorate audits the process.

Notifying Donors and Stakeholders

The charity has a duty to notify its donors and stakeholders about the revocation.

This keeps communication transparent and maintains trust.

Notices should explain what revocation means and how it affects donations or ongoing projects.

Donors might need information on how their contributions will be handled after revocation.

It is best practice to use multiple methods of communication, like letters, emails, or public notices.

This helps ensure everyone involved is informed promptly.

Complying With Ongoing Obligations

Even after revocation, certain obligations remain. The charity must file the required final tax forms with the CRA, including the T2046 if necessary.

The organization must also settle all legal and financial responsibilities. This includes closing bank accounts and canceling registrations or permits.

Failure to meet these obligations can cause penalties or legal trouble. The CRA may monitor compliance during the winding-up period to confirm all rules are followed.

Conclusion

Charities facing revocation should act carefully to understand the legal and financial effects. Revocation impacts a charity's ability to operate and may include a revocation tax on remaining assets.

For advice on managing or challenging revocation, B.I.G. Charity Law Group offers expert guidance. We can help your charity navigate complex rules and plan next steps effectively.

Contact us by email at dov.goldberg@charitylawgroup.ca or call us at 416-488-5888.

To learn more or schedule a free consultation, visit our website at CharityLawGroup.ca.

Early professional help can protect your charity's future—let us help you safeguard it.

Frequently Asked Questions

Charities can lose their registered status for several reasons. This can happen voluntarily or because of non-compliance with rules set by the Canada Revenue Agency (CRA).

Revocation has tax and operational effects that charities must understand.

What are the grounds for revoking donations?

Donations are not revoked, but a charity’s registration can be revoked for reasons such as failure to file required returns or non-compliance with rules. Sometimes revocation happens voluntarily when a charity chooses to end its status.

How do you revoke charitable status?

A charity can request voluntary revocation by sending a signed letter to the CRA. In other cases, the CRA can issue a Notice of Intent to Revoke after finding compliance issues.

The charity has a limited period to object or appeal.

What are the consequences of revocation?

Once revoked, a charity can no longer issue official donation receipts or receive gifts as a registered charity. Its name will be publicly listed as revoked.

The charity must transfer remaining assets to qualified donees or pay a revocation tax.

What is the revocation tax in Canada?

The revocation tax is equal to 100% of the value of a charity’s remaining property, unless it transfers assets to qualified donees within the prescribed time. This tax applies when a charity ceases to be registered but still holds assets.

What evidence is needed for revocation?

For involuntary revocation, the CRA provides evidence such as failure to file reports. Non-compliance discovered during audits can also be used as evidence.

For voluntary revocation, a signed letter from an authorized representative of the charity is required.

If there are objections, additional documentation may be needed.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)