Roles & Duties of Charity Boards and Officers in Canada

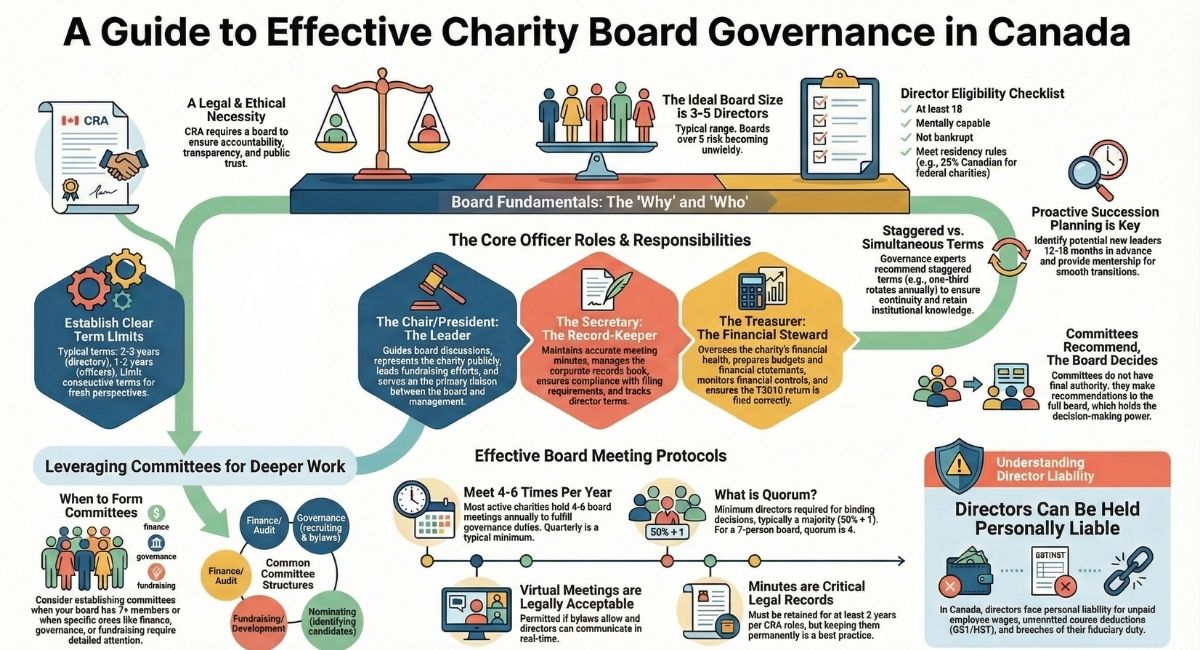

In Canada, charitable organizations are legally required to have a board of directors to oversee their operations. This board plays a crucial role in governance, ensuring that the organization stays true to its mission and operates within legal and ethical boundaries. But what exactly do the directors on this board do? Understanding the roles and responsibilities of directors is essential for the smooth functioning of any charity.

Why Is a Board of Directors Important?

The board of directors is the backbone of any charity. It provides oversight, guidance, and strategic direction to ensure the organization fulfills its mission. In Canada, like in many other countries, a charity is legally required to have a board to monitor its activities. The Canada Revenue Agency (CRA) mandates that registered charities have a board to ensure accountability and transparency in their operations. This requirement helps maintain public trust and ensures that the organization's resources are used effectively for its intended purpose.

How Are Board Officers Selected?

Once a charity in Canada establishes its board of directors, the next step is to appoint officers. These officers take on additional responsibilities to help the board function efficiently. The initial officers are typically elected by the board members, and the process for selecting these officers should be clearly outlined in the organisation's bylaws.

Canadian not-for-profits can have as little as 1 director, though more may be advisable depending on the size and complexity of the organisation. The typical not-for-profit in Canada has between 3-5 directors. More than 5 directors is typically not advised, as managing the boards and their egos will usually make it unwieldy to operate an organisation effectively.

Director Eligibility Requirements: Before appointing officers, ensure all directors meet basic eligibility criteria:

- Must be at least 18 years of age

- Cannot be bankrupt or have unresolved insolvency

- Must be of sound mind and legally capable

- For federal charities: at least 25% of directors must be Canadian residents

- Provincial requirements vary (e.g., Ontario requires a majority of Ontario residents for provincially incorporated charities)

The most common officer positions include the board chair (or president), secretary, and treasurer. Each of these roles comes with unique responsibilities that are vital to the organisation's success.

Term Limits and Rotation Best Practices

Effective board governance includes thoughtful approaches to director terms:

Typical Term Lengths in Canada:

- Most charities establish 2-3 year terms for directors

- Officers may serve 1-2 year terms in their specific roles

- Many organisations limit consecutive terms (e.g., maximum of 2-3 consecutive terms)

Staggered vs. Simultaneous Terms:

- Staggered terms: One-third of the board rotates off each year, ensuring continuity and institutional knowledge

- Simultaneous terms: All directors elected for the same period; provides fresh perspectives but risks loss of experience

- Most governance experts recommend staggered terms for organisational stability

Succession Planning: Effective boards plan for leadership transitions by:

- Identifying potential officer candidates 12-18 months in advance

- Providing mentorship opportunities for emerging leaders

- Creating clear role transition documents

- Maintaining a skills matrix to identify gaps

What Happens When an Officer Resigns Mid-Term? Your bylaws should address unexpected vacancies. Typically:

- The board appoints an interim officer from among current directors

- A formal election occurs at the next scheduled board meeting

- The replacement serves the remainder of the original term

- Document all changes in board minutes and update CRA records if required

What Are the Key Roles of Charity Board Officers?

1. The NPO Chair/President: The Leader of the Board

- Primary Responsibilities: The board chair or president is essentially the leader of the board. This person is responsible for guiding the board’s discussions and ensuring that all members participate actively. They work closely with the charity’s executive director or CEO to align the board’s goals with the organization’s mission. While it is more common in smaller or newer organizations, the board chair should ideally not be the same person as the CEO to maintain a clear separation of duties.

- Key Duties Include:

- Leading board meetings and facilitating discussions

- Representing the charity to external stakeholders, including the media

- Overseeing fundraising efforts and encouraging board members to contribute

- Managing the evaluation process for the executive director

- Mediating conflicts within the board

- Setting board meeting agendas in consultation with the executive director

- Ensuring all directors receive necessary materials in advance of meetings

- Acting as a signing authority on behalf of the organisation when required

- Conducting annual board self-assessments

- Serving as the primary liaison between board and management

2. The NPO Secretary: The Keeper of Records

- Primary Responsibilities: The board secretary plays a crucial role in maintaining the charity’s records. This includes taking detailed minutes during board meetings, ensuring that these minutes are archived properly, and that all legal documents are up-to-date. The secretary also monitors the terms of the board members to ensure that the organization remains compliant with its bylaws and legal obligations.

- Key Duties Include:

- Recording and maintaining accurate minutes of board meetings

- Keeping an updated list of directors and their contact information

- Coordinating the logistics of board meetings, including scheduling and sending out notices

- Distributing board packets that contain meeting agendas and relevant materials

- Ensuring that the organization complies with federal and provincial regulations

- Managing the corporate records book (minute book)

- Filing annual returns and updates with the incorporating jurisdiction

- Maintaining director resignation and appointment documentation

- Ensuring proper notice periods are met for all meetings (typically 10-21 days depending on bylaws)

- Tracking board attendance and quorum compliance

- Retaining records for the required period (CRA requires minimum 2 years; many organisations keep records for 7+ years)

3. The Treasurer: The Financial Steward

- Primary Responsibilities: The board treasurer is responsible for overseeing the financial health of the charity and non-profit. This includes managing the organization’s budget, ensuring that proper financial controls are in place, and providing regular financial reports to the board. While the treasurer does not need to be a professional accountant, they should have a solid understanding of financial management principles.

- Key Duties Include:

- Monitoring the organization’s cash flow and financial policies

- Preparing and presenting financial statements to the board

- Working with the executive director to develop the annual budget

- Ensuring that the organization’s financial practices comply with legal requirements

- Serving as a signatory on the charity’s bank accounts

- Overseeing the annual audit or financial review process

- Ensuring CRA T3010 return is filed accurately and on time

- Monitoring restricted vs. unrestricted fund balances

- Reviewing monthly financial statements for accuracy

- Chairing the Finance or Audit Committee (if one exists)

- Assessing financial risks and recommending mitigation strategies

- Ensuring adequate financial controls are in place to prevent fraud

What Other Roles Might Exist on a Charity Board?

In addition to the key officer roles, many charity boards in Canada include other positions to ensure the organization operates smoothly. These might include:

- Vice President: Often seen as the second-in-command, the vice president can step in when the president is unavailable and may also take on specific tasks assigned by the president.

- Committee Chairs: Some boards create committees to focus on specific areas, such as governance, finance, or fundraising. Each committee is typically headed by a board member who is responsible for reporting back to the full board.

Committees can be particularly useful for larger charities where the board needs to delegate work to be more effective. For example, a Governance Committee might focus on recruiting new board members, while a Fundraising Committee could be responsible for planning events and soliciting donations.

The key is to ensure that your board is effective in helping your charity achieve its mission. This might mean adjusting the board structure as the organization grows or as new challenges arise.

Creating Effective Board Committees

Committees allow boards to dive deeper into specific areas while maintaining efficient full board meetings.

When to Establish Committees

Create committees when:

- Your board has 7+ members

- Specific areas require detailed attention (finance, governance, fundraising)

- The full board lacks time to adequately address all issues

- You need to leverage specific expertise among directors

Keep work at the full board level when:

- Your board has fewer than 5 members

- The organisation is new or small

- Committee structure would create unnecessary bureaucracy

Common Committee Structures

Finance/Audit Committee

- Reviews financial statements in detail

- Oversees audit process and auditor selection

- Monitors financial controls and policies

- Makes budget recommendations to full board

- Typical size: 3-5 directors

Governance Committee

- Recruits and nominates new directors

- Conducts board evaluations

- Reviews and updates bylaws

- Oversees director orientation and training

- Develops governance policies

- Typical size: 3-4 directors

Fundraising/Development Committee

- Develops fundraising strategies

- Plans fundraising events

- Cultivates donor relationships

- Monitors campaign progress

- May include non-board volunteers

- Typical size: 4-6 members

Nominating Committee

- Identifies board skill gaps

- Recruits qualified candidates

- Conducts director interviews

- Recommends slate of officers annually

- Typical size: 3 directors

Key Principles for Effective Committees

- Written Terms of Reference: Each committee needs clear mandate, authority, composition, and reporting requirements

- Regular Reporting: Committees must report to the full board at each meeting

- No Final Authority: Committees make recommendations; the full board makes decisions (except where bylaws delegate specific authority)

- Meeting Minutes: Keep records of committee deliberations

Annual Review: Assess each committee's effectiveness annually

Board Meeting Requirements and Best Practices

Effective governance requires regular, well-run board meetings. Here's what you need to know about meeting requirements in Canada.

How Many Meetings Per Year?

Legal Minimums:

- Federal charities (CNCA): At least one annual meeting of members; board meetings as required by bylaws (typically quarterly minimum)

- Provincial requirements vary but generally require at least one annual general meeting

- CRA expects boards to meet regularly enough to fulfil governance responsibilities (typically quarterly minimum)

Best Practices:

- Most active charities hold board meetings 4-6 times per year

- Monthly meetings common for organisations with complex operations

- Special meetings called as needed for urgent matters

Quorum Requirements

Quorum is the minimum number of directors required to conduct business.

Typical Quorum:

- Majority of directors (50% + 1)

- Your bylaws specify your organisation's quorum

- Without quorum, the board cannot make binding decisions

Example: A board of 7 directors requires 4 directors present to meet quorum.

Notice Requirements

General Rule:

- 10-21 days' written notice for regular meetings (check your bylaws)

- Shorter notice acceptable if all directors consent

- Notice must include date, time, location, and general nature of business

What Constitutes Proper Notice:

- Email is acceptable in 2026

- Must be sent to directors' registered contact information

- Meeting materials should accompany notice when possible

Virtual vs. In-Person Meetings

Post-Pandemic Reality: Most Canadian charities now embrace hybrid governance:

- Virtual meetings via Zoom, Teams, or similar platforms are legally acceptable

- Bylaws should explicitly permit electronic meetings

- All directors must be able to hear and communicate with each other

- Consider hybrid options for accessibility

Requirements for Virtual Meetings:

- Technology must allow real-time participation

- Directors must consent to electronic participation

- Ensure secure platforms for confidential discussions

- Keep same protocols for motions, voting, and minutes

Minutes Retention

CRA Requirements:

- Minimum 2 years retention

- Must be available for CRA audit

Best Practice:

- Retain permanently in corporate records book

- Many organisations keep all governance records for 7-10 years

- Store electronically with secure backups

What Minutes Must Include:

- Date, time, location of meeting

- Directors present and absent

- Approval of previous minutes

- All motions made, who moved/seconded, outcome of vote

- Key discussions (brief summary)

- Declaration of conflicts of interest

- Adjournment time

Final Thoughts: Why Is It Important to Clearly Define Roles in the Governance Hierarchy of a Non-profit and Charity in Canada?

Clearly defining the roles and responsibilities of directors and officers is crucial for the success of any charity. It ensures that all board members understand their duties and can work together effectively. In Canada, where charities are required to comply with both federal and provincial regulations, having a well-organized board is essential for legal compliance and long-term success.

By understanding and implementing these roles, your charity will be better equipped to fulfill its mission and make a positive impact in your community.

Frequently Asked Questions

Understanding the governance structure of Canadian charities is essential for effective leadership and compliance. This FAQ addresses common questions about board roles, requirements, and director responsibilities.

What are the roles and responsibilities of board members?

Board members must provide strategic oversight, ensure compliance with laws and regulations, approve budgets and major decisions, hire and evaluate senior management, and act in the organization's best interests with care, diligence, and loyalty.

What are the three primary functions of a board of directors?

The three primary functions are: (1) governance and strategic direction, (2) oversight and accountability of management and operations, and (3) fiduciary responsibility for financial stewardship and legal compliance.

What is considered the most useful role of the board of directors?

Strategic governance - setting the organization's mission, vision, and long-term direction while ensuring resources are allocated effectively to achieve charitable objectives and create sustainable impact.

How many board members are required for a charity in Canada?

Federally incorporated charities require a minimum of three directors. Provincial requirements vary but typically range from one to three directors minimum, with many charitable organizations having 5-15 members for effective governance.

What are directors liable for in Canada?

Directors are personally liable for unpaid employee wages (up to 6 months), unremitted source deductions and HST/GST, environmental violations, and breaches of fiduciary duty. They may also face liability for decisions made without proper care or when acting outside their authority.

The material provided on this website is for information purposes only.. You should not act or abstain from acting based upon such information without first consulting a Charity Lawyer. We do not warrant the accuracy or completeness of any information on this site. E-mail contact with anyone at B.I.G. Charity Law Group Professional Corporation is not intended to create, and receipt will not constitute, a solicitor-client relationship. Solicitor client relationship will only be created after we have reviewed your case or particulars, decided to accept your case and entered into a written retainer agreement or retainer letter with you.

.png)