What is Form T1235? A Guide for Canadian Charities and Nonprofits

If you are part of a charity or nonprofit organization in Canada, you might have heard about Form T1235. But what exactly is this form, and why is it important? This article will explain everything you need to know about Form T1235, how to notify the Canada Revenue Agency (CRA) about changes in your charity’s directors, what the Registered Charity Information Return is, and how to contact the CRA’s Charities Directorate.

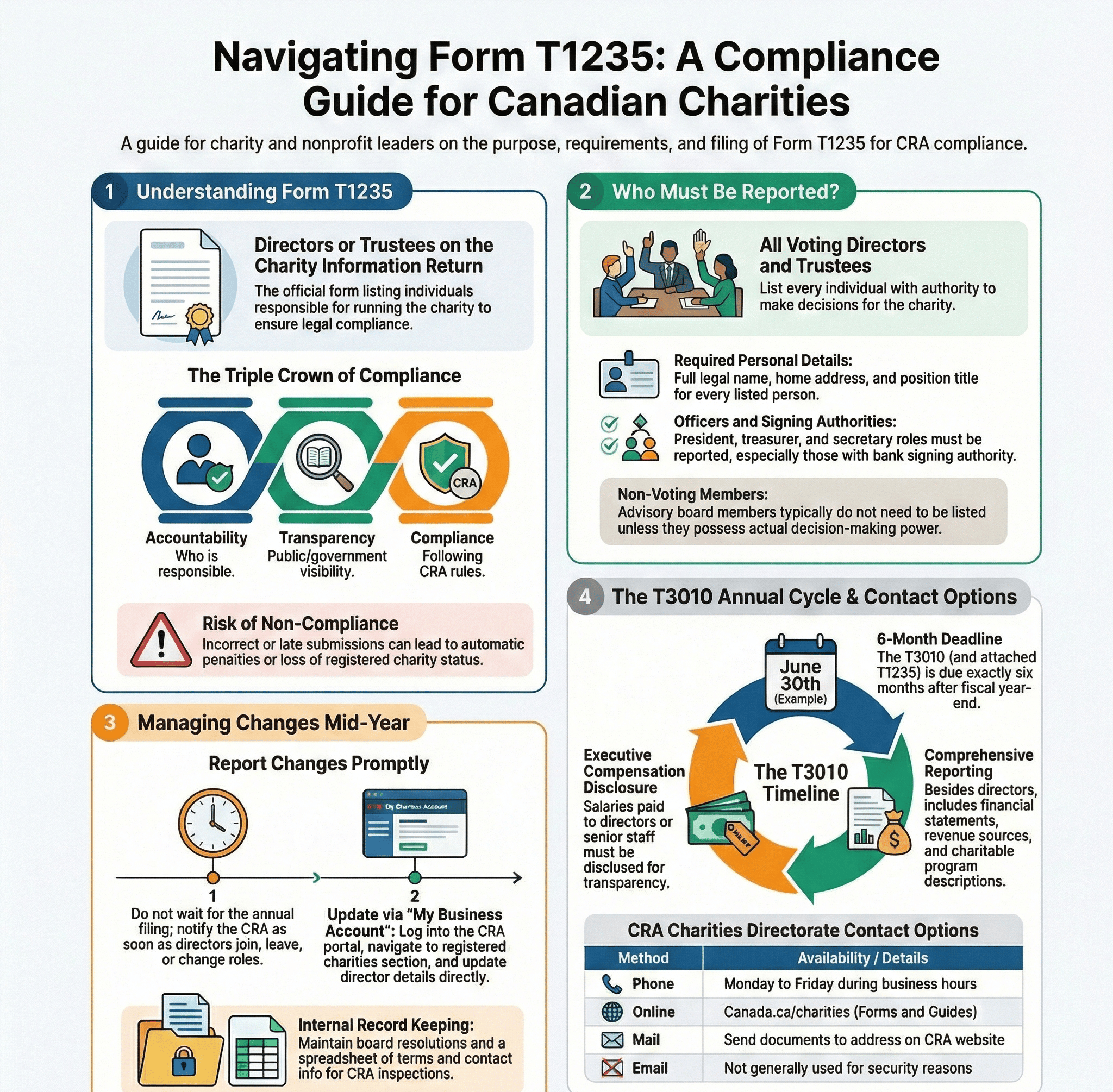

What is Form T1235?

Form T1235 is a form that Canadian registered charities and nonprofits must file every year with the CRA. Its full name is "Directors or Trustees on the Charity Information Return."

This form lists the names and information of the people who are responsible for running the charity, called directors or trustees. The CRA uses this information to keep track of who manages the charity and to make sure the charity follows Canadian laws.

Form T1235 is part of the charity’s annual reporting. The CRA requires it to maintain transparency and good governance in the charity sector.

Why is Form T1235 Important?

- Accountability: It shows the CRA who is responsible for managing the charity.

- Transparency: The public and government can see who controls the charity.

- Compliance: Helps ensure the charity is following the rules set by the CRA.

If the charity does not submit this form on time or gives incorrect information, it could face penalties or even lose its registered charity status.

How Do I Notify the CRA of a Change of Directors?

Sometimes, charities need to add new directors or remove current ones. If your charity makes changes like this, you must inform the CRA as soon as possible.

Here’s how to do it:

- Use Form T1235: When you submit your annual Registered Charity Information Return (called Form T3010), you include the updated list of directors or trustees on Form T1235.

- Notify Quickly: If the change happens during the year, you should notify the CRA right away by sending the updated Form T1235 or contacting the Charities Directorate.

- Keep Records: Always keep a record of your charity’s directors and any changes made for your own files and for CRA inspections.

Updating the CRA about changes helps keep your charity in good standing and prevents delays in important communications.

What is the Registered Charity Information Return Form?

The Registered Charity Information Return is a detailed annual report that all registered charities in Canada must send to the CRA. The form is officially called T3010.

This return includes:

- Information about the charity’s activities and programs.

- Financial details like income and expenses.

- A list of current directors or trustees using Form T1235.

- Other important information to show the charity is following the law.

The CRA uses this return to check if the charity is operating properly and using its funds for charitable purposes. It also helps keep the public informed.

Failing to file the T3010 on time can result in penalties or losing the charity status. So, filing this return accurately and on time is very important.

Who Must Be Listed on Form T1235?

Understanding who needs to be reported on Form T1235 can be confusing, especially if your charity has a large board or advisory committee. The CRA has specific requirements about which individuals must be listed and what information you need to provide about them. Let's break down exactly who belongs on your Form T1235 and what details the CRA expects to see.

Directors and Trustees Requirements

You must list all voting directors and trustees on Form T1235. These are the people who have authority to make decisions for your charity.

For each person, you'll need to provide their full legal name, home address, and position title. The CRA also wants to know if they're a signing officer.

Non-voting advisory board members typically don't need to be listed. However, if they have decision-making power, include them on the form.

Officers and Signing Authorities

Officers like your president, treasurer, and secretary must be reported. These individuals usually have signing authority for your charity's bank accounts and legal documents.

Anyone who can sign cheques or contracts on behalf of your organisation should be listed. This helps the CRA understand your charity's financial controls.

If someone holds multiple roles—like being both a director and treasurer—make sure to indicate all their positions clearly.

How to Notify the CRA About Changes in Directors

Board members come and go throughout the year as terms expire, people resign, or new directors join your charity. The CRA needs to know about these changes promptly, not just when you file your annual return. Keeping director information current helps ensure your charity receives important correspondence and maintains good standing with the CRA. Here's everything you need to know about reporting director changes.

When to Report Director Changes

Director changes happen regularly as board members join, leave, or switch roles. You need to inform the CRA as soon as these changes occur.

Don't wait until your next annual filing if directors change mid-year. Prompt reporting keeps your charity's records accurate and up to date.

The CRA sends important correspondence to the addresses on file. Outdated information could mean you miss crucial deadlines or compliance notices.

Step-by-Step Process for Updating Director Information

Updating director information is straightforward when you use My Business Account. Here's how to do it:

First, log into your My Business Account on the CRA website. Navigate to the section for registered charities.

Next, find the option to update your charity's information. Select the director or trustee information section.

Enter the new director's details or remove departing directors from the list. Make sure all information is accurate before submitting.

Finally, save your changes and keep a record of the update. The CRA will process your submission and update their records.

Common Mistakes to Avoid

Many charities delay reporting director changes, thinking they can wait until the annual return. This creates compliance gaps and outdated records.

Providing incomplete addresses or incorrect names causes problems. The CRA may reject your filing or flag your charity for review.

Always keep copies of board resolutions that appoint or remove directors. These documents support your Form T1235 submissions.

Don't forget to update signing authorities at your bank when directors change. Your CRA records and banking information should match.

Form T1235 and the T3010 Registered Charity Information Return

Form T1235 doesn't exist as a standalone document—it's actually one part of your charity's complete annual filing. The T3010 Registered Charity Information Return is the comprehensive report that all Canadian charities must submit each year, and Form T1235 fits within this larger package. Understanding how these two forms work together will help you approach your annual filing with confidence.

The Relationship Between T1235 and T3010

Form T1235 is part of the larger T3010 Registered Charity Information Return. You can't file one without the other.

The T3010 is your charity's complete annual report to the CRA. It includes financial statements, programme details, and governance information like your director list.

Think of T1235 as one section of your overall compliance package. Together, these forms give the CRA a full picture of your charity's operations.

What's Included in the T3010 Return

The T3010 requires detailed financial information. You'll report all revenue sources, including donations, grants, and fundraising income.

You must describe your charitable activities and programmes. The CRA wants to see how you're fulfilling your charitable purpose.

Executive compensation needs to be disclosed if you pay salaries to directors or senior staff. This promotes transparency about how charitable funds are used.

Your balance sheet shows assets, liabilities, and net assets. This financial snapshot helps the CRA assess your charity's financial health.

Filing Deadlines and Requirements

Your T3010 return is due six months after your charity's fiscal year-end. For example, if your year ends on 31 December, you must file by 30 June.

Missing the deadline triggers automatic penalties. The CRA charges fees based on how late your filing is and your charity's revenue.

Repeated late filings can result in losing your registered charity status. This means you can no longer issue tax receipts or operate as a registered charity.

If you need more time, contact the Charities Directorate before your deadline. Extensions aren't guaranteed, but early communication helps.

How Do I Contact the Charities Directorate of the CRA?

If you have questions about Form T1235, changes to your charity’s directors, or anything else related to your charity, the Charities Directorate of the CRA is the right place to ask.

Here are ways to contact them:

- Phone: The line is open Monday to Friday during normal business hours.

- Mail: You can send letters or documents by mail. The CRA website has the correct mailing address.

- Online: Visit the CRA’s official website at Canada.ca/charities for forms, guides, and more information.

- Email: The CRA does not generally respond to charity questions by email for security reasons, but you can use online portals if available.

If you need help with your charity’s filings or want to make sure you are following all rules, contacting the Charities Directorate is a good start.

Best Practises for Managing Director Information

Keeping accurate director records throughout the year makes filing Form T1235 much simpler when deadline season arrives. Many charities struggle with last-minute scrambles to collect current addresses or verify who's actually on the board. Good record-keeping habits and clear internal processes can eliminate this stress while ensuring your charity stays compliant. Here are practical strategies for managing director information effectively.

Maintaining Accurate Records

Keep detailed records of all board changes internally. Document when directors join, their term lengths, and when they leave.

Board meeting minutes should record director appointments and departures. These minutes support your Form T1235 filings and demonstrate good governance.

Create a simple spreadsheet tracking current directors, their contact information, and their terms. Update it immediately when changes occur.

Share director information with your bookkeeper or accountant. They need accurate data to prepare your T3010 return correctly.

Board Governance and Compliance

Good governance starts with a clear understanding of director responsibilities. Directors have a legal duty to act in the charity's best interest.

Implement conflict of interest policies that directors must follow. These policies protect your charity and demonstrate accountability.

Hold regular board meetings and keep proper minutes. Documentation shows the CRA that your board actively governs the charity.

Ensure directors understand their role in Form T1235 compliance. They should provide updated contact information promptly.

Working with Charity Law Professionals

Consider working with charity law experts for complex compliance matters. Professional guidance helps you avoid costly mistakes.

Legal professionals can review your governance documents and board procedures. They'll identify potential compliance gaps before they become problems.

Many charities work with lawyers or consultants to prepare their annual T3010 returns. This ensures accuracy and completeness.

An annual compliance review with a professional gives you peace of mind. You'll know your charity meets all CRA requirements.

Conclusion

In summary, Form T1235 is an important part of keeping Canadian charities transparent and accountable. It lists the directors or trustees who run the charity and must be submitted every year with the charity’s T3010 return. If directors change, the CRA must be informed quickly. The Registered Charity Information Return (Form T3010) gives a full picture of the charity’s work and finances. If you ever have questions, the Charities Directorate of the CRA is available to help.

If you need help with your charity’s forms or want to make sure you are following the right steps, we are here to assist. With over 830 five-star Google reviews, we specialize in helping Canadian charities stay compliant. Contact us at:

Email: ask@charitylawgroup.ca

Phone: 416-488-5888

Frequently Asked Questions About Form T1235

Charities often have similar questions about Form T1235 and director reporting requirements. We've compiled the most common questions we hear from nonprofit organisations across Canada. These answers will help clarify the rules and give you practical guidance for your specific situation.

Do all board members need to be listed?

All voting directors and trustees must be listed on Form T1235. Non-voting advisory members generally don't need to be included unless they have decision-making authority.

What happens if we forget to update director changes?

Your charity's records become outdated, which can cause communication problems with the CRA. You could also face compliance issues during audits or reviews.

Can directors be compensated?

Yes, directors can receive reasonable compensation for their work. However, you must disclose this compensation on your T3010 return.

How do we remove a director from CRA records?

Log into My Business Account and update your director information to remove departing board members. You can also update this information when filing your annual T3010.

What if a director refuses to provide their information?

Directors are legally required to provide this information as part of their duties. If someone refuses, they shouldn't serve on your board.

Do volunteers need to be listed on T1235?

Regular volunteers don't need to be listed. Only people with governance authority—directors and trustees—must be reported.

How does this apply to provincial vs federal charities?

All registered charities must file Form T1235, regardless of whether they're provincially or federally incorporated. Registration with the CRA creates this obligation.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)